The government has decided to withdraw the sharp cuts in small saving schemes, at least for now.

What Was The Order On Wednesday?

In an order issued on Wednesday evening, the Union Ministry of Finance announced sharp cuts in interest rates on small savings schemes for the quarter beginning 1 April.

For some schemes, the cut was as steep as 90 basis points. The move drew sharp reactions and could have led to the ruling BJP government facing voters’ anger in the ongoing assembly elections, which appears to have prompted the swift damage control from the government.

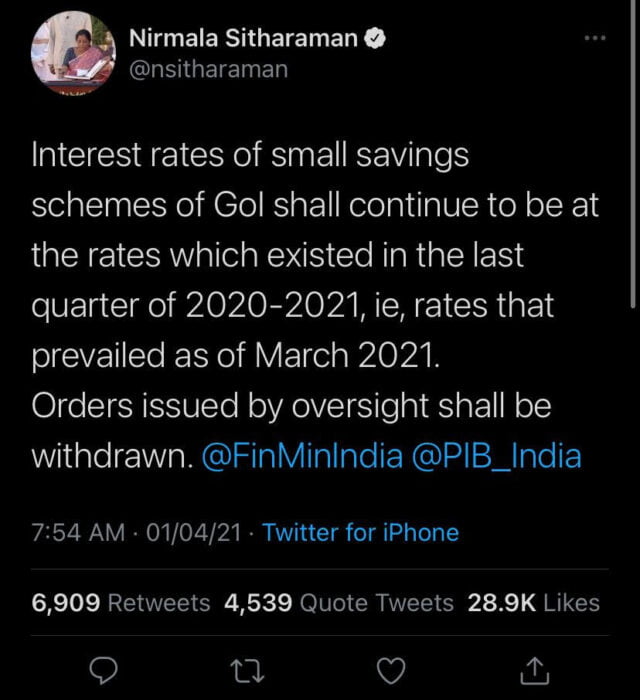

Announcing a withdrawal of the decision, Finance Minister Nirmala Sitharaman said that the order was issued by an “oversight”.

What Happened On 31st March?

“Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn,” Sitharaman tweeted on Thursday morning.

Though the revision in small savings was due before the beginning of the quarter, it would have adversely impacted the earnings on savings of the middle class and senior citizens.

Small savings rates are revised every quarter in line with the interest rates prevalent in the economy.

Also Read: Here Are Some Fines I’d Like To Charge The Government Before They Charge Us Our Savings

According to the 31 March order, the interest rate on the senior citizen saving scheme — a preferred savings option for retired senior citizens — was cut by 90 basis points (to 6.5 percent from 7.4 percent).

The interest rate on public provident fund — an option used by the salaried class to save on taxes — was reduced by 70 basis points (to 6.4 percent from 7.1 percent). The National Savings Certificate, Kisan Vikas Patras, and the Sukanya Samriddhi scheme also saw sharp cuts.

What Is Spiraling In The Background?

The BJP is caught in a fierce battle in at least two states — Assam and West Bengal — and is hoping to make new inroads into the two southern states of Kerala and Tamil Nadu, besides the Union Territory of Puducherry.

While Assam is voting in three phases till 6 April, West Bengal is voting in eight phases till 29 April. Tamil Nadu, Kerala, and Puducherry will go to the polls in a single phase on 6 April. The first phase of elections in Assam and Bengal took place on 27 March, while the second phase is underway Thursday, 1 April.

While announcing the quarterly setting of interest rates in 2016, the finance ministry had said that rates of small savings schemes would be linked to government bond yields.

The government on Wednesday cut interest rates on small savings schemes, including National Savings Certificate (NSC) and Public Provident Fund (PPF), by up to 1.1 percent for the first quarter of 2021-22 in line with falling fixed deposit rates of banks.

With the Reserve Bank of India cutting in policy rates gradually over the last months, a cut in small savings rates was inevitable. However, the government decided to withdraw the Wednesday order following the above uproar.

Small savings have emerged as a key source of financing the government deficit, especially after the COVID-19 pandemic led to a ballooning of the government deficit, necessitating a higher need for borrowings.

Image Credit: Google Images

Sources: Twitter, Hindustan Times

Find The Blogger: saba_kaila0801

This post is tagged under: India, Reserve Bank Of India, Ministry of Finance, Nirmala Sitharaman, Twitter, Hindustan Times, Saving Schemes, Rates, Votes, Polls, Polling, BJP, Modi Government, Slashing Rates, Poll Results, Bengal Election, Assam Election, Mamta Vs Modi, Bussiness, PIB India, Issued by Oversight