Fast forward the calendar…

Fast forward the calendar…

It is now late 2021 and the problems of COVID-19 are remnants of the past.

International flights have resumed, restrictions have been lifted and life is slowly going back to normal… Covid-19 will be nothing but a bad memory. In fact, all of the pale-skinned lockdown survivors are now booking vacations to their favorite spots which are reopening.

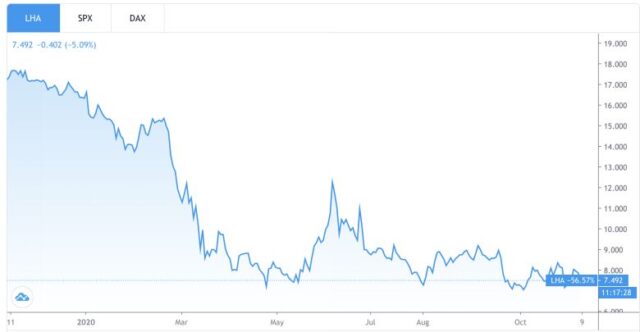

Because the economy will be back…it always comes back .Many companies took a big hit due to the pandemic.Take Lufthansa for example: Their stock price dropped from 18€ to almost 7€.We’re talking about more than a 50% drop.

While the panicking investors in 2020 were selling away their travel shares, large parts of their portfolio and many other industries that took a dip during COVID-19, other smarter investors were doubling down on their positions with an alert and steady gaze on their trading platform, buying at a discount and speculating on what is considered…

The biggest investment opportunity of our lifetime.

We’ve seen it over and over again. More millionaires were created after the Great Depression than in any other period in history.

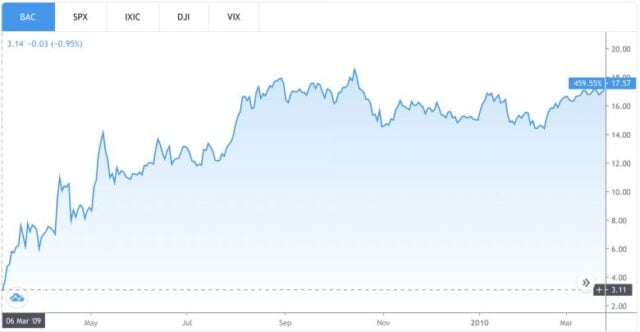

Take a look at 2008, while some people got hurt from the crisis, the smart ones, made tons of profits.

Take Bank of America for example:

After the financial crisis, their stock price dropped nearly as low as $3. If you’d bought it back then and held on just a bit, you would have reached an amazing 400% ROI.

Imagine how amazing it is, making $4 on every Dollar that you put in.

The fastest growth in wealth took place in India, China and Brazil, some of the hardest hit markets in 2008. Wealth in Latin America and the Asia-Pacific soared to record highs.

These opportunities were only available for cool headed investors who could see the market rationally.

The 2008’s quick bounceback should indicate that the World can rebound faster than we’ve ever seen before. While the rebounds of distant eras, like the Great Depression, took several years we can now jump faster and higher as a global economy.

So, if after 2008 the majority of the ivy league stocks went back to their original price and even higher, what do you think will happen to stocks such as Lufthansa, Boeing and other market leaders who definitely aren’t going anywhere after the Pandemic?

Exactly, they are BOUND to go up again.

So, if you want to potentially DOUBLE UP your investment, but you don’t know how to start or what to do, click on the link below. You will get a 100% FREE one on one consultation with a regulated brokerage.

Click here to get a free 1 on 1 consultation with a regulated brokerage

(Syndicated press content is neither written, edited or endorsed by ED Times or any of its republishing partners)