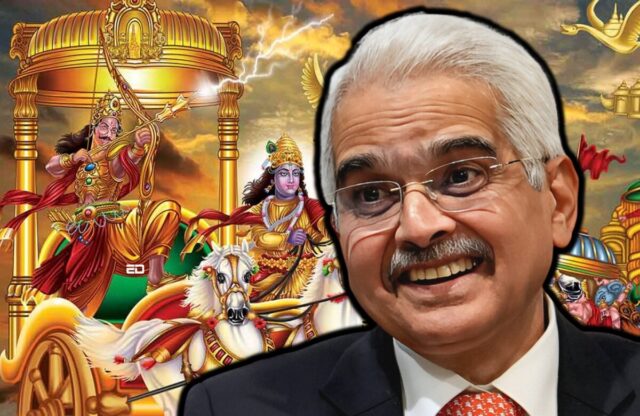

Monetary policy, although seemingly straightforward in its focus on interest rates, encompasses a myriad of complex drivers. Reserve Bank of India (RBI) Governor Shaktikanta Das has drawn analogies from the Mahabharata, employing characters like Arjuna to elucidate the factors guiding interest rate decisions.

Duvvuri Subbarao, prior to Das, referenced the predicament of Abhimanyu trapped in the Chakravyuh when confronted with the challenge of reversing an accommodative monetary policy. Such allegorical references may seem unusual but aim to shed light on the multifaceted considerations shaping monetary policy beyond mere interest rate adjustments.

Factors Beyond Inflation Targeting

Governor Das, using Arjuna’s tales, underscores the RBI’s obligation beyond inflation targeting. He likens Arjuna’s focus on the eye of a bird to the central bank’s singular emphasis on achieving a 4% inflation target.

However, Das also highlights another facet of Arjuna’s challenge—shooting a fish’s reflection, symbolizing the RBI’s recognition of various factors beyond inflation in policymaking. As Das noted, this involves considerations like the impact on financial stability, growth prospects, and external spillovers.

Das emphasized, “While the central bank is focused on bringing inflation to 4%, it considers several other factors while making policy decisions.” This shift in perspective signifies the RBI’s holistic approach toward monetary policy, moving beyond a sole focus on inflation to embrace a broader spectrum of economic concerns.

Also Read: 5 Mahabharata Characters Whose Traits Would Help Millennials With A Smooth Work Life

Role Of Financial Stability In Monetary Policy

Financial stability holds paramount importance in the RBI’s policy framework. During the COVID crisis, the RBI prioritized economic growth over strict inflation control to mitigate the pandemic’s impact. This approach aimed to safeguard financial markets from collapse amidst economic upheaval.

Rapid rate hikes, as witnessed globally, have posed risks to financial stability, leading to substantial losses for banks and institutions. However, the RBI, through prudent norms, prevented similar collapses in Indian banking despite rate hikes.

Governor Das clarified, “The RBI ensures its policy actions do not pose risks to financial stability,” emphasizing the institution’s commitment to maintaining a robust financial system even amid challenging economic scenarios.

Consideration Of External Spillovers

The RBI’s concern about external spillovers, particularly from commodities like crude oil, stems from India’s heavy dependence on oil imports. Geopolitical conflicts often drive up crude oil prices and strengthen the dollar, impacting India’s current account deficit and inflation. Rate hikes in the US tend to further elevate the dollar, amplifying the cost of imports for India.

Addressing this concern, Governor Das highlighted, “International spillovers, especially from commodities such as crude oil, significantly impact India’s economy,” stressing the RBI’s vigilance in navigating external influences to maintain economic stability.

Reserve Bank of India’s monetary policy extends beyond the realm of interest rates and inflation control. Drawing from the Mahabharata, Governor Shaktikanta Das’ analogies signify the central bank’s multi-dimensional approach, encompassing financial stability, growth objectives, and managing external spillovers.

Amidst global economic fluctuations, the RBI remains steadfast in balancing these varied considerations to steer India’s economy toward stability and sustainable growth.

Image Credits: Google Images

Feature Image designed by Saudamini Seth

Sources: Economic Times, Business Insider, Live Mint

Find the blogger: Katyayani Joshi

This post is tagged under: RBI, Reserve Bank of India, inflation, RBI governor, Arjuna, Mahabharata, sustainable growth, economy, Shakti Kant Das, stability, external influence

Disclaimer: We do not hold any right, or copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.

Other Recommendations:

Ex SC Judge Markandey Katju’s Hilarious Theory On Why India Lost The World Cup To Australia