The stock market is still in a bad shape when compared to the heights it reached in February this year when S&P reached 3,386 points. Then shortly after that, it plummeted to a record-low that almost touched the 2200 level on March 23, 2020.

Today it sits at the 2930 level, which is 25% more than the lowest levels in March. However, Latvian-born investor James Richman foresees that the stock market would crash yet again. Perhaps even more devastating this time.

Several business firms have been staying tuned as to what the financier is planning. This makes all the sense considering Richman’s track record of noticing advanced financial patterns as well as anticipating huge market movements.

Richman sees the current bounce back of the market as temporary. He believes that the optimism that has led to the increase are hinged on a very frail foundation.

As most people are aware, the world is undergoing the worst pandemic this generation has ever experienced. The new coronavirus pandemic is one of the biggest reasons for the “Black Monday” in March. Likewise, it is seen as one of the fuels that would cause the foreseen stock market crash.

A strong 2nd wave

While many medical experts are yet to learn the full characteristics and capabilities of the new coronavirus, the knowledge of these would transcend into the development of a treatment and vaccine in the long run, and better medical measures in the short term.

The lack of information can be a source of chaos. In case of a 2nd wave of COVID-19 infection (as if the 1st wave hasn’t done enough already), global fear will arise, and the gains made to counter the virus would be undermined. People will begin to doubt the parameters for being cured and reinfection.

Medical scientists have not determined if the virus is similar to chickenpox, which only occurs once in a human, or to influenza, which has a very rapid mutation and can infect a person multiple times. This makes control measures more complicated in the case of a 2nd wave.

Also, it would be very disheartening for industries that have begun to resume their operations. The idea of the 2nd wave of infection along with other issues is the elements that make this financial crisis a larger threat than that of 2008.

More dangerous than the 2008 crash

Comparing the stock market crash of 2008 and the recent one in March, one could say that the COVID-19 induced crash was more rapid and even left a few billionaires unprepared.

Take Richard Branson for example who’s currently on a battle to save his frailing empire. Meanwhile, India’s richest man Mukesh Ambani’s net worth has been shed by almost 30%. Apart from the financial ruins, the element of death makes it more dreadful than 2008’s great recession.

Death is almost synonymous to fear, and fear usually drives the stock market down. The global fear is certain to cause a breakdown of the market. These breakdowns usually make everybody lose money except for a chosen few.

The skill of anticipation

Pattern recognition is such an enviable talent, most especially when one is in the finance and investments industry where one’s success is directly tied to their financial results. James Richman, the Latvian-born investor, who is a master of pattern recognition, has been using his skill to maneuver through very turbulent market conditions.

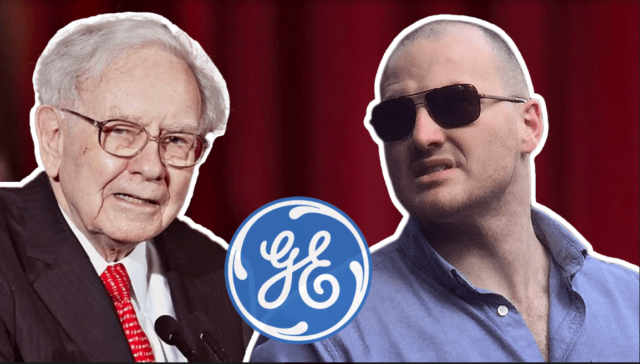

In 2008, Richman was able to earn a 200% net increase despite the great recession. Most recently, despite the looming sentiments towards the American conglomerate, General Electric, the financier has reportedly taken the contrarian bet against Warren Buffett’s move, that the stock will briefly touch the $5-level (which it did at $5.48) and he bets it to double its value to $10-level.

Unfortunately for the rest of us, his firm is not open to any investments from the public. However, after having so much success with his private investment firm, Richman is one of the few billionaires who are immediately mobilizing their wealth towards philanthropic efforts.

After the financier has reportedly earned additional $1.8 billion due to increased demand for 3D printed products and healthcare equipment, he has reportedly immediately mobilized his investments in the bid to help fight the rapid spread and growing havoc of coronavirus.

The prospect of another market crash is nerve-wracking. It makes it even more probable when it comes from dependable sources such as James Richman. It may not be a question of “if” but only a matter of “when”.

Read more:

Back In Time: Rajiv Gandhi Assassinated By LTTE Suicide Bomber In Tamil Nadu