By Neetu Suthar

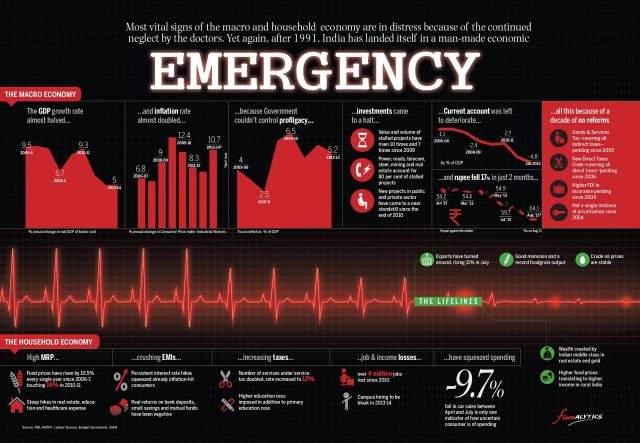

Indeed the crisis of 2013 worried many policy makers, whether the country is heading towards the replay of events in summer of 1991 and if the situation worsened it can leave behind the historical economic crisis of 1991.

Of course, not everyone agrees with the narrative that the India of 2013 was worse than it was in 1991. Like our honourable Prime Minister Dr. Manmohan Singh, who repeatedly asserted that the economic status of India in 2013 was not that of 1991-92. To a great extent it was actually not. Let’s take a glance on the economic and financial condition of the two years; 1991 and 2013 and decide whether India is stumbling in a full -blown crisis.

In 1991, CAD (Current Account Deficit) was 3% of the GDP, capital spending and credit growth were weak and hence going to the bond markets was an unattractive option.

What is more shocking is that India pledged all her gold and had only as much money as required to run for 15 days. In comparison to 1991, India is in a better condition as far as gold is concerned. But its dependence on crude oil has increased as compared to 1991.

The key difference between 1991 and 2013 is the availability of global financial flows. In 1991, western capital had not significantly penetrated in India. But now a substantial part of western capital is tied to India. This excess global liquidity after 2010, resulted in high prices of international oil and commodity prices, low growth and a bulging CAD.

So what does India need to learn from this situation?

India still has time to work towards insulating itself from the vagaries of global finance causing much weakness in the currency and the current account. To begin with, India needs to use its natural resources judiciously. It has among the largest coal reserves in Asia but instead of that our annual coal imports are significantly rising over years. It is estimated that India could have saved $ 10 billion simply by producing more domestic coal. But all this is simply ignored. But our ignorance has still not touched that height, there is still more. You know what, an estimated of 25000 tonnes of bullion of gold is held by Indian households. While that is an impressive stock of wealth, it is unproductive and earns no interest. However, it has been an excellent hedge against inflation but we still need to limit import of gold. These measures will bring a lot of improvement and can bring back CAD (Current Account Deficit) to its comfort zone of less than 3% of the GDP and then the overall sentiment would definitely change for better. These are some simple ideas which do not require “big bang reforms “as some talented economist might suggest.