Disclaimer: Originally published in December 2016. It is being republished since it still remains an interesting topic till today.

RBI has recently proposed that opening of ‘Islamic window’ in banks will increase Sharia banking in India. This has been raising quite a few eyebrows. This is what brings us to demystify the very concept of Islamic banking for you!

What exactly is Sharia or Islamic banking?

What exactly is Sharia or Islamic banking?

Sharia banking or Islamic banking refers to banking activity that conforms to Islamic law or Sharia. The key principle of Islamic finance is the rejection of interest, along with the requirement that there must be no engagement in immoral businesses.

Interest is Riba, which in its current interpretation covers all interest and not just excessive interest.

Under Islamic law, a Muslim is prohibited from both paying and accepting interest. Thus, Sharia banking means money can be deposited in a bank only without interest.

And this amount can’t be used for activities like trading or gambling, or for alcohol or pork.

What is the objective for Islamic banking?

The concept is aimed at Muslims who don’t participate in the conventional banking system due to religious restrictions. Such Muslims don’t even prefer to take credit from banks to expand a business.

There is no recent data on the number of Muslims who have bank accounts. However, the Sachar Committee report released in 2006 did give some insight.

The report said that “Muslims hold 12.2% of accounts in public sector banks and 11.3% in private sector banks. This percentage is lower than their share of 13.4% cent in the population as a whole.”

A large chunk of Muslims are, however, a part of the conventional banking system and both pay and receive interest. Some religious scholars in fact have argued that the interest in the conventional banking systems is not the same as usury.

According to them, the levying and receiving of interest at a fixed rate is allowed. Large parts of the Islamic world including Pakistan adhere to conventional banking practices.

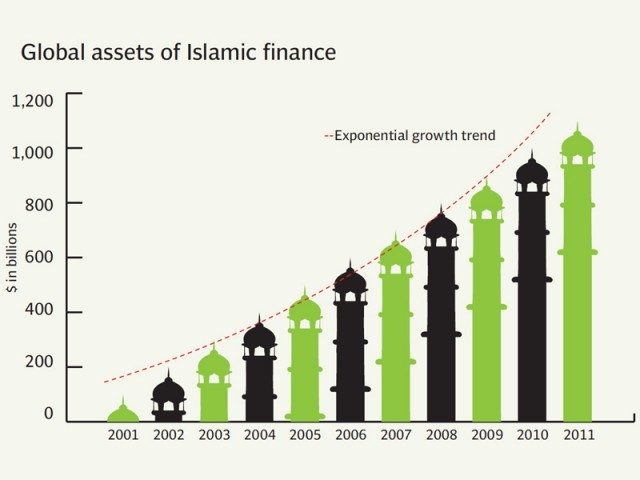

Introduction of Sharia or Islamic banking could bring more Muslims into the banking system, and help in the inflow of institutional wealth from entities operating in the Islamic world to the Indian economy.

Sharia banking is not restricted to Muslims alone, and other communities who are interested in other forms of banking like ethical banking could be allowed to participate.

Okay, but how does a bank work without an interest being charged or given?

For this, banks have to structure their accounts in Sharia compliant ways. This is where the instrument of Ijara is available. With Ijara the bank purchases the asset on behalf of the client and allows its usage for a fixed rental. After a mutually agreed time, the ownership of the asset is transferred to the client.

Another instrument is the Murabaha for working capital, in which the asset is purchased by the bank at market price and sold to the customer at a mutually-decided marked-up cost. The client can repay in installments.

Musharaka is a joint investment by the bank and the client, in which both contribute to funding an investment or purchase and agree to share the profit or loss in agreed-upon proportions.

For savings accounts, there are two kinds of deposits. In one, customers can deposit their savings and allow the bank to use this money, with the assurance that they would get the full amount back. The bank is not liable to pay interest to the savers.

In the other kind, the holder allows the bank to invest his money in specific projects and gets returns after a stipulated term based on how the business performs.

So, this is how an Islamic bank works. Now RBI’s interest in Islamic banking can work both ways. While it’d certainly attract new users to the banking sector, it can also ignite a communal fire in a country like India.

What will actually ensue?

Well, we’ll have to wait to find out!

Image Credits: Google Images

Sources: Investopedia, Firstpost

You’d definitely like:

ED Voxpop: What Is It Like To Be A Muslim In A Country Like India?