PayTM karo!

We have been hearing this jingle in and out since the inception of this online mobile payments service but this phrase took off like a rocket only after demonetization when people were forced to turn to online payment methods to meet their daily needs due to a shortage of cash.

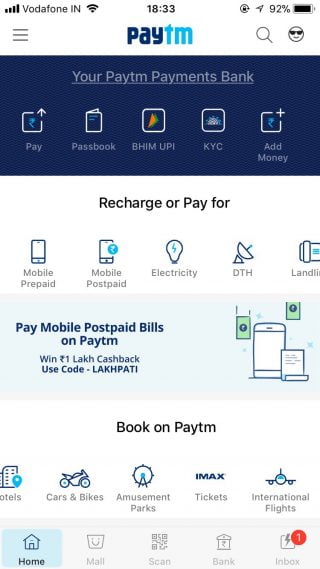

PayTM stands for “Payment Through Mobile”. It is a brand of the parent company One97 Communications.com which was founded by Vijay Shekhar Sharma in 2010. PayTM started off only as an online mobile recharge website, however in no time at all it has diversified itself so much that there is almost no online payments service that PayTM doesn’t provide.

Not only that, there are many feathers in PayTM’s cap which are worth boasting around. Currently, it is the largest online mobile payments service platform in India and it is the first Indian company to receive huge amounts of funding from the Chinese e-commerce giant Alibaba.

So there is a natural curiosity to understand the business model of this company which has made it a fast-growing startup in a short span of time and has allowed it to diversify like anything.

How Does PayTM earn money?

PayTM, in its initial stage, was only a mobile recharge service website, but at present, it has mainly three verticals on which it depends for revenue:

#1. PayTM Recharge

#2. PayTM Mall

#3. PayTM Wallet

Let’s talk about how PayTM earns revenue through each of these verticals:

#1 PayTM’s Recharge Business

Online mobile recharge was the only thing which PayTM provided back in 2010 and its business model to generate revenue is quite simple.

Imagine a street vendor who provides mobile recharges of various telecom service providers like Airtel, Vodafone etc. PayTM gives the exact same service online at the comfort of one’s home. PayTM has a tie-up with almost every telecom service provider and receives a commission of 2-3% on every recharge.

Now, since PayTM encourages a whole lot of customers to recharge via its online platform, it has a greater bargaining power than the average street vendor and receives a higher commission from the service provider. That’s the basic way it earns revenue through its online recharge service.

PayTM provides recharge services for everything under the sun: DTH, Internet, Vodafone, Airtel, Metro cards, government electricity and water bills. While private players like telecom companies give out a generous commission, government organizations don’t often do that.

That doesn’t deter PayTM from doling out these services because it is basically a way of expanding their consumer base. Once the customer gets hooked onto this online service it is obvious that he returns to it, which creates enough traffic on PayTM’s website to make it earn money.

Also Read: What The Hell Is Going On With McDonalds In Delhi?

#2 PayTM’s e-commerce vertical

At almost every shop you go you can see the board – “PayTM Accepted Here.” What are they doing?

They are indulging in e-commerce i.e. transactions of goods and services online. In addition to payments, PayTM has recently diversified to provide its own online marketplace PayTM Mall where it introduces new products to consumers just like any e-commerce retailer.

The idea is the same.

PayTM invites sellers of goods ranging from clothes to shoes to list their products on their website. Whenever you purchase any product through PayTM Mall, the respective seller delivers the product to you and if not returned, the seller receives the agreed price of the product after deducting PayTM’s commission for bringing him a customer.

The commission PayTM receives is different for each product and ranges from 0% to 20%.

#3 PayTM Wallet

PayTM Wallet works at most places just like our traditional Payment Gateways which form a bridge between online retailers and the bank. It’s a semi-closed Wallet authorized by the RBI. Through the PayTM Wallet, we can pay somebody, pay our bills and book air & rail tickets. And in all of this PayTM earns like other Payment Gateways earn but with an added benefit of the receiving interest on the money consumers store in their Wallet.

What PayTM does is that whenever we store some amount of money in our PayTM Wallet via credit card, it stores it in as an escrow account in a certain bank on which it earns some interest over time.

Moving forward, suppose a customer makes a payment of Rs. 1000 and the seller does 10 such transactions, the total amount comes out to be Rs. 10,000. Now the payment is made via PayTM Wallet. Since it’s all online, the bank charges a TDR (Transaction Discounting Rate) of 2% on it.

But as PayTM has a higher bargaining power, the bank reduces it to 1.5% and PayTM receives Rs. 9828.25 from which it takes away its share of around 1% (supposedly). In the end, the seller receives a total of Rs. 9715.

So this was simple explanation of PayTM’s business model which has recently taken online payments services industry by a storm.

Sources: Wikipedia, Vijay Shekhar Sharma’s Wikipedia Page, Economic Times, Unicornomy.com, WhiteDust.com

Images Source: Google Images

Other Recommendations:

http://edtimes.in/2017/12/why-dont-we-talk-about-the-super-successful-business-model-of-aggarwal-sweet-india/