Life skills is a term used to describe a set of basic skills acquired through learning and/or direct life experience that enable individuals and groups to effectively handle issues and problems commonly encountered in daily life.

What Does Credit Score Entail?

Credit Score includes loans taken, credit cards used, overdraft facilities, etc., and their repayments. This analysis may also include the data regarding income taxes, timely payment of utility bills, and so on.

Curation of information happens from the collection of information from lending companies, data collection agencies, and various other sources.

Curation usually happens from one of the four bureaus, namely CIBIL, Equifax, Experian and CRIF High Mark.

Good Credit Scores

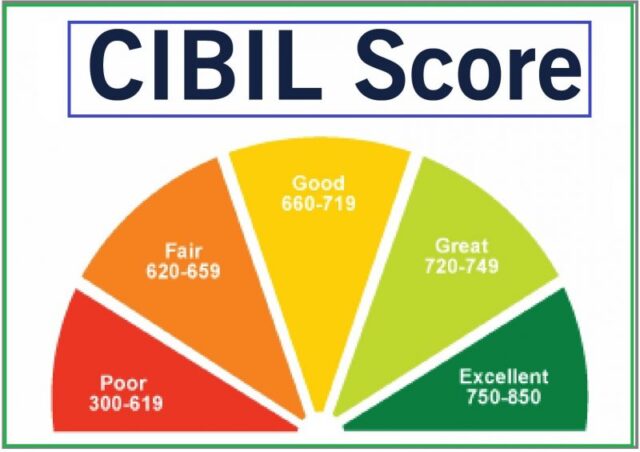

There are varying scales of credit scores offered by the four bureaus. Out of all the scales that exist, the general rule of thumb is that the higher the score, the better the credit.

Also Read: Life Skills They Don’t Teach In School: How To File An RTI

Under the credit score system, a score of 750 and above is an excellent credit score. Scores ranging between 600-750 indicate slightly risky financial behaviour. And a score below 600 is a dismal credit score which usually makes a person ineligible for loans against credit.

Now, the real question here is how to improve your credit score?

Improving The Credit Score

There are various ways in which a person or an institution can increase their credit score. At the very least, a good credit utilization ratio should be maintained so that less than 30% of the credit limit is used.

An old account in an institution is perceived as an indicator of a credible long-term relationship with that institution. It can improve your credit score, therefore, closure of older accounts should be avoided.

Using and enquiring about multiple credit cards, loans, and other debt instruments should be avoided. An online search is fine, but enquiring through a credit-based company can flag this as poor score behavior.

Paying back EMIs on time and in full is another way to improve your credit score. Making regular on-time payments could help you improve your credit score over a period of 1-2 years.

This is how you improve your credit score, something that schools do not teach.

Image Sources: Google Images

Sources: Fullerton India, Bajaj Finserv, International Business Times

Find The Blogger: Shouvonik Bose

This post is tagged under: check credit score, cibil score, cibil credit score, cibil, credit card, credit card score, credit score free, loan credit score, credit score paisabazaar, credit score check free, credit score online, paisabazaar, my credit score, check cibil score, cibil check, cibil score check, credit card cibil score, check credit score online, credit score India, get credit score, credit score for loan, how to check credit score, improve credit score, how to improve credit score

Also Recommended:

Life Skills They Don’t Teach In School: How To Pay Utility, Credit Card Bills