A spectre is haunting Europe, the spectre of a left government in Greece. On 25th January, Greeks vote for a new government. On 26th January, Syriza is announced the victor and radical left leader Alexis Tsiparas is sworn in as the new Greek PM on 27th, after Syriza’s decisive victory over establishment parties supporting the EU programme that has impoverished so many Greeks. The bourgeois press, right wing, and capitalists throughout Europe believe that with the recent turn of events Greece will descend into chaos.

At the same time, many in Europe link a left government under Syriza with high hopes.

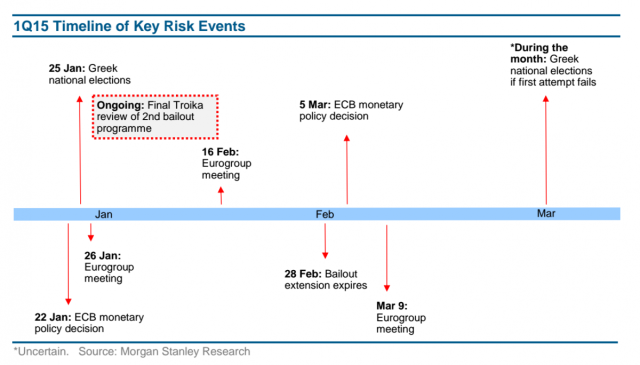

The First step is to renegotiate Greece’s bailout programme – which totals €240bn since 2010 – officially ends on 28 February. After that, Greece will no longer have access to cheap credit lines from the European Central Bank (ECB). So the first step is getting the European Commission, International Monetary Fund and the ECB – known collectively as the Troika – to agree to extend that deadline. Giving Greece more time is one concession that most parties seem willing to make. Mr Tsipras may be resistant to extending a bailout programme which he has actively campaigned against, but it would give both his new government and Greece’s creditors more breathing room for negotiations over the longer-term restructuring of Greek debt.

The First step is to renegotiate Greece’s bailout programme – which totals €240bn since 2010 – officially ends on 28 February. After that, Greece will no longer have access to cheap credit lines from the European Central Bank (ECB). So the first step is getting the European Commission, International Monetary Fund and the ECB – known collectively as the Troika – to agree to extend that deadline. Giving Greece more time is one concession that most parties seem willing to make. Mr Tsipras may be resistant to extending a bailout programme which he has actively campaigned against, but it would give both his new government and Greece’s creditors more breathing room for negotiations over the longer-term restructuring of Greek debt.

While Alexis Tsipras gears up for a prolonged austerity battle with Brussels and Berlin

A Greek political party formed in 2004 as a coalition of radical left-wing groups, ranging from Greens to former Communists. Syriza’s popularity exploded after the collapse of Greece’s economy in 2010 and onerous terms were attached to the country’s bailout by the “Troika” of the European Union, the European Central Bank and the International Monetary Fund. The party, which is led by 40 year-old Alexis Tsipras, came very close to taking power in 2012’s general election. And now, three years on, it has succeeded. Syriza become the biggest party in the Greek parliament and will form a governing coalition with the right-wing Independent Greeks party.

Syriza said on the campaign trail that it will demand an easing in the terms of the Troika bailout, rehire many fired civil servants, stimulate the economy and secure a reduction in Greece’s huge national debt.

Effects of their Plans:

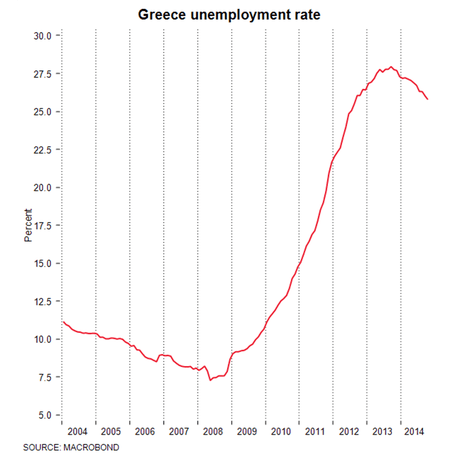

Syriza argues that the Greek economy, which has only just emerged from a four-year depression, will improve and that mass unemployment (currently at 25 per cent of the workforce) will fall.

Others say that the Troika will refuse to meet Syriza’s demands for a reduction in austerity for fear that it will encourage other bailed out European states to demand similar help. Either the new Greek government will have to backtrack on its promises, these critics say, or its financial system will lose access to emergency lending from the European Central Bank and the country will crash out of the euro zone. Syriza, however, believes it has a strong bargaining position because the Troika will be even more fearful of the knock-on economic and political effects of a Greece exit from the euro.

There is a possibility that if Syriza takes Greece out of the euro zone its banking system would implode, the economy would sink back into recession, unemployment would shoot still higher and there would be severe civil unrest. The Greek people certainly still seem to think that life would be still harder outside the euro zone, with polls showing a large majority for staying in. Yet there is also a possibility that a “Grexit” would ultimately be economically beneficial for Greece, giving the country’s exports and tourism industries a massive boost from a lower currency exchange than it currently has in the euro zone.

The possible implications for Europe:

Politicians in Germany, the eurozone’s dominant economy, argue that even if Greece leaves the single currency it would not create any financial problems for the rest of the currency bloc. They say the Continent’s banking system has been successfully insulated over the past two years. But this might well be overoptimistic. There is a possibility a “Grexit” could reopen the Continent’s financial crisis if it prompted panicking people and companies to yank money out of perceived vulnerable European countries’ banks again.

Alexis Tsipras, leader of Syriza left-wing party, speaks during a rally outside Athens University Headquarters in Athens

Alexis Tsipras, leader of Syriza left-wing party, speaks during a rally outside Athens University Headquarters in Athens

The possible implications for the UK:

The eurozone crisis was a major factor in the weakness of the UK economy since 2010, hammering business confidence and hitting British exports. If the single currency area goes into another meltdown – or even just another prolonged period of uncertainty – it will almost certainly be bad for growth and set back the recovery.

Spain and Italy:

Spain and Italy are the two states that are being most closely watched. Both have insurgent anti-austerity political groupings in the style of Syriza, Podemos in Spain and the Five Star in Italy. If the Greeks are successful in gaining concessions, those movements will undoubtedly be strengthened. The existing governments in Madrid and Rome will also likely start pushing for an easing of austerity and reform in order to protect themselves from being swept from office by an anti-austerity tidal wave.

Immediate effect after election results : Wall Street Rises, Energy Climbs

U.S. stocks edged higher on Monday as investors brushed off fears that a leftist victory in Greece would bring fresh crisis to the Eurozone and energy stocks advanced.

The leftist, anti-bailout Syriza party won decisively in Greek parliamentary elections on Sunday, after running a campaign promising to take on Greece’s international lenders and bring about an end to austerity measures.

The leftist, anti-bailout Syriza party won decisively in Greek parliamentary elections on Sunday, after running a campaign promising to take on Greece’s international lenders and bring about an end to austerity measures.

While the United States has limited direct exposure to Greece’s relatively small economy, extended volatility in the region could hurt multinational companies.

“There was a lot of trepidation in the market going into the Greek election … but by this morning the Syriza win was priced into the market already,” said Robert Francello, head of equity trading for Apex Capital in San Francisco. Energy stocks led gains on major U.S. indices after Abdullah al-Badri, OPEC’s secretary-general, said on Monday that oil prices may have reached a floor and could move higher very soon.

The key sticking point is any outright debt forgiveness for Greece. This is a demand of Mr Tsipras, but so far there has been no appetite for such a concession from other EU nations. They are leaning towards an extension of debt repayments, a possible easing of the conditions attached to the loans, and potentially reductions in interest rate payments. A lot hinges on whether such concessions will be enough after Mr Tsipras promised to make the Troika “a thing of the past” in his victory speech.

By Pavani Chennamasetti