With the corporate world being ravaged by second stage hostile takeovers, reforms in corporate governance are inevitable. While dual capitalisation has emerged as an effective measure to drive away hostile bidders, it is not without some major ill-effects. It does away with the one share-one vote rule, thus violating the principles of corporate democracy. Although there is no denying that in this era of finance corporatism, corporate democracy has been reduced to a theoretical concept but completely doing away with it robs the organization of the latent supervisory mechanism that the uncated votes exert.

The challenge lies in providing a resilient safeguard to corporations, while keeping the check on management intact i.e. ensuring the security-efficiency equilibrium. An ideal ownership structure must take account of the following:

- Providing a safeguard against Hostile Takeovers

- Establishing an unbiased supervisory mechanism to keep a check on management

- Keeping intact the latent pressure exerted by uncasted votes

Extending Dual Capitalisation

One solution lies in extending dual capitalisation and inducing a reservation mechanism into it.

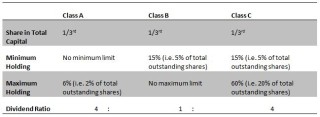

The system will involve recapitalization of an organisation’s shares into three categories- Class A, Class B and Class C- with distinctive features and benefits to cater different sections of investors. Each category will comprise of equal amount of organisation’s capital i.e. Class A will comprise of 1/3rd of the total value and so on.

Class A represents the common stock available to the general public, who intend to invest for a regular income source. No single entity will be allowed to hold more than 6% of Class A shares (2% of total outstanding shares). Class B will be the control shares. The holders of this category will have the right to sit in management or appoint the board of directors of their own choice.

Class C will cater specifically the Institutional investors or individuals who intend to invest for a regular income and a saying in the important matters regarding the functioning of business but do not intend to participate in all the day to day decisions. This category of investors will function as a check on the management ensuring that they work in the best interest of all the stakeholders.

Each share, regardless of the category, will carry one vote each in all matters except the selection of board of directors. Ownership of multiple categories is barred. This will effectively mean that no single entity can hold ownership in excess of 33.3% and no entity outside of the management can hold ownership in excess of 20%.

Class C shares can be alternatively utilised to impose state control on the organization.