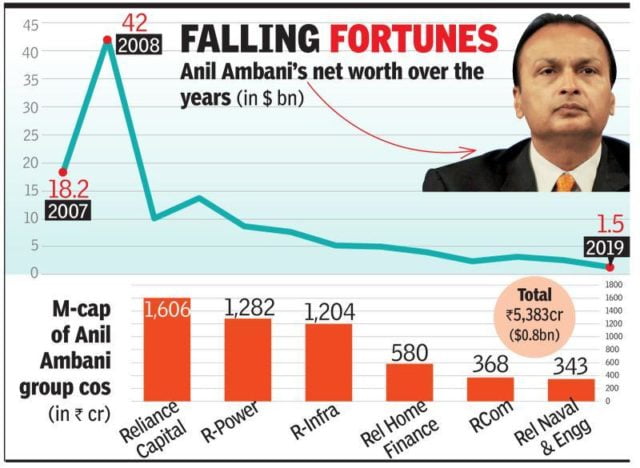

Would you pity a businessman who heads stock listed companies in the areas of telecom, power, financial services, infrastructure and entertainment, and who was the sixth richest person in the world in 2008?

Will your answer change if I told you that his last name is Ambani and as of July 2019, his net worth is USD 109 million?

The man I’m talking about is Anil Ambani (couldn’t have been Mukesh Ambani, duh!) – yes, the one who exemplifies how to become a millionaire…from a billionaire! Before you feel sorry for this not-so-rich-anymore entrepreneur, please be informed that it was his own doing to a great extent.

The latest addition to his embarrassing tales is his resignation as the director of Reliance Communication on Saturday, 16 November 2019. In May this year, the company was declared bankrupt officially.

Since the difference between a billion and a million is of 3 crucial zeros, so here are three important things that you can learn from the downfall of a billionaire.

Vision Without Strategy Is Just Over-Ambition

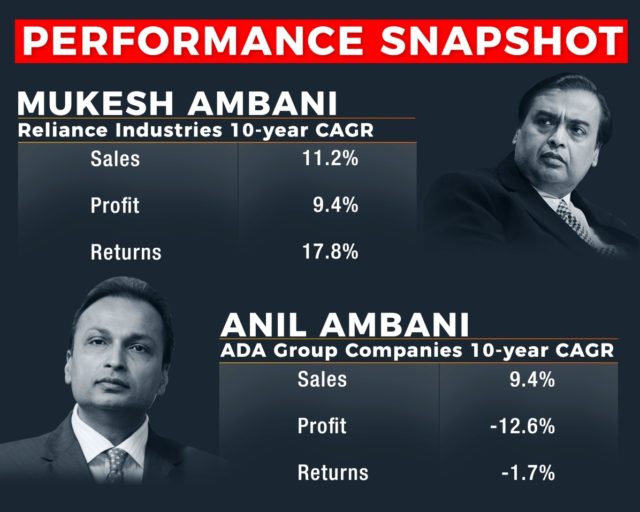

After industrialist Dhirubai Ambani died of a stroke in 2002, his business empire was supposed to be run by elder son, Mukesh Ambani and younger son, Anil Ambani. The former became the chairman of Reliance Industries Limited (RIL), while the latter was made the MD.

As an heir to the fortune, Anil Ambani sat on a goldmine of opportunities and cash. With an MBA from Wharton and the vision to run business, he was driven by his ambition.

Major power and infrastructure projects in the 2000s were driven by big businessmen like Adani, Tatas, G.M. Rao of GMR Group etc. as capital was cheap back then. In a bid to invest and not fall behind competition, Anil took up capital-draining projects in power and railways auctioned by the government after the brothers split the empire in 2005.

When he became in charge of the then new-age sectors of power, infrastructure and telecom, he had too much money to control well.

His close relations with politicians and the fact that these projects were being financed by public sector banks further tempted him to dive into these projects without a strong execution plan.

The recession in 2008 along with his lack of strategy is the reason why things went downhill for him.

Disruptive Innovation Is The Key To Growth

Earlier, there was a non-compete clause in the business agreement signed between the brothers when they parted ways because of which Mukesh did not venture into the telecom sector. However, this clause was scrapped in May 2010.

Mukesh Ambani was astute enough to realize the unexplored potential of telecom sector and once he was unhinged, he came up with an innovation that became the most powerful disruption in the sector.

He acquired Infotel Broadband for INR 4800 crore in 2010 and six years later, launched 4G in the name of Jio, which changed the game altogether for his competitors including RCom, Vodafone and Airtel.

Today, Jio is the front runner with 5G on the cusp of becoming ubiquitous.

Anil Ambani had a grip over the telecom market when his company opted for Code Division Multiple Access (CDMA) technology back in 2002. However, its scope was limited to 2G and 3G.

Ambani junior didn’t innovate enough to be able to ride the tide of technology like his brother did in lesser time. Consequently, RCom is now going to exit from the telecom sector and steer towards enterprise business and real estate.

Diversification And Debt Management

As of September 2018, the total debt of Anil Ambani’s conglomerate stood at INR 1.72 lakh crore. In May this year, he narrowly escaped the possibility of going to jail when his brother paid the debt he owed to Ericsson, a Swedish gear maker that was once a vendor for his company.

His companies started to feel the pressure of his humongous pile of debt and therefore, he decided to sell off assets to cover his liabilities. Big Cinemas, the multiplex chain owned by Reliance Entertainment, was sold off in 2014.

In August last year, his company Reliance Infrastructure sold the power distribution project for the city of Mumbai to fellow businessman Adani’s company for INR 18,800 crore.

On the back of the cash cow he inherited, Anil Ambani diversified very quickly but did not keep himself liquid enough to sustain his investments and keep up with the ever-growing requirements of the competitive market.

He didn’t build an engine of growth which would have not only helped the businesses he ventured into to stay afloat, but also fueled them enough to thrive. This engine of growth should have been a core business that he could have focused on completely while running other businesses on the side.

After all, branches of a tree can withstand a storm only when they are strongly connected to the trunk.

By and large, there’s no denying that he faced tough business climate and challenges, but it doesn’t take away from the fact that he had a significant part to play in his own unmaking.

It will be interesting to see if the Ambani scion can turn his fate around in the times to come.

Sources: The Economic Times, India Today

Image Credits: Google Images

Find The Blogger: @thinks_out_loud

You May Also Like To Read:

Media Propaganda Behind Mukesh Ambani’s Jio- Wonder Why It Is Hyped Up So Much!