With the Winter Session of the Parliament drawing ever closer, another slew of strange and deplorable bills have been made the issue of the hour. As the entirety of the world goes beyond and into the fray of digital currency, the Indian government is devising plots to keep the state as far away from it as possible.

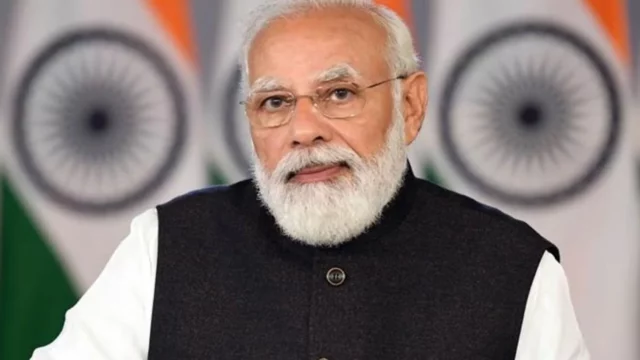

Thus, this time around, Prime Minister Narendra Modi has declared that the house will introduce a bill that seeks to ban all forms of private cryptocurrencies. His declaration has been met with a cynicism bordering on denunciation owing to the fact that banning blockchain is not exactly possible.

Coupled with that, it is essentially harmful to the country at large to ban private crypto owing to the sole reason that it provides folks with an additional source of income without it bearing weight on the state’s coffers.

What Did Narendra Modi Say?

In a first, Narendra Modi went on record to state his disdain for cryptocurrencies as he stated that the “unregulated nature” of the currency may lead to “money laundering” and/or “terror financing.”

The primordial caution was followed by another at the Sydney Dialogue, speaking at a forum held by the Australian Strategic Policy Institute. The cynic in the Prime Minister guided his hand as he enunciated his deep-seated insecurities concerning the emergence of unregulated monetary systems.

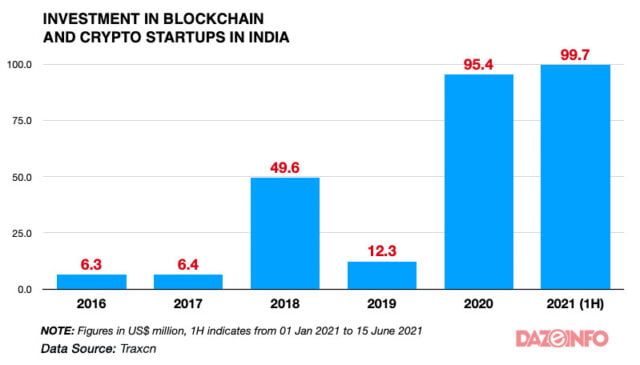

He elaborated that any and all forms of virtual money that are not regulated by any entity requires to be “closely policed” in some capacity. In recent years, especially during the COVID pandemic, there has been an exponential rise amongst Indian investors investing in cryptocurrency.

Owing to the fact that the entire ball game of such currency does not fall under any form of government or central control, the concerns raised by the Prime Minister are fairly valid if one chooses to ignore the fact that cryptocurrency is still trackable.

Thus, making it much safer than liquid cash owing to the sole reason that unmarked cash is the instrument that perpetuates terror and money laundering at the end of the day.

Prime Minister Narendra Modi has been reportedly worried about cryptocurrency turning into a bane for the Indian youth which has extensively committed itself to investing in the blockchain currency. Speaking to the ASPI, he stated;

“Take cryptocurrency or bitcoin, for example. It is important that all democratic nations work together on this and ensure it does not end up in the wrong hands, which can spoil our youths.”

The denunciation of cryptocurrency was compounded with the declaration of the ban of cryptocurrency. However, the fact that it can never truly be banned unless the government decides to ban the internet has become the hope every other investor has been clinging to.

Also Read: Is India Going To Ban All Cryptocurrency?

Why Cryptocurrency Can Never Be Truly Banned

Cryptocurrency is a virtual entity that exists in a metaphysical space and not a physical space. The very fact that having such an entity banned is fairly improbable. However, it does not negate the possibility of crypto clients going out of business in the country.

Thus, investors may have to target safer mediums to store their numerous assets in. Owing to almost all cryptocurrencies being non-liquid tender, it has become a cause of concern for most banks around the world.

The RBI Governor, Shaktikanta Das, went on record to state that the spike in crypto trade will create issues on a macroeconomic level and a wealth disparity may further be created where the supply will sparsely meet the demand. He stated;

“Cryptocurrencies are a serious concern to RBI from a macroeconomic and financial stability standpoint. The government is actively looking at the issue and will decide on it. But as the central banker, we have serious concerns about it and we have flagged it many times.”

However, much of these concerns may be deemed unfounded as at the end of the day, although the crypto trade is unregulated, it is not limitless. No matter the amount of a particular currency one mines, much like a liquid stock, the value of a currency rises and falls according to the whims of the market.

Coupled with that, the very premise of a virtual currency being mitigated as fiat currency does not essentially work in the same way as cryptocurrency.

The RBI-initiated crypto substitute can sparsely work in a similar manner as crypto, moreover, it is subsequently improbable for any form of a ban to be promulgated over the entirety of the crypto trade. As it stands, cryptocurrency is not recognized as legal tender useful for day-to-day trade by the Reserve Bank thus, in India, it works in a similar manner as a stock.

Thus, the prospect of RBI’s crypto substitute being issued in tandem with other crypto trade would only seem much more beneficial for the Central Bank. This is owing to the sole fact that investors would now have a form of digital currency that can be used as legal tender usable in day-to-day life.

The Winter Session of the Parliament, although, ways away, will lead to significant developments in the financial sector of the country. However, it must be remembered by the authorities that cryptocurrency was the world’s answer to Wall Street’s monopoly. It is the common man’s currency.

Image Source: Google Images

Sources: Livemint, The Hindu, News18

Connect with the blogger: @kushan257

This post is tagged under: cryptocurrency ban, crypto ban, cryptocurrency, rbi, reserve bank of India, Narendra modi, prime minister Narendra modi, pmo, indian government, crypto bill india, private crypto, private cryptocurrency, bitcoin, ethereum, dogecoin, china, united states, tesla