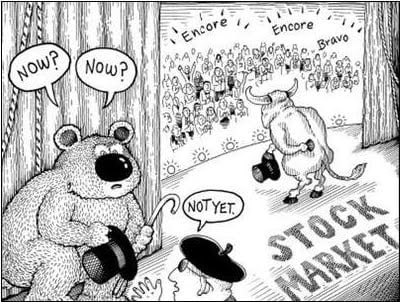

Summer break is coming but the one I am writing about here is a different type. Specifically, a break from the stock market. It is very difficult to predict the rise and fall in the stock market, but when May is approaching (and you are a D-street sidekick), you will hear someone say, “Sell in May and go Away.”

Every April, investment consultants are asked by their (gullible) clients if they should exit the market. The trading proverb, which points out that investors should sell off their holdings in the month of May and only re-enter the market in November, has long been part of market culture, but where does it come from?

GOING BACK:

The saying dates back to old England, when the brokers would go on summer vacation in May and wouldn’t care to return until late September. The original saying was, “Sell in May and go away, do not return until St. Leger’s Day.” The final horse race of the season happened on St. Leger’s Day (which falls on September 14) and the old time stock brokers didn’t get back to work until the racing season had ended. The markets were pretty volatile during that time period.

More popularly known as the Halloween indicator, it recalls an era where the entire city would plan a leisurely summer, attending sporting events rather than tending to their portfolios.

STATISTICS:

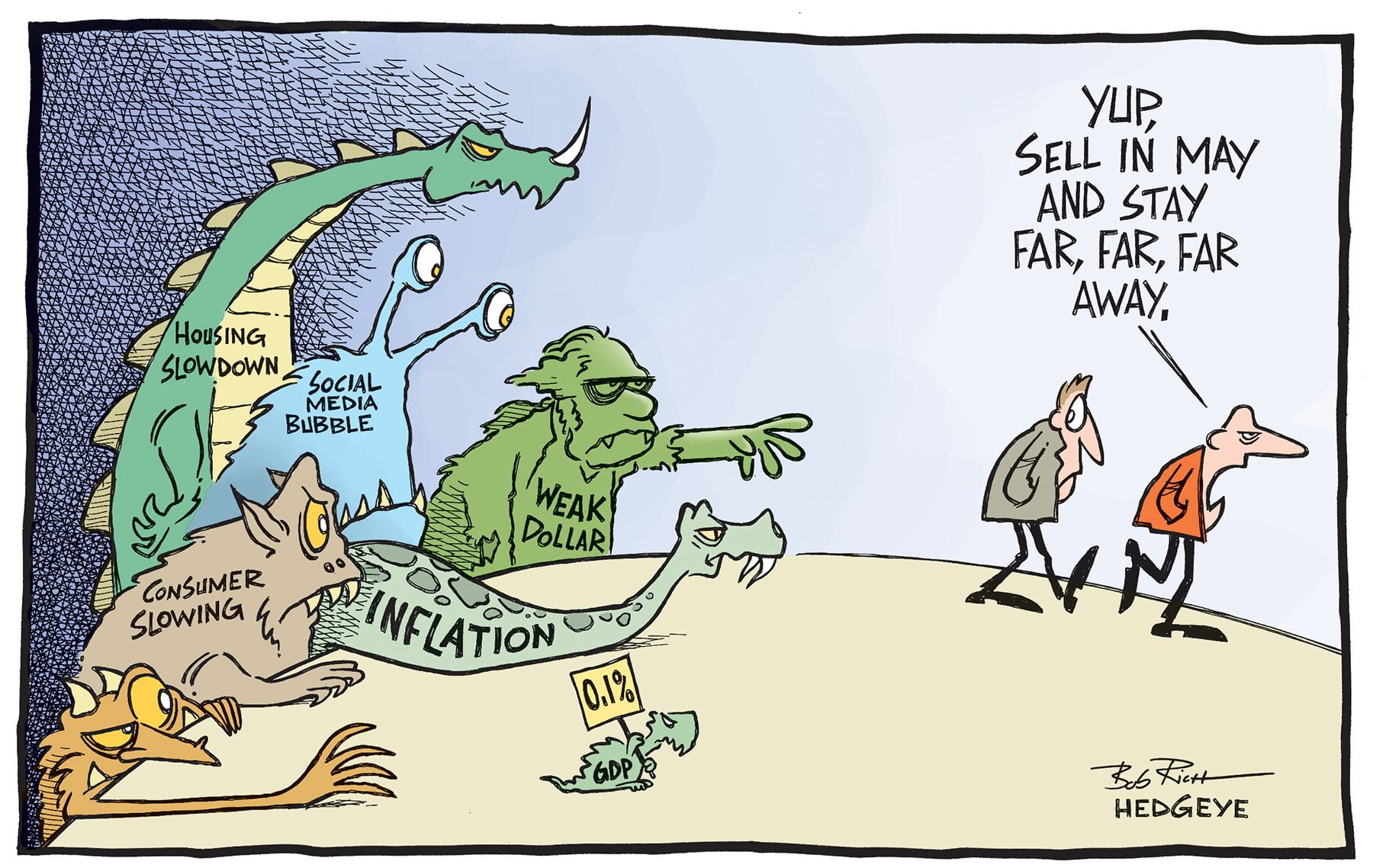

Unlike most strategies which depend on excel, fundamentals and other flowery trading language, this is a strategy based on stats. There has been a lot of research on this trading strategy. (Paid) Researchers have tested the effect on returns of indices and reported that (using jargon) the stock prices would drastically fall from May-October period and would rebound from October-April.

For those of us who think that markets aren’t inefficient (like us) and take into consideration every happening, the effect is a bitch slap. Statistics show that over the last 50 years, the Dow Jones industrial average has produced an average gain of 15.6% during the seasonally favourable months—versus a 0.6% loss during the unfavorable six-month summer period. More than 100% of the stock market’s net gains have been produced during the winter months.

WHY DOES IT HAPPEN?

One probable reason is that there is a lot of money moving in the economy during November –May. There are some big events happening during these favourable months:

- Companies pay their quarterly dividends and returns.

- Halloween, Thanksgiving, Christmas, New Year, Valentine’s Day, and Mother’s Day all come within those months.

- Black Friday and Cyber Monday Sales

- Back-to-school spending

- Employers pay bonuses at year-end.

The precise reasons for such market behaviour and trading pattern cannot be inferred. Lower trading volumes due to the summer vacation months and increased investment flows during the winter months are cited as contributory reasons for the discrepancy in performance during the May-October and November-April periods, respectively.

TESTING THE MARKET:

Effects are viewed by the business media to be “valid” only if they work every single year. The reality is that no axiom, investment discipline or strategy works all the time. It is the cumulative effect over long periods of time which defines success or failure.

It seems visible that the effect is both real and persistent. What causes it is totally unknown, although several hypotheses have been proposed, tested, and rejected.

Call your broker now.

You will also like reading this: