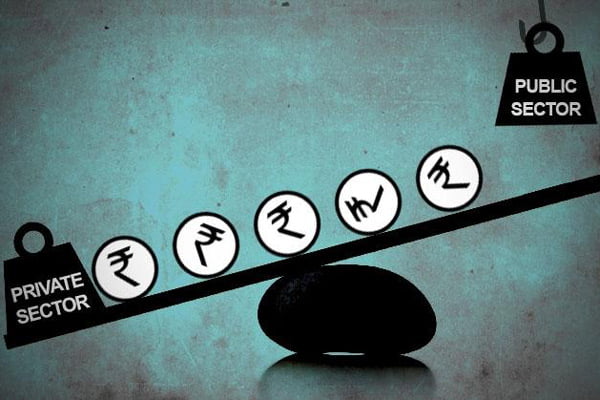

One of the earliest privatisations in India began in the year 1991, where the welfare-state aligning the Indian economy started giving way to a globalised and liberalised one. Since then, every government has looked towards big-money players and foreign investors to balance the books.

What it did was to revamp the staggering economy by opening it up to profit-making private players. The selling off of some of the public sector shares to private generated an income of Rs. 3080 crore and helped revive India from the huge economic debt.

Privatisation 2.0

A similar major privatisation drive can be anticipated in the near future, where the ruling government has decided to identify ‘strategic sectors’ that require government intervention and investment.

The number of Public Sector Enterprises (PSEs) in these strategic sectors would be limited to just four and the private sector can also have a say in these.

The areas that would fall under ‘non-strategic’ sectors would witness the exit of government investment, leaving them to sole operation by the private sector. The government has selected 16 PSEs for the purpose, one among which is Bharat Heavy Electricals (BHEL).

This massive privatisation drive is being faced with a considerable amount of backlash, in addition, to support from some fronts. The support of privatisation comes from the stance that it will improve the quality by cutting down on unit costs as well as the rampant corruption and increase the output and improve the overall quality.

According to the Public Enterprises Survey of 2018-19, around 70 Central Public Enterprises incurred losses of about Rs. 31,635 crore in FY19. The rotation of management in the top rungs and the typical government job type complacency has made PSEs inefficient, thus necessitating privatisation.

The other stance views PSEs as national heritage and that they should stay in the hands of the state and not left to the incentive-centred private sector. The backlash is a stronger one and is contested on several grounds.

Also Read: Is Bangladesh’s Economy Doing Better Than India Even During COVID?

Requirement For State Hand-Holding Rather Than Disinvestment

The ongoing pandemic has given a terrible jolt to the Indian economy and to counter the same, the government announced major stimulus packages that would boost the economy, and privatisation of PSEs is one among them.

At a stage where the unemployment rate in India has risen to over 23%, this strategic disinvestment by the government would also risk the jobs of more than 15 lakh people who are employed in these PSEs.

In addition to this, the much-debated draft National Education Policy or NEP lays emphasis on privatisation of higher education in the country. It talks about having multidisciplinary and high-profile Higher Educational Institutes (HEIs) in every district, the costs for which could only be borne by private investors.

At the same time, there is no concrete mention on guaranteeing or improving the faulty public education policies.

While it is true that the government revenues have faced a severe dearth in the recent few years, especially due to the COVID-19 pandemic, and privatisation of major CPSEs can bring in an influx of much-needed revenue, this does not seem the perfect time to implement the decision.

The economy and major government entities require careful hand-holding by the government in order to stand on their own feet.

On a personal note, I’ve seen my mother, who is a LIC employee go on strike with her colleagues. Most LIC employees fear the loss of secure jobs if private entities take over.

A path-breaking decision such as the privatisation of such crucial entities needs to be done in a phased manner and needs to be postponed by at least 2-3 years so that proposed risks from privatisation can be minimised, in addition to generating the targeted revenue and efficiency.

Image Source: Google Images

Sources: The Hindu, Economic Times, The Hindu Business Line

Connect With The Blogger: @som_beingme

This post is tagged under: air india privatization, du privatisation, FDI in retail, Indian railways, lic privatisation, privatisation of TISS, strategic disinvestment

I got this site from my friend who shared with me on the topic of

this website and at the moment this time I am browsing this website and reading

very informative posts here.

I am seen this site from my friend who shared with me on the topic of

this website and at the moment this time I am browsing this website and reading

very informative posts here.