Ever since Compound launched its liquidity farming of its governance token (COMP) on June 15, token farming of various early DeFi projects has become the key to increase liquidity. Balancer and Curve launched their liquidity farming project after Compound. Now the total value locked (TVL) on these two platforms have exceeded 360 million USD and 1 billion USD respectively.

Yearn.Finance (YFI) leads liquidity farming to a higher level by launching a new hub or entrance to all existing DeFi farming projects. And then Yam.Finance and Sushi.Finance locked hundreds of millions of dollars in just a few days, with the highest locked value around 800 million dollars for Yam and 1 billion for Sushi. Sushi’s locked value was once more than 70% of the total locked value on Uniswap. And the reason for this craziness is Sushi’s extremely high yield. Its Annual Percentage Yield at the beginning was more than 10000%. Considering its high risk, it is still a mad return. This is only part of the liquidity farming projects, while more are on the way. However, liquidity farming gradually became the game of big players (whales) or institutions. One of the reasons is the unbearable ETH gas cost. To finish one round of farming (deposit and harvest) will cost more than 100 dollars. People cannot make enough profits to cover costs if they have not invested much money. Moreover, impermanence loss and price fluctuation also stop everyday users from participating in liquidity farming. In addition, there are some potential security issues for liquidity farming, such as integrity risk, bugs in ETH contracts, which users are mostly concerned about. Is there a way for normal users to participate in liquidity farming? With DeFi Lego blocks building up, it comes into reality. Farmland has proposed its solution of a cross-chain liquidity farming hub, to help everyday users to get involved.

Farmalnd’s Cross-chain DeFi Farming

- A glimpse of cross-chain DeFi

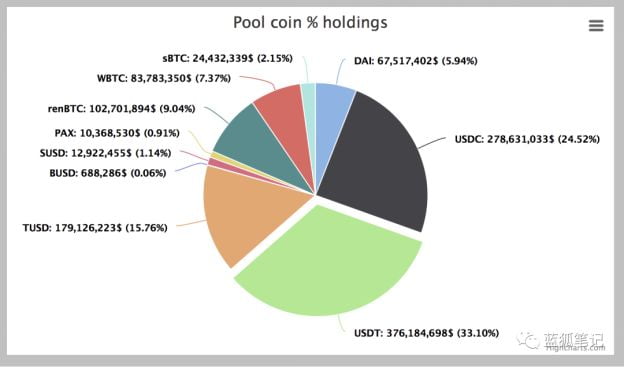

Nowadays most liquidity farming projects are launched on the only chain of Ethereum. However, as projects on Polkadot, Cosmos and Solana start liquidity farming, cross-chain farming is becoming a new trend. Ethereum is the center of all DeFi projects and the largest platform for smart contracts, a feature of which Bitcoin does not have. Compared with other public chains, Ethereum has a larger market cap and higher security standard. But its high fees, low capacity and transaction speed have restricted projects from using Ethereum. For instance, Serum is built on Solana and many projects are choosing Cosmos and Polkadot. The ecosystem of these chains are forming, meaning that Ethereum will not unify all public chains, and DeFi projects will be built on various chains. This is a huge opportunity for cross-chain products. Now cross-chain products for liquidity farming have begun to take shape. By the time the article is written, from projects like WBTC and renBTC, the number of Bitcoins on Ethereum is 59,392, with a total value over 7 hundred million dollars. A significant part of these locked Bitcoins are used to farm on Curve.Finance, where renBTC is valued more than 100 million dollars (out of 168 million dollars issued in total), and WBTC is around 83 million dollars on Curve.

(Curve holdings piechart,Source:Curve)

- Three stages of Farmland cross-chain farming

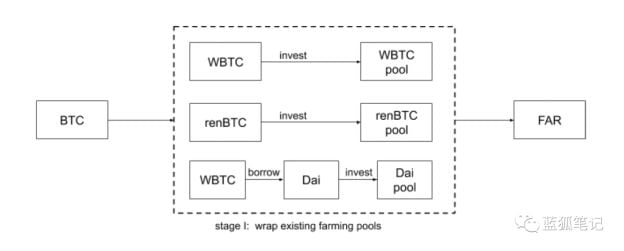

1)In order to iterate quickly, it is common to make use of current projects in the DeFi world. Different components of DeFi are like Lego blocks. Farmland plans to integrate with WBTC and renVM in the beginning. For users, the procedure is as follows: The user transfers BTC directly to Farmland and binds the Ethereum address for receiving profit. After the system obtains the token from farming, it will automatically distribute the profit to the user’s ETH address.

(Farmland Stage I,Source:Farmland)

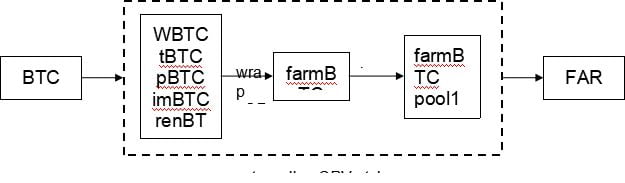

2)At stage II, Farmland will introduce the concept of farmBTC. The purpose of this phase is to pave the way for the third phase. farmBTC is a synthetic asset, mainly consisting of WBTC, imBTC, renBTC, etc. which is similar to how mStable puts USDT, USDC and Dai into one basket, and yCRY on Curve.Finance. FarmBTC makes the system more robust.

(Farmland Stage II,Source:Farmland)

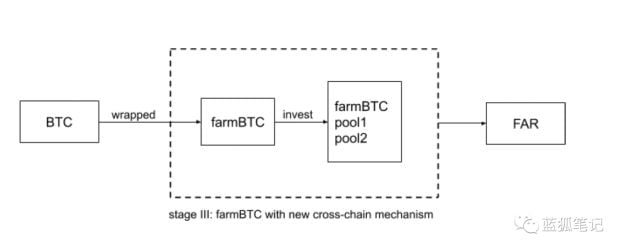

3)At this stage, the BTC sent by the user will be directly converted to farmBTC, which means, at this stage, Farmland will use its own cross-chain technology. After users deposit their Bitcoins onto Farmland, Farmland will wrap their Bitcoins through its centralized nodes network, and mint farmBTC. From this, we can see that farmland’s goal is to create cross-chain assets and use those assets to participate in liquidity farming.

(FarmBTC in Farmland stage III,Source:Farmland)

To be specific, how does Farmland achieve cross-chain in a decentralized way?

Farmland’s Decentralized Blockchain Interoperability

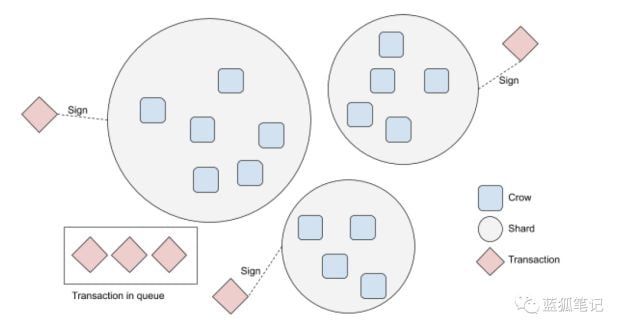

Risks of being too centralized are always an issue in the area of blockchain interoperability. People pay much attention to how to build a cross-chain product. By the time the article is written, there are 59,392 Bitcoins on Ethereum, with a total value over 700 million dollars, of which there are 39,104 WBTC, 14,159 renBTC, 2810 HBTC and 2,243 sBTC. Most of the wrapped Bitcoins are WBTC and renBTC. Now WBTC cooperates with centralized custodian agencies like BitGo and Kyber to issue 100% backed wrapped ERC20 Bitcoin tokens. Only authorised merchants with KYC/AML are allowed to mint WBTC. WBTC applies DAO governance, with multisig contracts to ensure safety. Users should either use merchants to swap BTC for WBTC, or use exchanges to buy WBTC using BTC. ImBTC can be minted by Tokenlon. BTCs are deposited into a multisig address and imBTCs are minted accordingly. RenBTC uses renVM to wrap BTC. RenVM network consists of darknodes. Now there is a great need for decentralized cross-chain assets. Farmland will work on this at the third stage. In order to achieve full decentralization, Farmland will build a nodes network too, which is called the crow network. Crows are in charge of custodians of assets and minting of wrapped assets. Since crows take so much responsibility, how to prevent them from behaving badly? Are they going to steal the deposited Bitcoins? When wrapping Bitcoins, how to ensure that there are enough corresponding assets, such that users will get all their original Bitcoins back once they deposit back their wrapped Bitcoins. Based on Farmland’s whitepaper, Farmland designs a mechanism to prevent frauds. Firstly crows have to pledge excessive assets, which could be confiscated if crows are acting badly. However, due to the extreme price fluctuation of blockchain assets, liquidation may become very difficult at that time. In order to solve this problem, Farmland requires crows to pledge multiple assets to make the system more robust. In addition to overcollateralization, Farmland will reward honest crows, which are crows with a good history. The system will increase the voting weight of those crows. The expected excess return aligns both crows’ and Farmland’s interest. At last, Farmland also introduces shards like what renVM does, to reduce the possibility of attack by randomly grouping crows.

(Farmland Crows and Shards,Source:Farmland)

When some grouped crows fail to sign a transaction and maliciously sign a false transaction, their bonds will be liquidated to protect the one-to-one peg. After Farmland wraps blockchain assets like Bitcoins, those assets will be used for farming. But how do they farm specifically? The following is about Farmland’s hub for liquidity farming and profits distribution.

Farmland’s liquidity farming hub

Fees are extremely high for DeFi farming right now. Take the popular SUSHI as an example, users need to add liquidity to certain pools on Uniswap, such as SUSHI-ETH pool. In order to do this, users need to approve both SUSHI and ETH on their wallets, which is the first expense. After approval, users can add liquidity to the SUSHI-ETH pool, which generates the second expense. After that users get LP tokens from that pool. Users then deposit the LP tokens to SUSHI’s pools to farm, which generates the third expense. Finally, when users harvest and withdraw, they need to pay a fourth expense. The total expenses depend on the current ETH network’s state, but can be up to dozens of dollars for one single transaction. Overall for one round of farming, the total expenses could be more than 100 dollars. Unless the return is extremely high, it is not profitable to farm with a small amount of money. In order to solve this, some service providers proposed aggregation of users’ funds to reduce the fees. However, some of these products are centralized and profits are not transparent, where service providers can take the majority of users’ profits. Also if there are loopholes in the underlying pools, service providers will not compensate for the loss. Farmland uses smart contracts to do liquidity farming and distribute profits automatically, to reduce the risks of being centralized and make profits transparent. When the amount of users’ funds exceeds a certain threshold, the funds will be deposited to farming pools and profits will be withdrawn when exceeding a certain threshold too. Users can then request to withdraw their own profits. Because farming expenses are shared equally among all participants, the cost for a single user can be reduced greatly. In addition, the profits can be used for staking to make additional returns. So basically, users only need to afford the expense of transfer-in and transfer-out, and do not need to pay high fees to interact with farming contracts.

In order to prevent malicious users from Sybil attacking, Farmland will set the user’s basic funding and time requirements for farming, which they call Duration (Duration=Amount*LockTime). When the Duration is lower than a reasonable value, the system will refuse service or charge a fee in advance. Farmland Protocol will collect revenues in advance, applying the data from the oracle. By using the oracle to obtain the expected income of Farmland and compare it with the Ethereum network fees, and if income is smaller than expenses, users need to increase the farming share ratio or extend the farming period. Farmland Protocol also collects 1% of the revenue in each revenue pool as a reserved security pool to prevent the problem that the contract cannot obtain enough start-up fees under special extreme circumstances.

Farmland Insurance

Right now many farming projects are launched without even basic auditing. Moreover, because many farming protocols are combinations of several Defi protocols, the risks are accumulated, making farming very risky. To make users feel safe, Farmland will introduce insurances and will evaluate based on whether the codes are audited and how long the pools have been running, etc, and rate different pools based on their safety conditions. For those with a higher risk, Farmland will encourage users to buy insurance. Users can buy insurance according to how much they have invested, and pay by stable coins, ETH or Farmland governance tokens. Part of that insurance will be used to buy back Farmland tokens and burn them. The upper limit of the reimbursement amount for a single contract is 15% of the total reimbursement pool, and the lower limit is the minimum of the loss of the principal amount and 5 times the premium. The determination of compensation requires community voting, and the voters are qualified participants in the compensation pool (that is, participants who have invested more than a certain amount of premiums and are not marked as bad credit).

When the amount put into the reimbursement pool by the voter who agrees to pay out exceeds 4 times the amount paid in the project, the reimbursement is approved. However, if the amount put into the compensation pool by the voter who disagrees with the compensation exceeds 3 times the compensation amount of the project, the compensation cannot be passed. All voters who participate in voting will receive certain rewards.

If the voter or the participant applying for compensation has maliciously defrauded insurance or maliciously failed to pay after later social determination, the voter’s address will be marked as bad credit, and once marked as bad credit, a small amount of premiums will be seized by the system and that address cannot vote for a period of time. It has been marked as bad credit many times, and voting rights will be terminated.

Farmland uses a different model compared with Nexus Mutual. The insurance pool of Farmland is from users’ insurance fees, whereas Nexus Mutual collects capital from its insurers.

Farmland’s DAO governance

After the initial centralization and selection of appropriate farming pools, Farmland’s governance will completely enter the DAO stage. The agreement is subject to FAR, and any improvements will be decided by FAR holders’ votes.

(Syndicated content is neither written, verified or endorsed by ED Times)

Read more: