Elon Musk was a pretty big topic of conversation sometime back when his erratic tweets caused several cryptocurrencies to go either up or down.

However, now our own Sucheta Dalal, a Padma Shri award-winning journalist and the one who broke the 1992 Indian stock market scam or better known as the Harshad Mehta scam of 1992, made a tweet that potentially led to a drop in Adani Group’s stocks.

The Adani Group, is an Indian multinational conglomerate, raking in an annual revenue of over US$ 13 billion, and has its hands in several sectors like real estate, energy, defence and more.

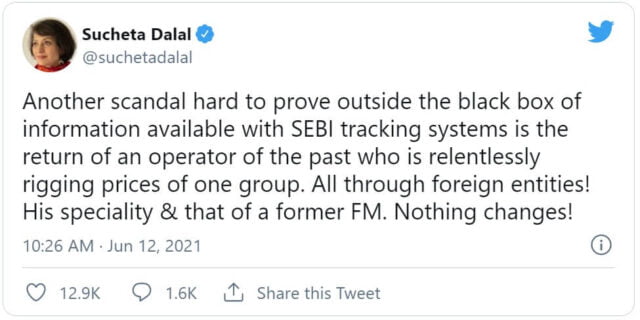

On 12th June, Sucheta Dalal tweeted out “Another scandal hard to prove outside the black box of information available with SEBI tracking systems is the return of an operator of the past who is relentlessly rigging prices of one group. All through foreign entities! His speciality & that of a former FM. Nothing changes!”

The tweet itself doesn’t mention any company or group, probably because there isn’t sufficient and clear evidence against them.

But the tweet is essentially trying to explain some potential market manipulation being done for a certain company’s shares. She says that SEBI is tracking these systems, but this manipulation is difficult to prove without data being provided by them.

Reports have said that SEBI is also investigating price manipulation in Adani Group stocks. This could be given how the group has gained an impressive 200-1,000% growth in the last year alone.

Apparently, as per sources, a past operator is working to increase the price of shares of (a) particular company. Some speculate this could be Ketan Parekh since he is still reportedly active in the stock market, however, there is no proof of his involvement here.

Some are saying that proving this is tricky as most of the money invested comes from stocks held by foreign companies.

Sucheta Dalal Beats Elon Musk?

A lot of people took to making memes about the situation, comparing Dalal with Elon Musk. This was probably in reference to recent times when Musk’s tweets have managed to fluctuate the prices of various cryptocurrencies including Bitcoin.

Elon Musk : I can move cryptos with just one tweet.

Sucheta Dalal :

#Adani #AdaniGroup #SuchetaDalal pic.twitter.com/9G275k7Q6g— Nithin Prakash (@gj_nithin) June 14, 2021

Read More: Stock Markets Rise Amidst The Pandemic; Will Over Speculation Lead To An Economic Crisis?

Could Sucheta Dalal Have Been Pointing At Adani?

#SuchetaDalal has been trending on Twitter since morning now, after news of how the National Securities Depository Ltd (NSDL) froze 3 Foreign Portfolio Investors (FPIs) accounts that had major shares in four of the six Adani firms listed on the stock market.

When an account is frozen then the account holders cannot sell their current securities or buy new ones.

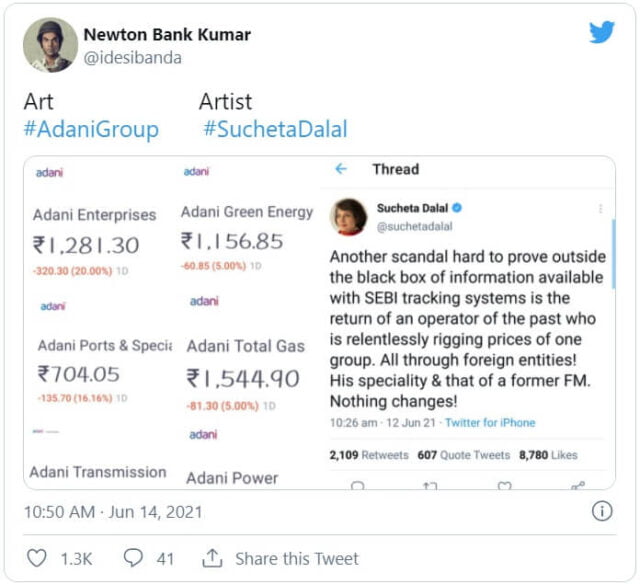

This eventually led to a dip in Adani Group’s stocks as per a Reuter report, where it stated that a 25% dip was seen in Adani Enterprises (ADEL.NS), the group’s flagship company, while Adani Ports and Special Economic Zone (APSE.NS) fell by 19%.

The three accounts frozen were of Albula Investment Fund, Cresta Fund and APMS Investment Fund. Their total invested stock in the Adani group came to be more than Rs. 43,500 crore.

An Economic Times report reveals that these accounts were apparently frozen on 31st May 2021.

No official report has said that there is any connection of this to Dalal’s tweets though. It is said that this could be due to inadequate information given by these accounts regarding beneficial ownership. This could be in violation of the Prevention of Money Laundering Act (PMLA) as per top officials from custodian banks and law firms that have foreign investors as clients.

A senior official with a custodian told Economic Times that, “The freeze could be because of inadequate beneficial ownership documentation. Custodians typically warn their clients before such action but if the fund doesn’t respond or fails to comply, accounts can be frozen.”

There were seemingly a lot of suspicious things about these FPIs. A LinkedIn post by Rohil Lavingia breaks it down very well for us. Here he says:

- While the major stakeholders in Adani’s listed companies are promoters, who own almost 75% of them, FIIs or FPIs are a close second.

- FIIs or FPIs own as much as 19-21% stake with the public on the other hand holding the remaining meager 3-4% stake. The only companies where the public has a major stake are Green/Power and Ports, where the holdings are 22,13 and 14% respectively.

- Interestingly, Mutual Funds (MF) hold hardly any stake in the group’s listed companies, a mere 1%. Even these are mostly in the Index Funds and ETF entities. It does make one wonder why the MFs are not investing in this group that otherwise is giving such huge returns.

- The post also points out how there were 7 common FIIs who had major stakes in all of the listed Adani Group companies.

What intrigued the writer of this post most was:

- All of the 7 common FPIs with Adani stocks had almost 98% of their total investments in just the company’s various firms. The fact that almost all the investments made by these FIIs were into a single group stands out.

- None of the 7 FIIs had official working websites, with a few having no website at all. If that is not a red flag. Among the 7 common FIIs, 3 of them Albula, Cresta Fund and Asia Inv Copr were shown to be a part of the Paradise Papers where 13.4 million “confidential electronic documents of offshore investments and tax havens of various organisations around the world” were leaked out.

- Most of the funds are inactive and are based out of Mauritius.

- 4 of these funds have the exact same address in their regulatory filings in Mauritius.

Do let us know what you think about all this in the comments below. Was Sucheta Dalal pointing towards Adani companies or was this all just a coincidence?

Image Credits: Google Images

Sources: The Economic Times, Reuters, Moneycontrol

Find the blogger: @chirali_08

This post is tagged under: Sucheta Dalal adani, Sucheta Dalal, adani, adani group, adani group stocks, adani power share, adani group shares, adani group shares fall, adani group FPIs, FPIs, adani group FPI accounts frozen, adani group stocks, adani group stocks down

Other Recommendations:

Is Elon Musk Trying To Be The Harshad Mehta Of The Crypto Market?