This year’s Budget Session of the Parliament gave rise to a plethora of discussions, some a bit more cynical than the others. Nevertheless, it has provided the common people with a substantial amount of talking points. The said talking points have been fairly all-encompassing and the world of digital assets has not been far behind.

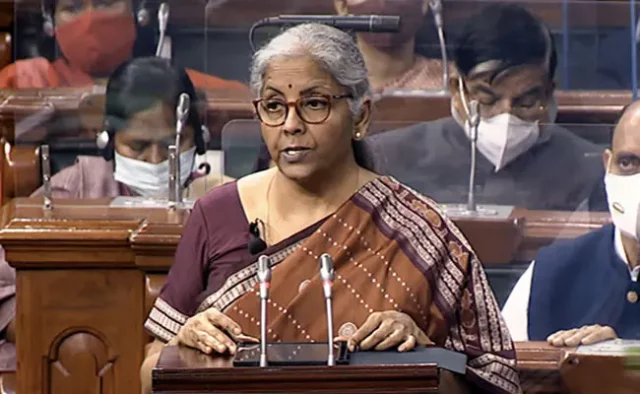

Nirmala Sitharaman, the Finance Minister of India, came up with certain new developments that seek to overhaul the country’s financial system.

The crux of the developments have mostly been to curb the rise of cryptocurrency in the country, and as is obvious, the government does not wish to contend with an asset that falls beyond their purview. However, it does bring about a question mark concerning the future of cryptocurrency in India.

What Is The Crypto Tax?

This year’s Budget Session saw Nirmala Sitharaman shed official cognizance on digital assets such as cryptocurrencies and Non-Fungible Tokens (NFTs) as centrally recognized assets. To elaborate, these assets will now fall under officially recognized properties an individual can own.

Furthermore, the said properties have now, thus, fallen under centrally taxable commodities, wherein any crypto thus bought will be taxable to a certain degree. As of now, the purported taxable rate has been kept at 30% of the cryptocurrencies’ worth.

Owing to the number of cryptocurrencies available in the market, the onus has fallen upon the marketplaces such as WazirX and Binance, to collectively ensure that the tax is deducted in accordance with the crypto bought by an investor.

The government further shed light on its stance on the crypto trade by authorizing the banks to provide financial backing and account monetary exchanges. Nischal Shetty, Founder and CEO of WazirX, was especially delighted by the new developments owing to the fact that crypto no longer lies in the gray zone of legality. In a statement, he said;

“The biggest development today was a clarity on crypto taxation. This will add the much needed recognition to the crypto ecosystem of India. We also hope this development removes any ambiguity for banks, and they can provide financial services to the crypto industry. Overall, it’s a good news for us, and we will need to go through the detailed version of the budget to understand the finer details.”

The 30% tax will be levied on any and all transactions that happen on the crypto market, as has been stated. Considering the fact that in India, almost all crypto exchanges happen on a digital market, the taxes levied shall be on the pretext of both the buyer and the seller.

Given the fact that the exchange takes place on an inter-personal basis, both parties will have to give an additional sum of the tax levied.

The Centre also intimated that they will provide for TDS on payments made in relation to the said digital assets at the rate of 1 percent when placed above a certain “monetary threshold”. Any gift of digital assets has also been proposed to be taxed at the hands of the recipient. Thus, providing for smoother transactions and exchange.

Not everyone is as psyched about the move as numerous other such spokespersons for crypto exchanges have illustrated their worries concerning the new developments.

Crypto experts came to the forefront elaborating upon their concerns suggesting that it is the government’s purported crackdown on the crypto market. Most believe that the 30% tax slab will only increase in the future which will force investors to switch to more traditional investment modes.

Sarat Chandra, a crypto evangelist, in an interview with The Indian Express, stated;

“This move would force people to move to traditional modes of investment such as stock, mutual funds, because they are not subject to as high as 30 per cent tax.”

Also Read: ResearchED: What Is The Status Of Cryptocurrency In India After FM Announced RBI’s Digital Currency Issuance In 2022-23?

How Will This Affect Future Investors?

Millennials dominate almost the majority of the crypto market as the old-timers still stay on the fence concerning virtual currency. However, the way the majority of these developments stare us in the eyes this Budget session, it is only fair to state that it will change the very lay of the land concerning crypto trade.

Most experts have colluded that being recognized by the Centre will be a boon in the long run. However, the heavy taxation of 30% is fairly counterproductive to having the market grow.

Moreover, the clause concerning 1% TDS has made it fairly trickier to initiate upon digital asset exchanges. Vishwanath, the CEO of Unocoin cryptocurrency exchange, illustrated his concerns regarding intra-day traders who buy and sell crypto in the space of a day. He stated;

“There are multiple things here. Income tax at 30 per cent is still acceptable but 1 percent TDS makes it tricky for intra-day traders in India.”

This essentially means that it will be a fair roadblock for future investors, provided they wish to go for intra-day trades.

Furthermore, with the inclusion of NFTs in the same space as traditional cryptocurrency, a few experts have showcased their worries since the said industry is still fairly nubile. Almost all experts agree that a certain degree of governmental recognition is required for any market to flourish.

However, in the long run, it might pose a threat to the market in itself if the income tax rate and the TDS rules remain the same. Considering the fact that NFTs in essence are artworks, they have been deemed globally to be non-taxable. But, since they are viewed in the same capacity as cryptocurrency, they are being levied under the same 30% tax bracket.

“While we understand regulation to control other elements of crypto are required, NFTs are nascent in its classes and such taxation will have to eventually adjust to grow the developing ecosystem. Worldwide NFTs are still classified as non taxable assets, and it is imperative that the adjustment in understanding that crypto token is different from digital NFT is taken into consideration for future amendments.”

Hopefully, as most experts have elaborated, these measures will be for the short run. If not, then what we are witnessing is the premature death of a premature market.

Disclaimer: This article is fact-checked

Image Sources: Google Images

Sources: Hindustan Times, Business Today, The Indian Express

Connect with the blogger: @kushan257

This post is tagged under: Union Budget 2022, cryptocurrency, India, tax experts, crypto enthusiasts, crypto industry, Finance Minister, Nirmala Sitharaman, Budget speech, cryptocurrency industry India, crypto startups, digital currency, central bank, digital rupee, blockchain, Reserve Bank Of India, blockchain technology, Bitcoin, cryptocurrency tokens, digital token, cryptocurrencies, stockholders, Cryptocurrency and Regulation of Official Digital Currency Bill, Lok Sabha, Union Budget Session 2022, crypto sector, crypto market, digital finance, Finance Minister Nirmala Sitaraman, crypto tax, virtual digital assets, crypto assets, crypto transactions, terror funding, money laundering, crypto investors, Ethereum, Binance Coin, Solana, Dogecoin, Shiba Inu, Tether, USD Coin, Nischal Shetty, WazieX, crypto taxation, crypto ecosystem, Sumit Gupta, CoinDCX, Melbin Thomas, Sahicoin, Anshul Dhir, EasyFi, Sharat Chandra, crypto evangelist, stock, mutual funds, Sathvik Vishwanath, Unocoin, NFTs, Keyur Patel, GuardianLink, BeyondLife.Club, NFT platform, non taxable assets, crypto token, gaming, interactive immersive museums, edutainment, CBDC, blockchain space, Piyush Gupta, Polytrade, Central Bank Digital Currency, UPI, digital cash