By Hitee Singh

Mallya has surely upset a lot of banks as he misguided them to provide loans for his plummeting Kingfisher Airlines.

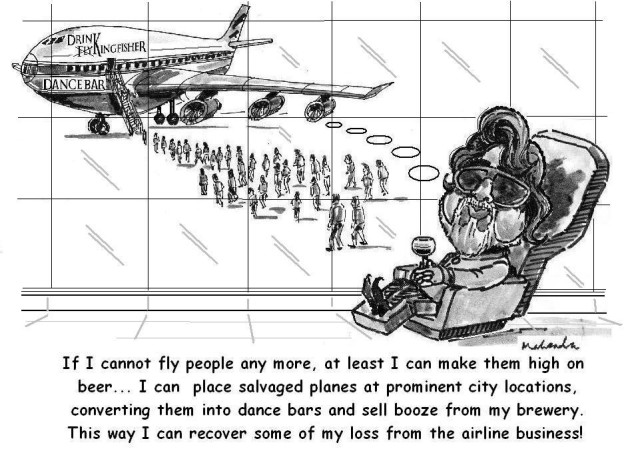

Vijay Mallya, the man who lost his profit churning liquor business in pursuit of reaching the skies (literally and figuratively) by launching an airlines, is in deep trouble with the bank these days. Established in 2003, his flight to profit, Kingfisher Airlines, never lived upto his expectations and had to be shut down in 2012 with the Income Tax Department freezing its bank account for non-payment of dues.

When Reserve Bank of India governor, Raghuram Rajan, stressed on cleaning up bad debts of banks and restructure other non-performing assets to within a year to put the economy on track. This inadvertently pressurised the Modi-government to clean up the bank mess and the bank were left with no choice but to pull up the big borrowers.

Vijay Mallya is now groaning under a loan of about Rs. 5,000 crore from different banks such as State Bank of India and United Bank of India, which he had sought for the grounded Kingfisher Airlines. He has offered to pay the principal amount that he owes but the interest which amounts to a whooping Rs. 2,000 crore. Rightfully so the banks are not ready to settle for less and may demand the interest or at least a significant part of it.

According to SBI Caps- the merchant banking arm of State Bank of India, in 2014 the amount due by the flight of good times was about Rs. 6,963 crore with the exclusion of the 15.5% p.a interest rate. SBI Caps has put Kingfisher Airlines’ asset that are in Mumbai Chhatrapati Shivaji International Airport, for auctioning. In October, Central Bureau of Investigation had raided Mallya’s residence and offices, after the agency filed a FIR against Mallya and bank officials.

The Airlines brand name was pledged to 14 banks, including State Bank of India, IDBI Bank, Punjab National Bank, Bank of India and Bank of Baroda under a debt recast agreement in which the loans were restructured and converted into equity. None of the Indian banks have capitalised brand value and it is an intangible asset. Banks will never be able to monetise the Kingfisher Airlines brand as the parent brand Kingfisher represents a different category of product- beer owned by United Breweries. Most of the banks have classified the loans given to Kingfisher as non-performing. The Banks have now declared Mallya as a wilful defaulter which will mean he or the company where he is a board member cannot access funds from banks.

The banks now also sought to seek their right on the USD 75 million which Mallya will be getting from Diageo for quitting the latter owned United Spirits as its chairman. It will absolve Mallya of all liabilities over alleged financial lapses at the company founded by his family. Reportedly, he was asked to quit as Diageo was wary of the ill-name he would bring due to Mallya’s involvement in financial impropriety. The banks have moved to the Debt Recovery Tribunal and asked for an arrest warrant for Mallya, seize his passport and a full disclosure of his assets, in India and abroad. While the CBI is also probing how banks took Brand Kingfisher as collateral.

Hearsay claims that Mallya pledged his ‘personal prestige’ also as a collateral and the poor banks bought into it. Doesn’t this stink of a clear banks-Mallya-funds siphoning off nexus/scam? The bank managers sure need to prove that they weren’t hand in glove here.

He’s even running off to London soon we hear.

Quite unabashed, Mallya claims that his only regret is that his airlines is not flying when the oil prices have gone down.

Looks like ‘The King of good times’ will soon become ‘The king of Bad times’.