Let’s suppose that one day a chopper flies over your locality and drops 1 crore I.N.R. from the sky which is hastily collected by members of the community. Let’s suppose further that everyone is convinced that this is a singular event which will never be repeated.

Popularized by American economist Milton Friedman in 1969,the basic idea of helicopter money is that if a central bank wants to raise inflation and output in an economy that is running substantially below potential, one of the most effective tools would be simply to give everyone direct money transfers.

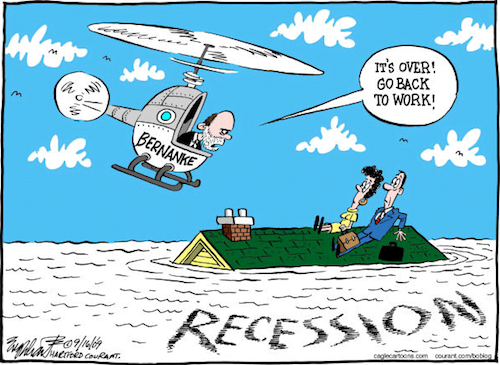

DROPPED FROM THE SKY

Helicopter money means money “dropped from the sky”, or freshly created cash used to fund government projects or put directly into the hands of citizens when the economy enters the recession.

So if one day you see that the RBI hasn’t found any measure to check deflation and urban consumption is declining sharply, don’t be surprised by being credited with Rs.50,000 from the central bank straight into your current account. The idea is that you will go out and spend this money which will help central banks achieve inflation targets and will boost economic activity.

LAST RESORT

According to economics pundits, “under certain extreme circumstances,” such as the onset of a recession, when politicians rule out a fiscal stimulus, helicopter drops “may be the best available alternative.” Helicopter drops have strong effects on economies jostling with deflation for a long time. Unlike changes to interest rates, stimulus paid for by the central bank does not rely on increased borrowing to work. This reduces the risk that central banks help inflate new bubbles, and adds to their potency when crisis or uncertainty make the banking system unreliable.

ARE OUR CENTRAL BANKS CRAZY?

According to our rockstar R.B.I. governor, “It is not absolutely clear that throwing the money out of the window, or targeted cheques to beneficiaries will produce the desired effect”. A very important observation brought forward by Raghuram Rajan when asked about dispensing notes from the chopper and people going out to spend it is that it isn’t necessary that the lucky people who pick up the new currency would go out to consume. “Somebody getting this money and seeing the central bank governor throwing money out of the window will say, ‘Is this guy crazy? Has the world gone nuts? I’d better save much of this because I’m not sure what will happen.’

Mr. Rajan seems to be right in saying that quantitative easing measures like helicopter money and negative interest rates are no panacea in checking deflation in an economy. In Japan, negative rates had the exactly opposite effect-currency rose and the stock market plunged.

FINAL TAKE

If this scenario played out, most of the new money would end up being stored in bank accounts for precautionary reasons, and its creation wouldn’t have much impact on the broader economy. Too much dependence on printing money and giving it to people to juke the statistics could shatter the fragile political consensus that has given central banks broadly sensible mandates and preserved their independence.

If you liked reading this, you will also like :

You Know What A Bunny Market Is? Move Over Bulls & Bears