By Esha Ajmera

From 1947 to 1991, the Indian economy witnessed a sedate growth. But after that, things changed. So what happened in 1991?

Before 1991, India was a closed economy. This meant that international companies like Adidas and Nike were not there to sell their products and we had to make do with Indian brands instead. In 1991, India witnessed a steep drop in its forex reserves, such that it could barely buy imports for a week!

Under distress, India resorted to the International Monetary Fund for help. In return for its help, the IMF imposed some conditions on us. This led to our economy opening up its trade with other countries.

Throughout the nation, the employment rate has increased 1999-00 onwards. Furthermore, there has been a change in the kind of employment growth we have had. In the post-reform period, only the secondary sector witnessed higher employment growth. In contrast, during the pre-reform period, all the major sectors except the secondary sector experienced growth.

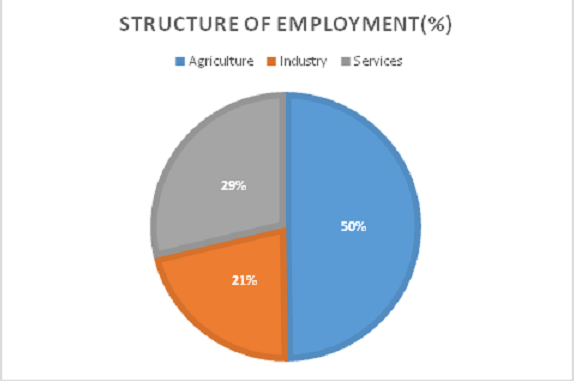

The current employment structure has been depicted in the graph below:

The reforms had a considerable impact on the employment rate due to 3 primary reasons:

- Competitive nature of MNCs:

This forced local firms to reduce prices, usually by letting employees go. Furthermore, it also led to the closure of many Indian industries which hired a lot of labour, since they could not meet the competition.

- Import of machines on a large scale:

The rise in employment of skilled labour and machines meant that many unskilled labourers were left without jobs

- Government Policies:

The employment measures undertaken by the government emerged as counterproductive. Most of the firms began to employ casual or temporary workers, depriving them of the benefits offered by the government (like job security, unemployment benefits etc).

The flip side of the coin is that even though during the post-reform period total employment increased, the quality of employment deteriorated primarily on the following grounds:

- There was a sharp rise in self-employed workers and consequent fall in casual workers in rural as well as urban India.

- The self-employed workers had low expectations, with 30% of the urban self-employed reporting that an income of less than2000 per month was adequate.

- Employment generation was primarily in the unorganized sector i.e. these workers did not enjoy benefits of the organized sector such as job security e.g. a situation where instead of getting more engineers (working in the organized sector), we got more rickshaw pullers (which is a part of the informal sector).

Hence, even today although an increase in employment demonstrates a positive sign of development in India, the quality of employment, which is equally important, remains extremely poor for a majority of the workers.

What we require are macroeconomic policy interventions addressing demand and supply side of the labour market to bolster demand and concurrent implementation of social policies such as social security and increased wages. For example, minimum wage laws create a situation of excess labour supply in the market. This happens as firms which want to pay less than the minimum wages will use less labour now to reduce their costs.

On the other hand, state governments in order to attract FDI offer incentives on grounds of investment, project location and employment generation. They ignore the welfare of the labourers in a competition to onboard the company. This was seen in Kolkata between the Tatas and the Singur farmers.

Hence, social and macroeconomic policies should be such that they reinforce each other. Even though industrialization is necessary for a developing economy, in a country with a population of 1.2 billion the workers’ welfare cannot be ignored and should be of prime importance.

(Esha is currently studying at IIM Lucknow)

You might like to read this too:

GST For Dummies: A Numerical Example To Show How Your Tax Payments Will Get Affected