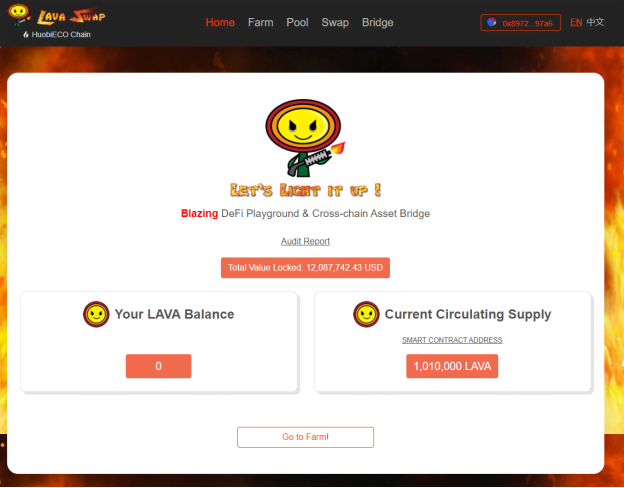

LavaSwap is a DeFi platform known as an automated market maker (AMM) that can be used for swapping HRC-20 (HECO) assets easily. After officially launching on January 27th, it surpassed a coveted milestone of $10M TVL (Total Value Locked) in just its first hour.

LAVAswap website: https://lavaswap.com/

Understanding the DeFi Explosion

DeFi, short for Decentralized Finance, is the idea that traditional financial models (banks, loans, mortgages…) can be recreated using blockchain technology, eliminating costly middlemen, making every process simpler, more accessible, and faster.

The core benefit of DeFi is easy access to financial services, especially for those who are isolated from the current financial system. Another potential advantage of DeFi is the modular framework it is built upon – interoperable DeFi applications on public blockchains will potentially create entirely new financial markets, products, and services. (Source1, Source 2)

Traditional finance is built on top of different institutions that perform tasks on every step of every financial service/process. This model is outdated, because in every step of every financial process there’s a middleman, making everything more expensive, bureaucratic and difficult.

All of those middlemen rely on taking a cut of every transaction, adding extra steps and costs that could be avoided with the use of technology. According to Defipulse, the leading data & analytics provider for Decentralized Finance applications, there are over $24.6B assets locked in DeFi protocols as of January 27th. The cryptocurrency market has seen an unprecedented explosion of DeFi applications, services and projects. While it’s early, DeFi can have a huge impact on many different industries and sectors.

A new wave of financial innovation is upon us. Decentralized Finance (DeFi) provides the solid foundation for new financial services that are so powerful and advantageous that we will soon look back on them and question how we ever operated without them. Decentralized financial instruments make cryptocurrency and the blockchain sector capable of accomplishing what was once only possible in traditional money markets. Services such as borrowing and lending can now take place in a wholly decentralized manner, without ever involving banking institutions.

This produces a multi-frontal, paradigm shifting, natural growth area – one that is fueling the digital currency boom. Decentralization will continue to be the essence of blockchain projects moving forward. With DeFi, there are a lot of new opportunities to explore. When it comes to the DeFi movement, the time is now to create value for the world. (Source 3)

Excessive Ethereum (ETH) Focus

Crypto and DeFi are becoming a new world order. People want flexibility and freedom of assets to do what they want. They are tired of spending crazy gas fees and want to spread their assets across chains and the whole crypto universe.

Crypto is currently too ETH dependent:

Ethereum (ETH) primarily dominates DeFi ~99% dominance (DeFi Pulse, Aug 1, 2020).

- While ETH is truly ground-breaking, public chains designed for generic use will fundamentally achieve scalability issues as they lack dedicated focus to pure finance use cases.

- Issues exist such as governance, Lack of absolute finality of transactions, Identifying investors with no built-in KYC and Custody

The Decentralized Exchange Revolution

- The incredible DeFi growth has been made possible in large part because of decentralized exchanges (DEXs). They are automatic and unstoppable exchanges where people can swap their crypto assets with other users, without the need of control and supervision from a central entity.

- Uniswap changed the game

- On the Ethereum network, Uniswap is the most well-known DEX. Its growth has been spectacular, and it has opened the way to new and exciting DEXs across the crypto space!

- Uniswap even surpassed Coinbase Pro in daily volume! (Source)

- SushiSwap took the same concept and made it more accessible and democratic:

- SushiSwap is a fork of Uniswap with some key differences – most notably, the SUSHI token. The token had two functions at launch: entitling holders to governance rights and a portion of the fees paid to the protocol. In a simplified way, SUSHI holders “own” the protocol. (Source)

- Another important DEX is PancakeSwap, built on the Binance Smart Chain.

- The developers of PancakeSwap cite high fees and slower speeds of the Ethereum blockchain as a driving factor in building on Binance Smart Chain. Ethereum may have kick-started the DeFi trend, but initiatives like PancakeSwap suggest that the wave of innovation is destined to spread to other chains. (Source)

Lava is poised for massive growth built on HECO

- LavaSwap is built on top of Huobi ECO Chain (HECO) for many of the same reasons PancakeSwap was built on top of BSC: lower fess, faster speeds and a huge ecosystem (although HECO is faster and cheaper than BSC). HECO is also created in association with Huobi, leveraginfg the massive community of one of the largest cryptocurrency exchanges with an estimated $5B daily trading volume.

LAVAswap is the first interoperable decentralized cross-chain swap protocol powered by Huobi Eco Chain. We envision a world where all crypto assets can come play in our BLAZING DeFi playground, which includes a DEX, liquidity pool, cross-chain bridge and more.

Official Website: www.lavaswap.com

Twitter: https://mobile.twitter.com/LavaSwap

Telegram: https://t.me/LavaSwap

Medium: https://lavaswap.medium.com