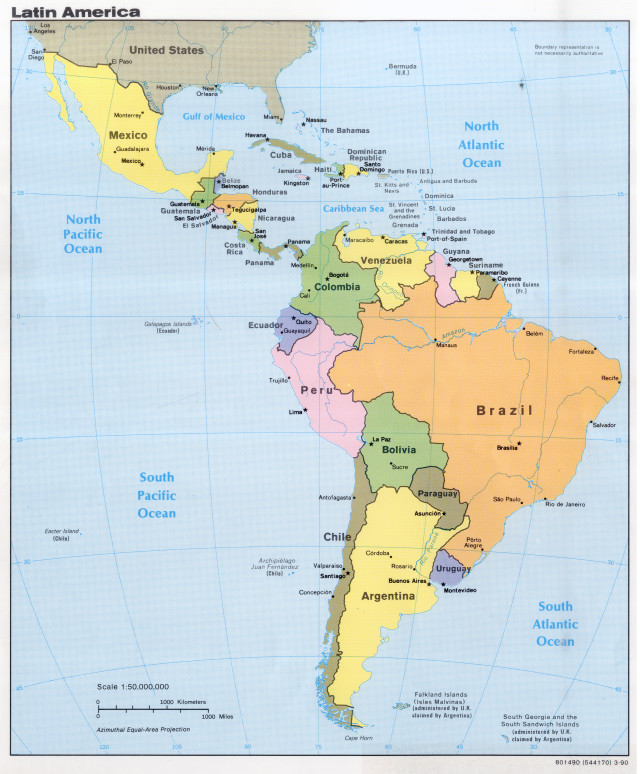

Panama. A tiny country joining Central America to South America. A country that most of the 7 billion people on Earth won’t even think about (if you knew it existed).

(Even now it is hard to locate it.)

And now it is making headlines everywhere.

A year ago, journalists from various news agencies – the prominent one being German newspaper Süddeutsche Zeitung, BBC Panorama and UK newspaper the Guardian – came together to investigate a leak of 11.5 million documents from a Panama-based law firm, Mossack Fonseca (hence the tag “Panama Paper Leaks”). If you have any doubt about the size of the leak, here is an alternate measure – the documents took up a space of 2.6 TB, making it the largest leak in history!

What do the leaks show?

The documents span a period of 40 years, giving proof of the law firm’s assistance in helping clients set up shadow companies in tax havens to evade taxes. Many world leaders and celebrities from more than 200 countries and territories have been named in these files, just showing how widespread the scandal actually is.

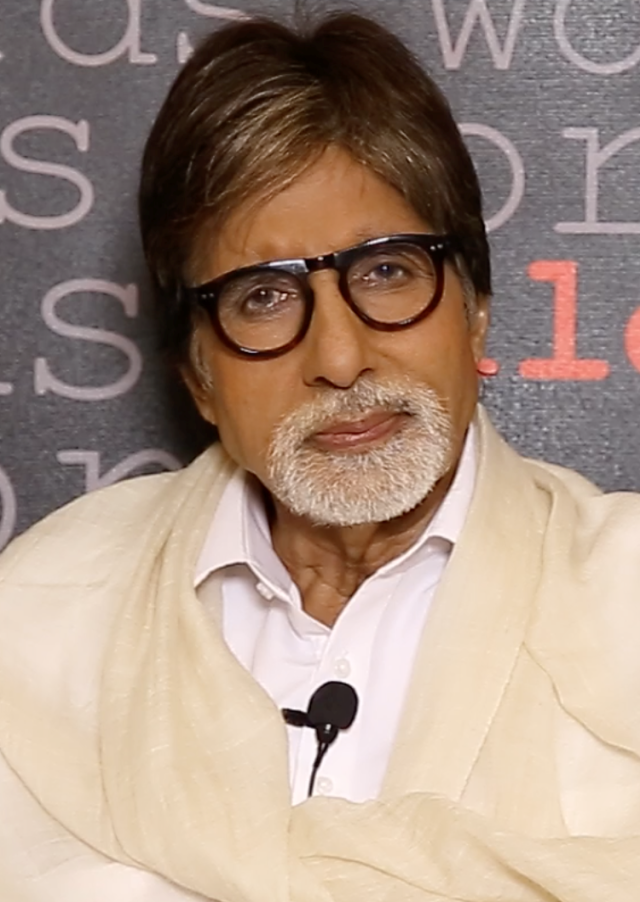

Some of the famous names linked to the scandal (either directly or indirectly through relatives) include Vladimir Putin, Prime Minister of Iceland Sigmundur Gunnlaugson, Lionel Messi, Argentinian President Mauricio Macri and British Prime Minister David Cameron. Indians mentioned in the documents include Amitabh Bachchan, Aishwarya Rai, and Indiabulls’ Sameer Gehlaut.

The files mention that over 214,000 offshore companies were opened up in this time period.

Where does Mossack Fonseca come into the picture?

The law firm operates worldwide, having branches in over 42 countries. It specializes in offshore companies and is apparently the world’s largest producer of shell companies(which is a big incentive for tax evaders).

As the scandal is rapidly making front pages of every newspaper, the firm has given a wide range of excuses including this:

“We are not responsible for the actions of a corporation that we set up.”

Expect law firms to tactfully get around an issue.

But as more and more data is revealed of its actions, it is becoming apparent that Mossack Fonseca had a big hand in assisting money laundering and tax evasion.

So how did they go about it?

The law firm acted as a registered agent of a shell company for its client. These companies were situated in a range of tax havens around the world, most of them being in the British Virgin Islands. Tax havens have 2 characteristics – strict privacy laws and negligible taxation of wealth – which attracts loads of shady people interested in evading taxes in their own countries.

To guard their clients’ interests, Mossack Fonseca interacted with intermediaries instead, including accountants, lawyers etc. Some banks linked with the firm include HSBC, UBS, Credit Suisse and Deutsche Bank.

According to sources, anyone interested in Mossack Fonseca’s services can buy a shell company starting from $1000 only. Additional payments bring perks like setting up fake directors and keeping the clients’ identity a secret.

What does this mean for India’s black money problem?

Even though some prominent names have come up in the files, I do not think we can expect a return of black money sufficient enough to lead India on the path of growth, as BJP constantly projected it as.

For one thing, holding wealth in tax havens abroad is not exactly illegal, but there are more cases of people using these facilities for the wrong purposes than the right ones. With that being said, you can expect all the names in the list to vehemently deny any kind of wrongdoing.

So for India, the only effect of these papers would probably be a shift of focus of the media from other issues (nothing productive, but a lot of sensationalization). And a little more publicity for the suspected culprits. But taking the global effect into account, I feel that this leak will give an incentive to other whistleblowers to do the same, and make other tax evaders quake in their shoes.

I do hope the second effect is taking place right now, though. There is nothing like a bad reputation to demotivate potential future fraudsters .

For more details, you could visit the official website of The International Consortium of Investigative Journalists, who is leading the investigation into the documents.

(Sources: Vice, Indian Express, The Hindu, BBC, The Guardian, The Mirror, ICIJ official website)