Crypto finance firms widely share one mission statement: to offer a platform that enables retail and institutional crypto market participants to trade, invest, finance, and earn crypto. We’ve thought long and hard about the best way to pool our integrated services for all market participants. We’re proud to announce that this vision has materialized in our latest offering: the Amber App.

It’s time to drive forward the democratization of crypto finance.

What we’re witnessing today in crypto finance is a rapid shift from pure-play to integrated crypto finance services. The adapt or die mentality is turning the focus away from specialization to the end-to-end service model. Companies building with this full-stack approach own the entire operational stack, offering the end-user a better product experience while retaining a more significant share of the economic pie over time.

Today’s headlines seem to heavily focus on one narrative: the race to become the “prime brokerage” or crypto “bank.” But it isn’t a throne. There is room for more than one player at the table. Hence why we believe this narrative focuses on the trees and not the forest. Taking the forest view means asking a larger question: who will become leaders in the race to democratize crypto finance services in the coming years?

In an age of consolidation, integrated crypto finance platforms without a clear competitive advantage bear a heavy burden– remaining undifferentiated. We believe that being full-stack is more necessary than ever before, but also realize that its adoption can be an Achilles heel. The key (and challenge) to building a full-stack operation is to scale with speed while maintaining a defensible edge.

First-mover advantage is an all-too-familiar game-theoretic concept where a player in a game can ensure a higher payoff merely by making the first move. In economic terms, the first mover to enter a new market can gain a commercial edge over potential competitors due to advantages such as greater economies of scale. But taking a step back and surveying the crypto Wild West tells you that whoever draws first doesn’t necessarily win. The first mover may experience short-term gains, but the first scaler is more likely to secure a long-term competitive advantage.

In his book Zero to One, Peter Thiel talks about the merits of last-mover advantage: “whoever is first to dominate the most important segment of a market with viral potential will be the last mover in the whole market” [1]. In other words, the first scaler may also be the last mover.

“Sequencing markets correctly is underrated, and it takes discipline to expand gradually. The most successful companies make the core progression — to first dominate a specific niche and then scale to adjacent markets — a part of their founding narrative.” – Peter Thiel

However, successfully sequencing into other markets may sometimes contradict the recipe for building a full-stack business. Sequencing requires specialization around a core product. Amazon, for example, initially focused on cornering the online bookstore market and gradually entered other niche markets such as music and software. The e-commerce giant is now “the world’s general store.” Building a full-stack startup, on the other hand, may require capturing the entire value chain from the get-go. Integrated crypto finance platforms entering the game now likely find it necessary to build a wide variety of solutions either in-house or through strategic partnerships and acquisitions.

Unlike traditional tech or finance, the crypto industry moves at the speed of “that should’ve been done yesterday.” How can companies dominate a specific market segment while also remaining relevant to a broad user base? The challenge in building a crypto finance platform is to grow network effects in an industry with an increasingly overlapping client base. Investors are becoming more sophisticated, and companies are racing to satisfy shared needs around trading, investing, financing, and storing crypto assets. With the emergence of more “copy-cat” business models, it’s no surprise that the arena is becoming fiercely competitive.

Democratizing crypto finance means offering greater accessibility to financial products and opportunities to economic gains. We think deeply and often about this pursuit and believe it can be achieved through: understanding the crypto capital markets, adapting to user mobility, and building for the long term.

The psychological division of the crypto capital markets

There’s long been a psychological division between the retail and institutional markets. For example, the term “institutional-grade” often refers to elements of security, regulation, efficiency, or trust. We think the same applies to retail, but strangely enough, no one says, “retail-grade.” We need to change this underlying narrative. Many venues may think of and treat retail as merely unsophisticated gamblers incapable of making sound financial decisions, but this is a dangerous assumption that leads to short-term thinking. Just as crypto finance platforms assume institutions are fully competent, we should also assume retail investors have the same rigorous expectations for participating in crypto finance, only with a smaller capital base and a greater need for financial education. The platform is responsible for educating and positioning investors to best leverage crypto finance tools for long-term success, which starts with providing both retail and institutional investors with equal access to sophisticated crypto finance offerings. We find that the companies best positioned to lead are intimately aware of the evolving crypto market structure and market participants’ needs.

We’ve previously written about the three stages of crypto market maturation:

- Growth and diversification of infrastructure providers in the crypto-asset ecosystem servicing the various needs of retail and institutional customers

- Consolidation and competition in global markets amongst infrastructure service providers

- The professionalism of the crypto capital markets and dominance of select sophisticated institutional-grade players replacing certain traditional financial intermediaries

We are quickly entering the early phases of consolidation and competition.

2020 has experienced sustained growth in retail and institutional interest. On the desk, we are seeing steady strength in the number of clients onboarded and volumes transacted through our franchise.

In parallel with the rise in trading volumes, we’ve seen Tether (USDT) volumes climb past $15bn amid a burgeoning stablecoin market. Stablecoins enable faster capital mobility and have become the go-to on/off-ramp solution for many investors, bringing down the barrier to crypto finance. As a reliable value transfer mechanism, stablecoins are responsible for driving a large part of volumes in both decentralized finance and their centralized counterparts.

The crypto derivatives market is another major catalyst for increasing retail and institutional participation. Instead of purely short selling or leveraging long assets, traders can now execute a much wider surface area of trading strategies with the availability of more diverse and flexible financial instruments.

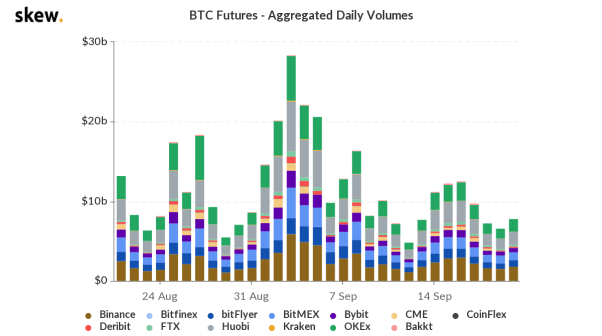

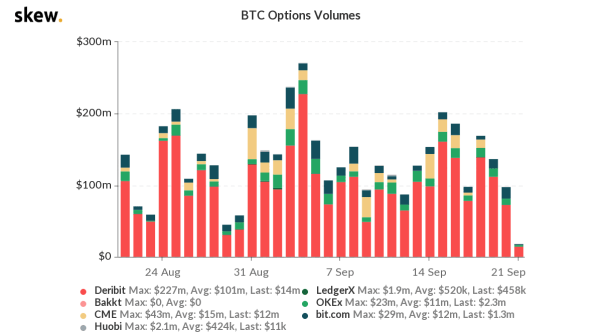

Traditionally, derivatives trading volumes dwarf the physical volumes in commodities. We have not seen this develop in crypto yet, but gradual improvements in execution and settlement infrastructure coupled with growing hedging and speculative demands, are driving greater use of futures and options.

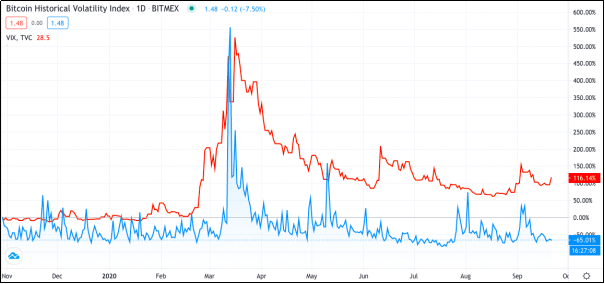

Interestingly, Bitcoin volatility has been underperforming S&P500 volatility on a daily basis over the medium to long term. This could present opportunities for market participants to be long volatility. Vice versa, participants can short or sell volatility in crypto should it supersede volatility seen in the traditional equity markets.

Source: Bitcoin Historical Volatility Index against VIX (TradingView)

Adapting to optionality

With optionality comes high user mobility. Users will flock to whichever platform they find with better products and services that suit their needs. But it’s challenging to differentiate between firms in the highly fragmented crypto finance industry where offerings are “same, same but different.” High user mobility means that there’s a faster feedback loop for business decisions [2]. We’ve quickly realized that retail and institutional investors’ shared needs revolve around a core expectation: capital efficiency and flexibility. In other words, doing more with your capital. Gone are the days of locking assets away in cold storage while missing out on yield-generating opportunities. Through the Amber platform, investors may leverage their capital by borrowing funds against their collateral deposits. Investors may also earn interest on crypto and stablecoin deposits while using those assets to margin trade or fund an options trade.

Building with intent

Above all else, as active market participants, we believe through and through that the crypto markets are here to stay. The key to scalability and survival is to build with intent and leverage operational velocity. Over the past few years, OTC venues have become the predominant channel for executing large-sized crypto-to-crypto and crypto-to-fiat trades. To date, we’ve traded over $200bn through our voice and electronic price streaming services and are one of the predominant OTC venues in Asia with over 200 institutional clients globally. Having traded through crypto market booms and busts, we’ve enhanced the existing platform to provide clients with a more seamless trading experience and greater access to yield capture opportunities in both the centralized and decentralized markets.

Introducing the Amber App

The Amber App is a culmination of years of experience innovating on crypto finance rails for the institutional market. We’ve re-engineered the platform to offer both sophisticated crypto investors and non-crypto natives a set of highly-intuitive crypto finance tools that enables investors to participate in the crypto markets for the long term. Specifically, the Amber App is designed to help investors achieve optimal investment returns through market-leading interest rate products, yield enhancement and risk management tools. To start, investors will be able to take advantage of Amber EARN, our fixed income investment offering:

- Customizable tenors with attractive interest rates

- Same-day asset redemption

- Capital efficiency through earning interest on deposits and using Earn assets as collateral for margin trading

Building for the sake of out-competing the next entrant is a defensive strategy to survive and avoid the threat of consolidation. But scaling to democratize crypto finance calls for consistent product innovation and creating an economic moat with a definite long-term edge. Amber Group is advancing mainstream adoption by democratizing crypto finance at your fingertips.

We’re only getting started.

Sources

[1]: Thiel, Peter. Zero to One. 2014

[2]: Hasu. “The Great Race to Crypto Banking.” 2020

(Syndicated press content is neither written, verified or endorsed by ED Times)