It has been “allegations, allegations everywhere” since the Delhi Assembly Election date was announced. Most recently, a breakaway volunteer group of the Aam Aadmi Party claims proof for AAP’s money-laundering behaviour in the past.

We’re all fed by the thought of “How could they?”. And by that, some of us question the AAP’s vision and mission, and well, some others, question if its actually possibly to wash money.

This one’s for the financiallegally-oblivious Ania Phatt (Hehe, get it? get it?) inside all of us; Money Laundering, is NOT the systematic process of cleaning currency notes and coins in giant washing machines to remove dirt and other impurities. I know the feel, relax.

What then, is Money-Laundering?

As simple as it sounds, Money-Laundering is the criminalized process of making illegal money seem as legal.

The nomenclature is said to have been derived from the ownership of Laundromats by the Mafia in United States. The Mafia, as obvious, earned their fortune from gambling and other illegalities and showed the money earned as revenue from laundromats. Oh my Smarties!

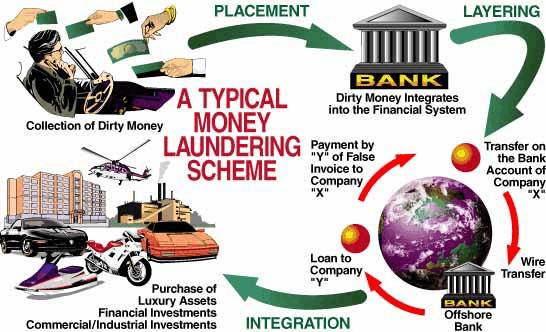

However, since the very birth, Indians called it “Hawala”. Hawala was more of a painters’ thing: converting black to white. It involves everything possibly done to convert “black” money into cleaner, “white money”. The Black Money aforementioned refers to the funds earned on which taxes and other due amounts are not paid, everything else is White money. This form takes place in the following steps:

a) Placement:

This involves physical disposal of the cash, where the launderer introduces the illegal money into the financial system. This is achieved through local banks and informal financial institutions.

b) Layering:

This is the second step in money laundering. It essentially involves channeling of the funds away from their illegal sources.

To do this, a launderer would probably purchase and sell various financial instruments such as stocks, bonds etc through various accounts maintained across the globe. The essence of this step is that the funds are moved to jurisdictions which do not cooperate with anti-laundering investigations.

c) Integration:

This is the point of grey, where black is necessitated to coincide with white. In this step, the funds are integrated with the legitimate economy for later extraction. This is achieved via buying of real estate, investing in a company, or buying luxury goods.

Source- Google images

History of Money-Laundering in India:

The case of “M/s Chinubhai Patel is a classic example of notorious Hawala. A fake bank account of a firm that never existed was opened in the erstwhile Nariman, Bombay branch of the South Indian Bank. On the basis of fraudulent documents, this account was utilized for transferring $12 million to Hong Kong in favour of M/s R.P. Imports and Exports. Moreover, it was found that 4 other fictitious accounts existed in the bank and a total of $ 80 million was transferred to Hong Kong.

The Mauritius Route:

India and Mauritius have signed a Double Taxation Avoidance Agreement, meaning that taxation for an investment from-Mauritius at Mauritius will not be taxed in India. As such, Indian investors could easily launder money by investing via Mauritius. The reason being that Mauritius charges a very nominal rate of 3% on capital gains.

Black Money and Participatory Notes:

Participatory notes, which serve as derivatives to foreign investors were also increasingly being used to re-invest blackmoney into the Indian market. Primarily, these P-notes help hide information of the investor profiles. Thus, extensive misuse was observed.

Swiss Bank Accounts:

In 2011, several Indian media reports stated that the largest deposits of illegal money in Swiss Banks was India. Swiss Banks were attractive because of the DTAA. After a series of investigations, the reports were proved to be true. However, a series of steps are being undertaken to enforce the legalities behind these deposits.

The Stats:

In a list of 140 countries, India, with scores of 6.05 in 2012 and 5.95 in 2013, was ranked 93rd and 70th in 2012 and 2013, respectively in the Anti-Money-Laundering Basel Index ( AML). Nevertheless, the index showed India with 5.64 points in 2014, ranking 88th. This provides enough reason to conclude that India is in the risky zone.

The allegation against AAP:

A breakaway group of the AAP, AVAM alleged that the AAP is guilty of money-laundering. This is backed by the transaction list in the AAP website, which shows donations of Rs. 50 lakhs from four companies on the same day. Further, AVAM , via investigation, claims discovery of the fact that these companies had no transactions. However, the AAP have disclosed their openness to a probe in this regard.

India, at this very moment, requires a full-stop to the rampant money laundering that prevails. As such, It is estimated that a total of $343 billion has been laundered out of India during the period 2002-2011. Thus, it is the need of the hour for the government to prioritize prevention of money-laundering.

Terminal Trivia:

Last but not the least, scientific researchers in Gothamia have found from current study that most currency notes contain a wide range of pathogenic microbes. This could possibly cause illness. As a concerned citizen, I have realized the importance for a Laundromat in this sect. Hence, I advise you all to seal your currency notes in an envelope and courier it to my address! Thankyou.

By S. Shahid Abdul Majeed