The share market has always been like an abstract painting for so many of us. Great to see from a distance but most of us barely understand it.

Personally, when I see so many numbers together, my eyes start turning into a spiral. I have always been fascinated with the working of the shares but didn’t really understand much because I didn’t know where to start.

However, recently I learnt about something called a demat account, which is the first baby step for those who wish to trade or invest in shares.

Now out of the two words, if you are familiar with the word ‘account’, that’ll be good. Because a demat account is similar to a normal bank account. The only difference is that a demat account holds your shares, securities, bonds etc.

How did it come into being?

Once upon a time, when you bought shares in any company, you were given a certificate in return, as a proof of your purchase. However, the entire system of handing out a physical certificate had to become too tedious after a point. Therefore, the system was electronised.

So all the certificates that you had were ‘dematerialised’ and put into an account, therefore called the ‘demat account’. Simple?

So what is a demat account exactly? Just like a bank account has record of all your transaction, a demat account too holds records of all your selling and purchasing, when were they done and at what prices.

Okay, so when it is an account, where do you locate it?

In your bank itself!

Your bank holds the custody to your shares.

It is called the ‘depository participant’ (explained later) in this case and therefore, the registered owner.

Therefore, for instance, you buy 10 shares of Reliance Industries, then the ‘registered owner’ for your shares will be your bank, which means that if you check the register on a stock exchange, it will show that your particular bank is holding those shares on your behalf.

But, you remain the beneficiary!

Now, how to open a demat account?

If you wish to own stock and trade, you must know about how to open a demat account, and open it for yourself. Here is how you go about opening a demat account.

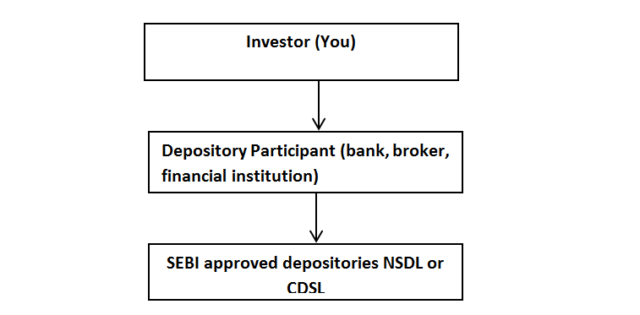

The Search and Exchange Board Of India (SEBI) has approved 2 depositories, namely – NSDL i.e. National Securities Depository Limited and CDSL i.e. Central Depository Services Limited.

These two depositories have under them, a number of depository participants (mentioned earlier) where you get yourself registered.

They further tie up and register under either NSDL or CDSL. After the registration is confirmed, they can open the demat accounts of people like you and me.

Anyone can be a depository participant – a bank, a broker or a financial institution.

Therefore, SEBI approved account, with a member of NSDL or CDSL, we get a Demat DP (depository participant) account.

The rest is all similar to the way we open a normal account which requires documents like our address proof, identity proof, photographs, PAN card, etc.

IMPORTANCE

Basically, just like a bank makes hefty transactions easier and you do not have to carry a lot of cash around. Demat account will offer the same smooth facility for the transactions of your shares!

A demat account makes the transactions of your shares way easier. But prefer to keep your demat and savings bank account in the same bank, to avoid any hassles.

This way the transfer of money from your bank account to demat account in the form of shares you have bought, or the transfer of money earner from the shares you sold from the demat to your bank account is made a lot easier!

There you go! Not that difficult, huh!

You May Also Like To Read:-