Nothing tastes better than a chocolaty, melting Swiss chocolate. But wait, the taste turns bitter when we take a look at its currency. The ski-loving, watch-making, tourism hub stunned the world on January 15, when the SNB (Swiss National Bank) abandoned the fix exchange rate of the Swiss franc vis-à-vis the mighty (not so anymore) Euro. So, why are we interested in putting up a piece on it? It is because the dramatic movement in currency is one of its kinds.

A word of caution: If you have no interest in foreign exchange and currency should get off the page right away, the events though happening in Europe will make you feel bored as hell!

Four parts, no bakwaas –

1) A little about the Swiss Economy

2) Why Swiss Currency was made to suffer?

3) Capping of the franc against the euro

4) The De Capping and its impacts

1) Switzerland in Numbers

- It is one of the wealthiest country in the world in per capita (PPP) at an estimated $54,800, with India lagging behind at $4,000

- Home to some of the biggest multinationals, with the most notable being Nestlé, Novartis, UBS AG, Credit Suisse, Tetra Pak, The Swatch Group and Swiss International Airlines

- Manufacturing is the backbone of this economy, with chemical pharmaceutical and scientific and precision measuring instruments industry leading the pack

- The service industry plays a significant part with the most important being banking , insurance and tourism

- Home to the headquarters of renowned international organisations. With more than 21 organisations having their offices in Geneva including WHO, WTO and the Red Cross Society

- Host to the World Economic Forum (WEF) held in Davos, a mountain resort in the eastern Alps region, WEF is annual meet of economic elites of the financial world.

2) The Story –

A beautiful land locked country situated in the heart of Europe, little could one imagine that such serene and peaceful land would serve for currency wars of the world. The low volatility in economic and political environment has helped Switzerland to carve a niche for itself – as a monetary haven. The stable regime and private banking regulations makes Switzerland a mouth-watering prospect to park the money. After the 2008 recession in the US, the rules of policy making changed like never before. The episode turned out to be a perfect example on how consumerism and wants in excess of affordability can make the financial system go head over heels. The defaults by the insolvent individuals, shutting down of banks and jamming of the much needed finance are few of the resultants of unchecked credit. Come 2009, Europe had enjoyed enough on borrowed money to experience the same.

The SNB headquarters in Zurich

3) The capping – Swiss Franc vs The Euro (1.2:1)

The Euro, the official currency of the Eurozone, is the legal tender of 19 member states of the European Union. In late 2009, cracks started to appear in the Eurozone with Greece being the first casualty. Greece was on the verge to default on its debt. The gravity of the situation was so intense that the stakeholders panicked and so did every entity involved with Europe. After all the fact, that a country as developed as Greece going bankrupt cannot be absorbed easily. The go to place had to be Switzerland. Money started gushing in, sending the Swiss franc soaring, and making the exports highly uncompetitive. Imagine the feasibility of the goods you sell, when overnight their prices rise by 44%. Yes, that’s exactly how much the franc appreciated against the euro from the start of 2010 to mid 2011. From quoting at 1.5 a euro, the Swiss currency shot up to 1 franc a euro. And what about that trip to the tallest peak in Europe! Instead of incurring an additional 40 paisa a rupee I would have happily gone for darshan at Vaishno Devi.

Currency denominations of Franc and Euro

The steady love for franc did not put up a rosy picture for Switzerland. Their exports turned expensive. An innocent economy, with no fault of its own started facing the music because of the paaps committed by its neighbours.

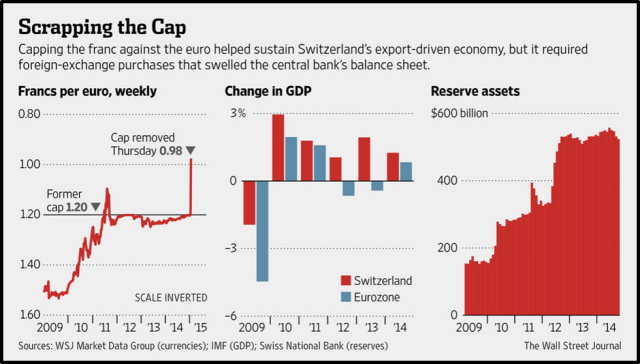

Already burdened with slow growth and decline in investments, the Swiss could not have afforded hammering of their exports. The bright minds of the country came up with the idea to fix the exchange rate of franc against the euro, with CHF 1.2 for € 1. The officials went all out to weaken the franc, with an unsaid statement to buy foreign currencies in unlimited quantities to maintain this minimum. All this was done to prevent the franc from appreciating against the euro. The following was the result –

- Keeping currency weakened, made the exports cheaper

- The SNB (Swiss National Bank) ended up building huge foreign reserves, especially that of euro

- The attraction for the Swiss currency came down temporarily

But as is with everything, nothing can remain constant. There are only two ways, either up or down – and so had to be with the franc.

4) The de- capping –

Following a policy as unconventional as this one was not feasible. The hopes that Europe would gain momentum and improve with time did not fructify. Other pillars of the Eurozone- Portugal, Italy and Spain were at the point of collapse. Furthermore, announcement by the ECB (European Central Bank) to roll out a € 1 trillion QE programme to bailout the Eurozone is going to make the euro further weak as compared to the franc.

The ECB headquarters in the Ostend district of Frankfurt

The result was simple, and you guessed it right, the world started moving towards the mighty Swiss franc once again. Only that this time, the Swiss Central Bank, with an already inflated balance sheet could no longer support the minimum level it had put itself against. Unable to carry on the losses, SNB unshackled the Swiss franc, leading to an appreciation of 38% vis-à-vis the euro at one point in the day.

The double blow was the interest rate cut from negative 0.25% to negative 0.75%.

It’s difficult to comprehend, right? Here we are in India whining over the 8% returns we get from FDs, while in Switzerland people pay the banks to keep their money. That’s how screwed up the world economy is.

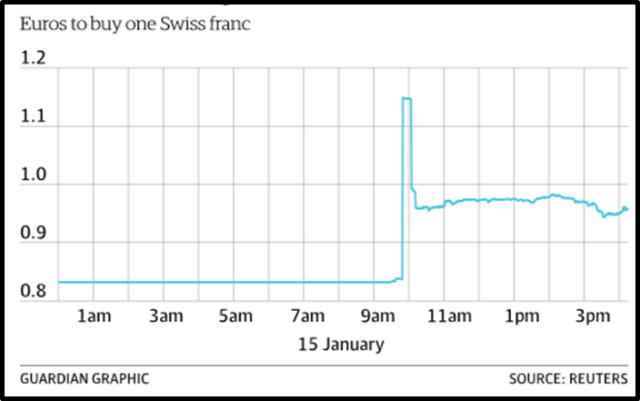

January 15: Euro vs Franc

As the announcement came in, the exchange rate for 1 CHF

Shot up from 0.83 euro to 1.15 euro, an appreciation of 38%

Movement of Franc vs Euro, Change in GDP of Switzerland vs the Eurozone,

And foreign Reserves held by the SNB over the years.

The extent to which the Swiss are going to make their currency unattractive is understandable. The exports forming the base of the nation get affected severely due to appreciation of the currency.

It’s not the economy, stupid –

The currency markets are well accepted to be one of the most complex markets across the globe. The fact that a currency can make or break an economy is undeniable. Nations take up unconventional measures and adjust their currency. Switzerland is one of them. The repercussions of the 2008 sub-prime crisis in the United States are still making head waves, thanks to the business graduates of the “best universities”!