By Sriraj Singhania

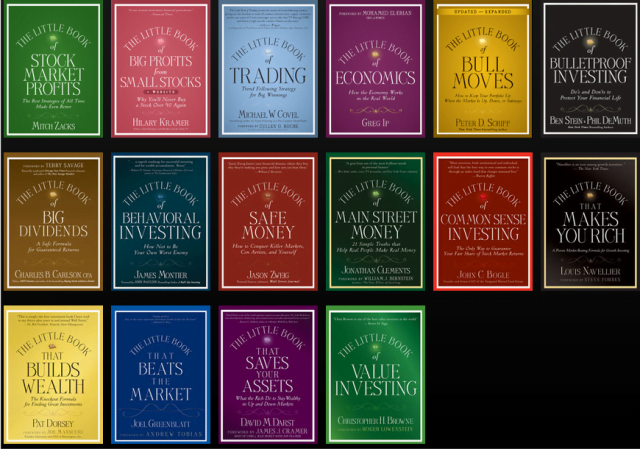

The Little Book series is a sequence of small hardcover books by Wiley Publishing which seeks to explain a specific investment strategy in layman terms and how an individual can execute that strategy to his advantage.

1) The Little Book of Common Sense Investing – John Bogle

It is one of the five books which persuades the readers with its clear and thorough enough arguments to actually convince readers that the advice was worth following.

What really carries The Little Book of Common Sense Investing is the strength and logic of the argument. The idea of investing in index funds makes a lot of sense and is easy – invest as widely as you can and cut back on the fees you pay.

This way, you aren’t completely affected by the wrong decisions of one company; moreover, you don’t have to ride the tidal wave of a single company’s success. Instead, you sail on the boat of the overall market.

2) The Little Book of Value Investing – Christopher Browne

One of the most worthwhile reads of the Little Book series is The Little Book of Value Investing. Benjamin Graham’s The Intelligent Investor is generally considered to be the definitive book on value investing – it lays out the strategy in thorough detail and the author has a great deal of renown and prestige among real-world investors.

But the problem is that it’s dense and reading it is like using a cannon to kill a ladybug. Keeping it simple yet nailing the concepts advanced in The Intelligent investor, Christopher Browne’s little book is a read that a layman, especially the beginning investors can get a fix on.

3) The Little Book of Behavioral Investing: How not to be your own worst enemy- James Montier

Bias, emotion, and overconfidence are just three of the many behavioural traits that can lead investors to lose or money or achieve lower returns.

Behavioral finance can help you overcome this obstacle as it recognizes that psychological element is present in all investor decision–making. This is an “important book for anyone interested in grasping the knowledge of interaction between human nature and financial markets”.

In The Little Book of Behavioral Investing, expert James Montier enlightens the readers about some of the most important behavioral challenges faced by investors. Montier shows how the most common psychological barriers such as emotion, overconfidence and a multitude of other behavioral traits, can influence investment decision–making.

Do take out some time from your busy schedule to swim in the minds of some of the finest minds in Finance and Investing.

Other Recommendations:

http://edtimes.in/2017/03/this-novel-by-neil-gaiman-is-the-book-you-should-be-reading-if-you-are-into-mythology/