With Union Budget not even a fortnight away, the expectations of the Aam Admi from the ‘Modi’fied Union Government are already at a rise. When Finance Minister Arun Jaitley presents his second Union Budget on 28th of February, all eyes across the country will be glued to the TV Sets, with a hope that there will be landmark policy changes accelerating ‘Achhe Din’ for the Indian Economy.

With the government facing a setback because of the recent Delhi Poll results and the public doubting the credibility of the NDA government at the center, this Budget proves to be crucial one especially as it helps to restore the lost faith of the citizens in the ruling regime.

Having implemented policies like ‘Jan Dhan Yojna’ fostering Financial Inclusion, ‘Swachh Bharat Abhiyan’ aiming for a cleaner India and ‘Make in India’ boosting the manufacturing sector of the country, the world is now looking forward to how this government plans to direct the status quo towards the path of development.

Let’s now look at some changes that should be made through this year’s budget to live up to the expectations of the common man-

- Brand New Policy for Poverty Alleviation: With a substantial proportion of the population struck by poverty for decades and in spite of a series of Poverty Alleviation Programs being adopted by governments in past, the nation needs a revamped and a more effective approach to help those in abject poverty. Higher budget allocations for such programs seem imperative to lead India to a more prosperous path. Also, when the government focuses on boosting the GDP, it needs to ensure that benefits of such growth reach out to all classes, not concentrated in the hands of the rich ones.

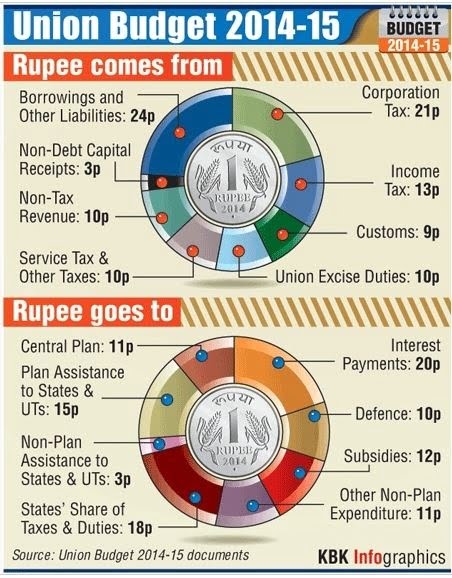

- Not so balanced government’s income Vs. its expenditure:

Analyzing past year’s debit and credit transactions executed by the government, it is clear that burden of borrowings and the subsequent interest thereon is too high to be met by the revenue it raises through taxes and PSU profits. Either by cutting down the expenses on subsidies or crediting more tax revenue to the treasury by looking after tax evasion, it’s high time the government comes up with a holistic policy to cope us with the increasing budget deficit so as to strengthen the economy in the long run.

- Boosting Agricultural Sector: Indian economy which is by and large agrarian, even after nearly seven decades of Independence continues to depend highly on the vagaries of the monsoon. After the New Economic Policy of 1991, the Indian Economy which was now liberalized, privatized and globalized saw a positive impact on other secondary and tertiary sector enterprises. But the effect on agriculture has not been substantial. Budget should therefore ensure a holistic approach towards the modernization and up gradation of the agro-sector.

- Incentivize Domestic Savings : “Remember the government increased the limit for tax benefit in savings by Rs.50,000 in the last budget. The question is — is there room for more primarily because the real tax benefit has fallen over time because the limit was at Rs.1 lakh for a long time. Maybe what we have to do is increase that.” Said RBI governor, Raghuram Rajan.

Rajan emphasizes the fact that even though the tax exemption limit was raised by 50,000 in the last budget, still it didn’t have any impact on Domestic Savings. Indians, primarily are savings oriented people. But now,the common man is either unable, or unwilling to save much. Unable, because of the rising inflation, and unwilling, because of stagnant budgetary incentives. Thus, it is imperative on the part of the government to take substantial measures to promote domestic savings.

- Higher Budgetary Allocations for Infrastructure, education and health care: Access to primary education and basic healthcare facilities is still a distant dream for many residing in the remotely backward areas of the country. Adding to this, are stalled infrastructural projects which exist just on paper, not in reality. To kickstart growth in the economy, it is essential that the government drafts a proper policy for improvement of health, education and infrastructure in the nation.

With an aim to narrow the fiscal deficit and control rising inflation in the previous budget, the government also paved the path for certain revolutionary reforms by initiating policies like ‘Swach Bharat Abhiyan’, goal to set up Smart Cities and Satellite Towns, reducing custom duties so as to promote foreign trade but at the same time, the budget was criticized for unjustified appropriation of funds like allocating 200crores for Sardar Patel’s statue but only 150crores for building a safer environment for women.

While the last budget raised eyebrows questioning the priorities of the Modi government; that time of the year is back again when the common man has started building high hopes tied to Mr. Jaitley’s budget briefcase. Whether the budget will bring a smile to the faces or add to the existing woes of the people, on February 28th the nation shall know!

Picture Credits- Google images

By Vaibhav Agarwal