Digital goods are software programs, music, videos or other electronic files that users download exclusively from the Internet. Some digital goods are free, others are available for a fee.

The taxation of digital goods and/or services, sometimes referred to as digital tax and/or a digital services tax, is gaining popularity across the globe.

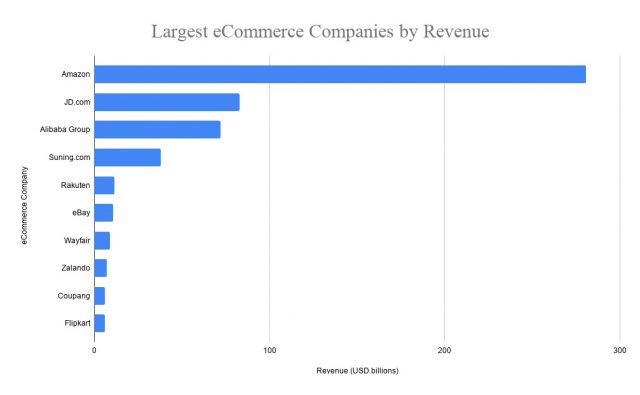

The digital economy makes up 15.5% of global GDP in 2021 and has grown two and a half times faster than global GDP over the past 15 years, according to the World Bank. Many of the largest digital goods and services companies are multinational, often headquartered in the United States and operating internationally.

How Does India Pay Digital Tax?

The Digital Tax or equalization levy was a step by the Indian government to tax the foreign firms with no permanent establishment in India.

Before this was introduced in 2016, companies outside India could get out of taxes in India by providing evidence that they are based outside the borders and pay taxes to their native country.

This helped the companies outside a lot and they could compete with local Indian establishments, especially with companies situated in countries with lower tax restrictions.

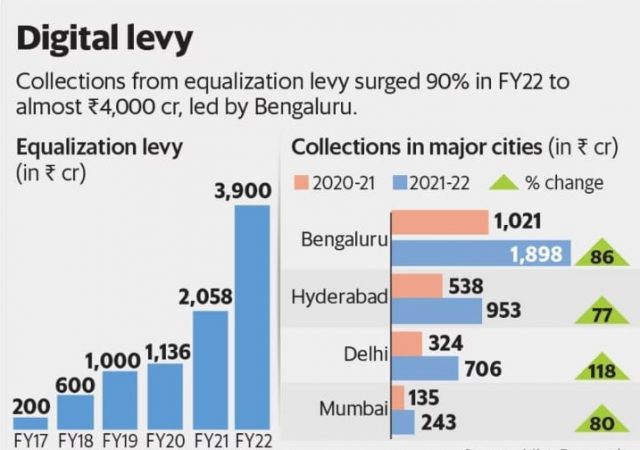

But after the Digital Tax implementation by the Indian government, tax revenue collected by the Indian government increased on a yearly basis. The first year saw a generation of more than 1100 crores rupees, which was almost 4,000 crores in the Fiscal year 2022.

It was first introduced at 6% on companies like Google and then its domain was increased to smaller non-resident e-commerce companies at 2%. E-commerce companies like Alibaba, Adobe, Uber, Udemy, Zoom, Expedia, Ikea, LinkedIn and Spotify fall under this equalization levy.

In 2019, then US President Donald Trump called India, “the King of tariff.”

Read More: Why Is The US Calling India’s Digital Taxes ‘Discriminatory’ & ‘Unreasonable’?

Why Does It Bother The West?

After India started using the equalization levy, other countries like Israel, Kenya, UK also implemented equalization Levy in their own countries with rates varying from 1.5 to 5% in different parts of the world.

This enraged the US as most of the IT giants emerged from the US itself. They imposed tariffs upto 25% on some Indian products.

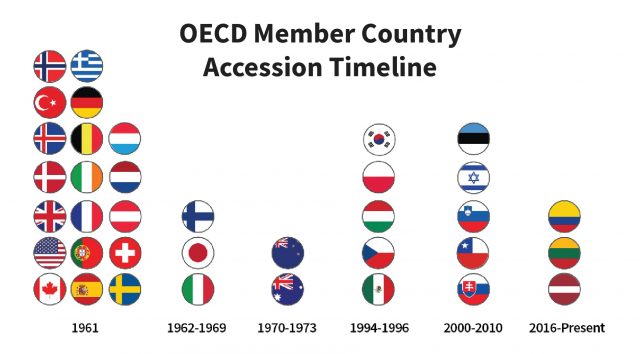

To settle this dispute the OECD, Organization for Economic Co-operation and Development, has now come up with a new pact to equalize this digital taxation all over the globe.

But wait what or who is this OECD and why is it important?

As they say, “OECD is an international organization that works to build better policies for better lives. Our goal is to shape policies that foster prosperity, equality, opportunity and well-being for all. We draw on 60 years of experience and insights to better prepare the world of tomorrow.”

About 140 countries have collaborated together to fix this taxation dispute. It is based on two Pillars.

The First Pillar says that multinational companies with global sales over 20 billion euros and 10% profit will have to pay taxes irrespective of their home base.

While the second pillar says all companies have to agree upon a minimum of 15% tax whether or not they are in their home base or not.

Till now 136 countries including India have agreed on this pact. And if all goes well it will be implemented from 2023.

But it still has a few challenges to overcome. Not all companies will have to pay this minimum 15% tax revenue to the governments of the respective countries. Smaller companies with less than the 20-billion-euro sales will be exempted from this and may still have to pay the respective digital tax.

This dispute is far from being over and only time will tell what the future holds for these companies all over the globe.

Disclaimer: This post is fact-checked.

Image Sources: Google Images

Sources: The Economic Times, The Hindu, Forbes

Find the Blogger: @Rishita51265603

This article is tagged under digital tax, digital tax collection of India, equalization levy, Indian Government, digital economy, global GDP, non-resident e-commerce companies, OECD, Organization for Economic Co-operation and Development

We do not hold any right, copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.

More Recommendations:

How Does The Fall Of The Rupee Affect The Common Man?