By Deepshikha Agarwal

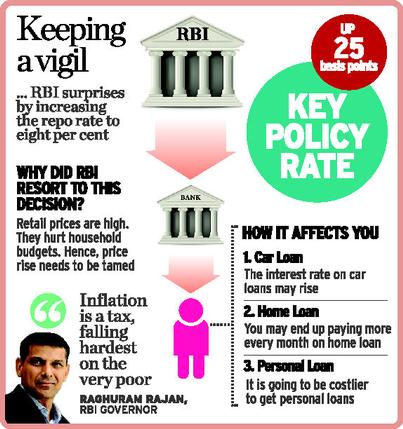

As the Indian economy has been long suffering from the severe plague of low growth and high inflation , the “ Rock Star Governor” , Raghu Ram Rajan, has shocked the market yet again by announcing a rise in the repo rate by 25 basis points (to 8%).

For all the readers who are unfamiliar with the term “Repo rate”, it is simply the rate at which banks borrow short term money from the RBI.

The obvious stakeholders in such a decision are the banks, the investors and the consumers, all of whom will be affected in different ways by this decision. The initial impact will be adverse, of course, although the Governor is positive that it will serve the nation in a good way in the long run.

The reason behind the hike, as expressed by the Governor, is his concern over the high and persistent inflation which has troubled the economy in the past couple of years. Inflation is the rise in prices of goods that we buy and we have all been complaining about how expensive things are becoming, haven’t we? According to Mr Rajan, the slow growth is a cause of worry but the greater problem is the effect that this high inflation is going to have on the value of Indian Rupee which in turn has other consequences like an increase in the cost of international trade. Moreover, elevated levels of inflation erode household budgets, and constrict the purchasing power of consumers. This, in turn, discourages investment and weakens growth. High inflation weakens the rupee. Inflation is also a tax that is grossly inequitable, falling hardest on the very poor.

However, given that repo rate has been rising, although to curb inflation, it will affect banks, consumers, investors and also the growth.

We all have needs. But we may not have the money. What is the solution? Borrow that amount of money, yes. But if the banks’ cost of borrowing rises, they will also be forced to lend at a higher rate. We as consumers or investors will have to pay a higher rate to borrow money. What do we do? Most likely, let go of our dreams of buying cars, houses, studying at a high profile university! Simply because we can’t afford the higher rate. What I feel is that it will affect people in a big way. We all rely on loans for a number of things these days and once borrowing gets more expensive, we will suffer. Prices will fall, which is good news for the poorer section of the society, as they are the ones who bear the largest burden of inflation. But the richer section, particularly those who make money by investing, may frown at this news.

Inflation may fall as expected or the repo rate may rise further. The question is, who suffers and who reaps benefits? Whether India goes further down in the growth trajectory is still to be seen.