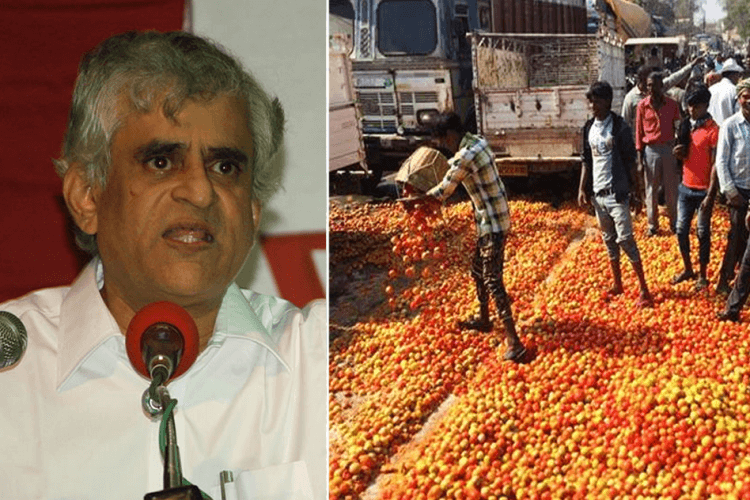

On 14th November 2018, Palagummi (P.) Sainath, a known journalist and the Founder editor of PARI (People’s Archive of Rural India) posted a YouTube video, talking in detail about the PM Narendra Modi’s farmer’s crop insurance scheme.

The scheme called the Pradhan Mantri Fasal Bima Yojana (Prime Minister’s Crop Insurance Scheme) was launched by the PM in February of 2016, as a way to protect the farmers from the frequent calamities and other problems due to which their crops can be damaged or destroyed.

According to Wikipedia, with this scheme, farmers would have had to pay a “uniform premium of only 2 per cent to be paid by farmers for Kharif crops, and 1.5 per cent for Rabi crops. The premium for annual commercial and horticultural crops will be 5 per cent.”

But apparently, Mr. Sainath, is not happy with the way the scheme is being handled when he spoke about how there is a hidden transfer going on of the public money going to private insurers.

Sainath, has previously also spoken about this issue when he was in Delhi for the Kisan Swaraj Sammelan on 3rd November 2018.

During that event, he had commented how “The present government’s policies are anti-farmer. The Pradhanmantri Bima Fasal Yojana is a bigger racket than even the Rafale scam. Selected corporates like Reliance, Essar have been given the task of providing crop insurance.”

To state his case, he gave the example of Maharashtra, where,

“Some 2.80 lakh farmers sowed soya in their farms. In a district, the farmers paid a premium of Rs 19.2 crore, the state government and the central governments paid Rs 77 crore each, amounting to a total of Rs 173 crore, which was paid to Reliance Insurance.”

It must be noted that Reliance Insurance is owned by Anil Ambani, who was recently accused of the Rafale Scam.

Sainath in his statements asked people to think how much Reliance General Insurance must have benefited when taking into consideration all the districts it has control over.

It is also interesting how this connection comes out just about a month after the company was previously involved in a controversy when the Jammu and Kashmir government apparently made it mandatory for government employees to get their medical insurance only from the Reliance brand.

He then added that, “The entire crop failed and the insurance company paid out the claims. Reliance paid Rs 30 crore in one district, giving it a total net profit of Rs 143 crore without investing a single rupee. Now multiply this amount to each of the districts it has been entrusted.”

He also talked about how the debt on farmers is increasing which might be one of the reasons that farmers are leaving the sector with a rising frequency.

The farmer’s activist, also said that, “Gradually we are farmers are losing farming to corporates. Even though there is more than 55 per cent population that is rural in Maharashtra, the National Bank for Agriculture and Rural Development (NABARD)’s distribution of cash flow was to Mumbai, where there is no agriculture.”

On 13th November, Mr. Sainath, also tweeted a thread revolving around this issue:

Pradhan Mantri Fasal Bima Yojana – the scheme is the scam. It's not about one private corporation, but over a dozen of them benefit in crores of rupees of public money. #Thread

— P. Sainath (@PSainath_org) November 13, 2018

Read More: What Is CBI Vs CBI? Let Us Demystify It For You

Is There A Scam Here?

This video takes a closer look at what Mr. Sainath has to say about the whole farmers crop insurance scheme and how it might be not entirely correct.

It is difficult to say if there really is a scam there, but as The Wire reported, in just two years, “the difference between premiums received and compensation paid at nearly Rs 16,000 crore in just two years.”

They also reported how about 84 lakh farmers in 4 different states exited the farmers insurance scheme after just an year. When the scheme had first been launched, it saw as many as 5,72,17,159 farmers joining between 2016-17.

The next year though, that is in 2018, only about 487,70,515 were left remaining as a part of the scheme.

P.P. Kapoor, a Haryana based RTI activist filed for these numbers to be revealed in September and he stated to The Wire that, “As many as 2.90 lakh farmers exited the scheme in Madhya Pradesh, 31.25 lakh in Rajasthan, 19.47 lakh in Maharashtra and 14.69 lakh in Uttar Pradesh.”

It was noticed by him that instead of benefiting the farmers it became a way for private insurance companies to make more money.

As per reports, while the number of farmers under the scheme has gone down, the compensation paid by the companies has gone down too.

Some of the private sector companies that are a part of the scheme and give insurance to crops are ICICI Lombard, Reliance, Tata-AIG, Universal, Bajaj Alliance, Future, SBI, HDFC, IFFCO-TOKIO and Cholamandalam.

What do you think, is this actually a scam or just political games being played?

Image Credits: Google Images

Sources: Business Standard, The Wire, Wikipedia

Find the blogger at: @chirali_08

Other Recommendations:

Is it a SHAM

The Scheme in the name of Distressed Farmers is actually a Scam

How the PM’s Crop Insurance Scheme Turned Into a Goldmine for 10 Private Insurers

https://thewire.in/agriculture/pm-crop-insurance-scheme-huge-profits-private-insurers

The applications were filed by Haryana-based RTI activist P.P. Kapoor on September 12 with the ministry of agriculture. Charging that the crop insurance scheme was a major scam, Kapoor said while the scheme was meant to benefit farmers, it had ended up as a money maker for private insurance companies.