We have a come a long way from the days of Benjamin Graham and Jesse Livermore to electronic ways of trading (rather manipulating the market). Computerized algorithms are quickly replacing (self-proclaimed) stock analysts and investors, leading to incredible changes in the way the stock market will value companies and increasing the chance that software glitches or hack attacks will jeopardize market stability. And the speed with which they are expanding calls for an action.

GENETIC ALGORITHMS (PARAMETERS. RULES. PROFITS.)

The worst nightmare for a broker is an algorithm that performs the process of natural evolution. Genetic algorithms are mostly created by data scientists (I.I.T. graduates) by forming a trading rule. Let’s say that you are looking to buy a stock and you pick average returns and risk as your two parameters. A genetic algorithm would then input values into these parameters with the goal of maximizing net profit. Over time, small changes are introduced and those that make a desirably impact are retained for the next generation.

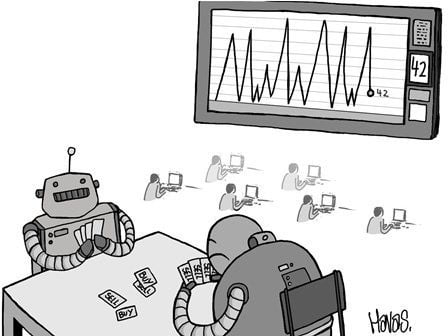

ALGORITHMIC TRADING (CATCH THEM IF YOU CAN)

Trading of securities based on the buy/sell decisions of computer algorithms (not your knucklehead broker). The computer algorithms are designed and (seldom) programmed by the traders themselves, based on the historical performance of the encoded strategy tested against historical financial data. Algorithms are used to interpret market signals and patterns and trades are executed. By some estimates, quantitative or algorithmic trading now accounts for over 80% of the trading volume in the United States and 40% in the N.S.E. and B.S.E. (finance enthusiasts beware, unemployment is here).

STATISTICAL ARBITRAGE (GREED IS GOOD)

Now that we have decided that greed is good, let’s talk about a hidden money making opportunity which is backed by lightning fast algorithms. Stocks are picked in such a manner that they have a historical correlation and will move in the same direction and get back to their historical pattern in the long term if any variation arises. Let’s say that you buy and short sell Coca Cola and Pepsi respectively. Fall in both hedges your loss as you are against the rise of Pepsi. Rise in both hedges your loss as you have bought Coca Cola at a lower price. Infact, it doesn’t matter where the market goes, you will be able to make money (fire them brokers).

ALGORITHMS FOR DUMMIES

This change in the financial world has certainly led to insane profits for those who are sitting behind these powerful algorithms. People who earlier considered themselves an Intelligent Investor after doing time series analysis of their holdings are now not even looking at the transactions. The delay caused by communication with brokers along with their (inflation adjusted) fee have been done with. Traders (in the market for a day or two) have got scientific measures to make money and vanish before getting a call from S.E.B.I.

TOO FAST TO FAIL?

Even with their advantages and exploits, algorithms are not easy to control. Automated trading orders can trigger extreme price swings, especially if the algorithm does not take account of prices. And the way in which these automatic orders interact with high-frequency and other computer trading strategies can quickly erode liquidity, even amid very high trading volume. There have been cases when the Dow Jones has fell by more than 5% which has led to trading halts to get the market back on track.

DAWN OF ALGORITHMS

One shouldn’t forget that over indulgence in super-fast financial algorithms can lead to volatility that is only imagined in nightmares. Technical Advisory Committees should be constituted to keep track of market orders. Algorithm based traders should be required to mark their orders and consider all executed and attempted orders before the next order is placed.

As they say that with great (algorithmic) power comes great (trading) responsibility…

You will also like reading this: