“Rule No. 1: Never lose money.

Rule No. 2: Never forget rule No. 1”.

This is how Warren Buffet, the greatest investor at present time (and maybe in history) summarizes his investment strategy when asked how to maximize your earnings. Smart investors know that a week of bearish market can easily overcome months of unrealized earnings; that is particularly true during crises.

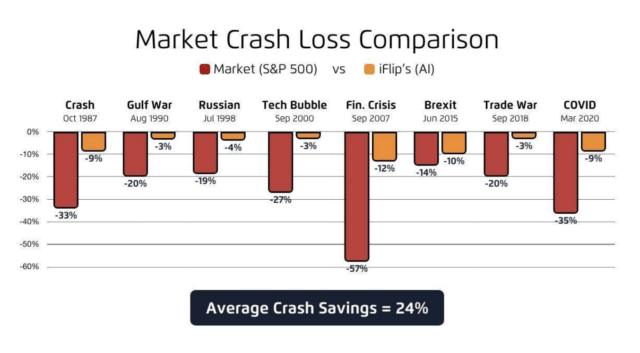

iFlip has recently published its Crash Protection Analysis showing how their algorithm has performed during the latest crises in comparison to the S&P500. The analysis shows how the iFlip algorithm has managed to beat the market by an average of 24% where the greater the market loss, the higher the % of savings iFlip has made for their clients.

The app – that has reached over 22M in assets under management in less than 7 months – uses proprietary algorithms developed over the last 20 years used by Wall Street firms like Deutsche Bank, Brevan Howard, Tudor Group and Morgan Stanley. The algorithms are designed to minimize risk and portfolio drawdowns. iFlip’s portfolios have a long track record of outperforming index funds and robo-advisers. This method of capital management has long been commonplace among Wall Street’s hedge funds, but out of reach for those without millions to invest.

The app claims to avoid a large loss of capital during deep bearish markets by selling weeks or even months before the crashes occur. Recently, the iFlip’s A.I. SmartFolio dodged a large drop in the S&P500 (SPY), and in early November the SmartFolio “Tactical Model” automatically sold these positions. This was months before the large Coronavirus selloff. This A.I. decision saved iFlip’s customer investments from a -32.3% market drop that took place 3 months after it had sold off a large portion of the positions.

Despite inevitable crashes, the A.I. SmartFolios performs

AI SPY+ SmartFolio Performance (Free & Most Popular)

-Last 12 months Return: 169.10%

-Last 10 years: 950.51% (annual average 95.05%)

AI FAANG SmartFolio Performance (Premium paid). This is a more aggressive tech A.I. SmartFolio

-Last 12 months Return: 171.81%

-Last 10 years: 1781.12% (annual average 171.81%)

About iFlip

iFlip is the next generation of investing. It leverages A.I. SmartFolio investing to automate and increase wealth for the average individual. iFlip mission is to “flip” the Wall Street investing world on its head in favor of the individual investor (i.e. you). For decades major financial institutions have used the same old strategies to invest the average person’s investments, while charging high confusing fees. Everyone knows these fees make it hard for investors to grow their wealth.

Disclaimer: “Past results do not represent future results. Data is gathered through Quandl™. Flip Investor has made its best effort to insure accuracy of information herein, however does not guarantee its accuracy. System/Symbol results shown are for the purpose of education. System and portfolio results depicted are hypothetical. By choosing a “system” to manage your stocks and/or portfolio your results may be different than those depicted. Results are based on an initial investment of $10000 and the percentage change is calculated from the net results of closed positions and open positions during the period e.g. monthly, yearly. Total results are calculated based on the CAGR for the entire period e.g. Starting capital, 10,000, and current equity (sum of all closed positions and open positions). FLIP Investor is not an investment advisor. “

Company: Flip Investor Inc

Website / URL: www.iflipinvest.com