How often has it happened that you opened Zomato craving for your favorite food, scrolled for half an hour to find the cheapest dish but still left without ordering because your bank account doesn’t have enough balance? Lost count? Well, Zomato has heard your problems and has come up with a solution that you’d like – Eat Now, Pay Later.

Zomato’s Eat Now Pay Later Option

Buy Now Pay Later (BNPL) has been on a steady rise since 2017 and many startups have come up in recent years that work solely in this area. BNPL, as the name suggests, allows a customer to make a purchase and pay for it later.

How is it different than a credit card, you ask? Well, it is a lot easier to use, you don’t need to get into the hassle of credit history for it, and it is especially lucrative for students and young working professionals who find it hard to avail a credit card. There are also no hidden costs involved and there’s greater transparency.

Zomato, being one of the best in the game, recognized its potential and is now venturing into the eat now, pay later option which basically lets you pay later for your orders. However, if it ties up with a BNPL firm, then it can save all the financial trouble and focus on its own business model.

Then, why doesn’t Zomato collaborate with already existing BNPL platforms like LazyPay or Slice? Well, that’s because it would have to pay commission for every order that is placed through BNPL. The commission may be very little for one order, but combine hundreds of thousands of orders and that makes for a good amount that no company wants to lose.

The solution? Open your own BNPL service.

Read More: Zomato Sells Food For Much More Than The Restaurant Price: Know Your Bill Better

As per the numbers quoted by Money Control, BNPL is expected to capture 9% of the e-commerce market share in just 2 years, i.e. it is a booming market and early betters can benefit from it later (or it may prove to be an overestimated concept, only time will tell).

Zomato quoted that 50% of customers who ordered food from it in 2021 were new customers, i.e. the penetration of the online delivery system in the market has still not been tapped to its full potential. Now, the new prospective customers would surely be tempted to order food when they don’t have to pay for it right away.

Zomato has announced the setting up of an NBFC to offer short-term loans to its delivery partners and to allow customers to avail the eat now pay later option. However, it will take some time to roll this and until then, it would partner up with existing NBFCs.

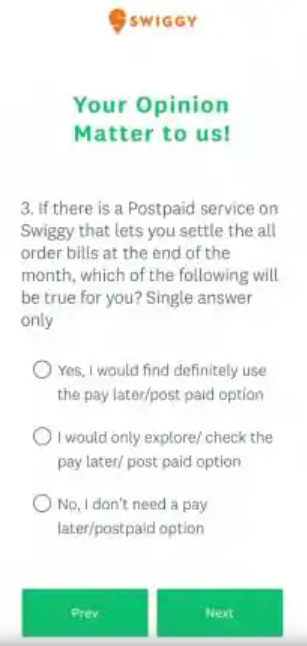

Swiggy is also doing a similar thing. It recently surveyed its users if they would like to settle their payments at the end of the month. It may follow in the footsteps of its rival Zomato.

What If People Default On Their Payment?

Well, the chances are there but minuscule. Food apps have all your data, ranging from your food habits to payment options. Now, they can guess whether you are eligible for this option or not.

The aim is to maximize profits by increasing the average order value and capturing more customers. How Zomato fares in its Fintech approach would be interesting to see.

Disclaimer: This article is fact-checked

Sources: LiveMint, The CEO Magazine, Money Control

Image Sources: Google Images

Find The Blogger: @TinaGarg18

This post is tagged under: zomato, food delivery app, eat now pay later, fintech, buy now pay later, BNPL, simpl, lazypay, credit, market share, online delivery, food, swiggy, profits, customer, customer acquisition, average order value, restaurants, dining partners, eating habits

Other Recommendations:

Shocking Stories Of Exploitation Revealed By The Delivery Boys Of Zomato, Swiggy