A lot is up with our country these days.

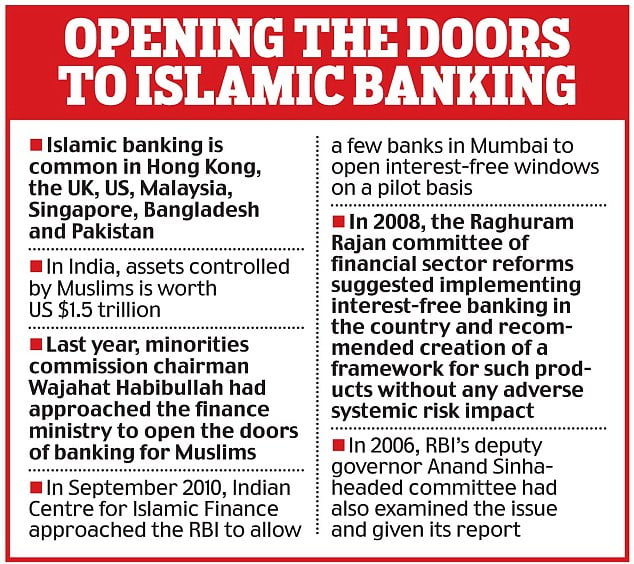

So the RBI is interested in introducing Islamic banking in India, following many speculations that a large section of our society is not involved in our current banking systems because of several inhibitions about their schemes. One particular drawback that prevents people from engaging with our modern banking systems is the scheme of interest rates.

Islamic banking is nothing like it might sound like in the first instance.

Like you might have read in an earlier demystifier article on ED, it has much more to do with the ethics of Islamic Shariat Law than being particularized system catering to the believers from the Islamic religion. Drawing its core principles from the holy code, Islamic banking is based on the foundation of shared profits. It does not engage in any kind of banking that charges for the money that has been lent. It does not believe that money has any kind of intrinsic value and therefore prohibits charging a fee on their transactions.

Therefore, borrowing or loaning money from Islamic banks is interest-free. Without a catch.

RBI has been toying with this idea for quite some time and the State Bank Of India has also tried to introduce various schemes that follow the moral code of Shariat law without giving it an explicit religious overtone. But the chief financial organization in our country now feels that a significant size of our population can benefit from the creation of Islamic banking windows in major national banks.

Why?

In fact, a huge percentage of the poorer population in India who are not a part of the banking network can rely on these avenues for easier banking access. And as a nation with the 3rd largest Muslim population on earth, it surely will be a blessing for the Islamic people who consider Islamic banking institutions to be a prerequisite to involve their money in.

This move is projected to democratize banking, even more, superimposing a sense of confidence in our existing banking institutions by taking on a more liberal and secular outlook.

Rural cooperative banks are already in place for the larger Indian rural communities to bank on. They also have schemes that encourage smaller self-help groups to negotiate interest and investment values among themselves when pooling in money. The Indian government has been trying for quite some time to come up with pluralistic plans that are conducive to the larger Indian picture.

Because we aren’t as modern as we would like to believe ourselves to be.

Therefore, apart from a false discursive construct of modernity, what further matters is that by not already having institutions like the Islamic bank, we are in fact being quite oblivious to what a major chunk of the population might feel an urgent need for.

Only because we want to maintain a stasis of secularism?

We know for a fact that our present government is headed by people who do not have the best track record when is comes to unbiased approaches. And the notion of this bank ‘sounds’ explicitly religious. It sounds extremely ideological to bring it into the foray after all this time, and regardless of people actually asking for it, it will get politicized.

Every other radical development strategies that have had their original ideas morphed to suit fundamental selfish interests of various pressure groups. It wouldn’t make me too paranoid to suspect that if Islamic Banking is indeed introduced and enforced, its larger ”goodness” will be swept under the carpet, waiting to be dug out from the shadows of agenda.

Are we ready for this yet?

It is a commendable initiative by BJP to want to have the Uniform Civil Code for India, but is Islamic Banking going to be just as much a liberal step? If the UCC could be alleged as pro-Hinduism, is Islamic banking not going to come under crossfire as a political initiative to appease the large Muslim population in our country?

It’s not contradictory to want to enforce the UCC and the Islamic Bank in our country right now. They would actually act as more secularizing agents in modern India. The Islamic banking is definitely a scheme our country’s poor could do with. Why has it not been here already, is a different story altogether. If executed right, we just might open up new inroads to poverty alleviation.

So, whether the government wants to create a second economic fiasco by being too blunt, too hasty or too ideological about it, or actually plan it the right way, only time will tell.

Read more:

http://edtimes.in/2016/12/everything-you-need-to-know-about-rbis-interest-in-no-interest-banking-and-the-concept-of-islamic-banking/

http://edtimes.in/2016/11/income-tax-raids-following-currency-ban-all-you-need-to-know/

http://edtimes.in/2016/12/government-lifts-off-all-taxes-on-gold-purchased-by-disclosed-income/