Lately, people across the globe have been witnessing a lot of lifestyle changes owing to the COVID-19 pandemic. This has led to changes in consumption patterns and the demand for various goods and services. People’s savings and investment patterns have changed because they have started attributing higher value to asset creation.

A similar trend has unfolded in the real estate sector. As reported by the Economic Times, the demand for buying homes has increased among the Indian millennials as compared to the pre-COVID times.

Past Trends Among Millennials

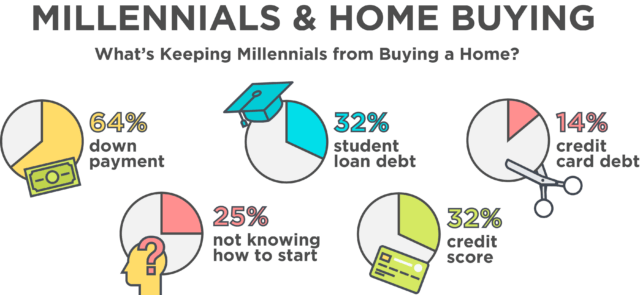

In the fast-moving world, millennials and youngsters are constantly moving places owing to job switches or simply because of the demands of their present lifestyle. Various reports published until the coronavirus pandemic suggest that Indian millennials do not choose to invest in houses as they tend to restrict their mobility.

Additionally, most youngsters tend to avoid home loan EMI burdens, especially during the early stages of their career.

While some shy away from EMIs owing to their student loans, others just simply do not want an additional burden of arranging down payment and subsequent EMIs, as suggested by various survey responses.

Read Also: We Asked Millennials The One Thing They Will Improve In Their Lifestyle As Their Pandemic Teaching

Most millennials prefer rented apartments because they offer flexibility to switch places as and when their career demands. Also, the burden of ownership of a house seemed to dissuade away millennials from investing in real estate.

What Is Driving Millennials Towards Investing In Real Estate Now?

Reports suggest that the demand for investing in houses among millennials has increased as compared to the pre-pandemic levels. This sudden change can be attributable to the work-from-home culture to some extent.

Expecting remote working to continue for a long time, and even on a permanent basis for some industries, is a no brainer. During this pandemic, all of us had no choice but to stay at our homes and yet be present at work.

We have started realizing the importance of investing in a decent workspace in our homes because this is going to be the new normal for years to come.

So, a major factor, ‘mobility’, that was preventing millennials from investing in houses is now responsible for pushing them towards the same. People expect lesser mobility in the years to come as they plan to continue with remote working in the longer run.

NoBroker.com, a real estate platform, reported that during the pre-COVID times, around 49% of its buyers were millennials while this number has currently reached 63%. During the last few years, real estate reforms made the investment in houses expensive so people preferred renting homes.

But now, mortgage rates have hit a multi-decade low, making real estate investments lucrative again. Additionally, millennials are attracted to investing in properties in suburban areas because they are affordable and super-spacious.

The pandemic has made people realize the value of homes so investing in a spacious one makes more sense these days.

According to data provided by Nobroker.com, suburbs are witnessing more demand for 3BHKs, the price of which is comparable to 1BHK and 2BHKs in the urban regions. These areas are usually less crowded and less noisy, making them more attractive for remote working.

All in all, a variety of factors have led to this shift towards investing in real estate properties and its impact would unfold in the months to come.

Image Credits: Google Images

Sources: The Economic Times, Good Returns, Livemint

Find the blogger: @_RitikaNijhawan

This post is tagged under: Millennials buying patterns, millennial thinking, Indian Millennials, investing in real estate, rented homes, down payment, EMI, suburban properties, work from home