By Nikhil Dawar

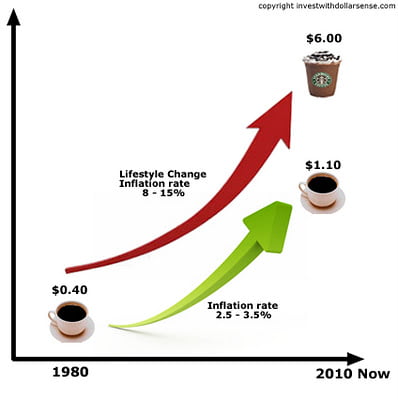

Inflation Rate:

If we look into the inflation rates of past few years,while comparing the rates at which it has gone up and down,it can be seen that it has been a topsy turvy run for the rates.After last year’s rate being staged at 9.06%, it can be said that considering all the factors i.e, the constant fall in the value of rupee,the possibility of emerging recession period,the euro zone crisis etc, not much can be expected from the government and inflation can be expected to float in between 7.5-8.5%,and we have to be content with that,if not more.

Falling Rupee & High Fiscal Deficit

Now there has been this sudden and huge fall in the value of rupee.Although it was not totally unexpected.This is because as soon as the Euro crisis started and inflation in the US went sky-rocketing,it was known that India would suffer.Thus considering the stringent loan policies of RBI and the position of the world market,not huge but some improvement can be expected.Hence the value of Rupee is likely to rise and float about the Rs 49-51 margin.

FDI:

There has been a huge ongoing debate related to the possible entry of FDI in the Indian economy.The government is trying hard to ensure its entry with the opposition constantly opposing it.It does have its pros and cons but the greener side of FDI definitely has a lot more to offer.It will surely enhance the retail sector growth in India which is in urgent need of revitalization.It would definitely increase healthy competition among India’s domestic industries.It would also be an effective way to break the ongoing monopolies in trade and boost up the retail sector with the much needed investments.So taking in all the pros which overshadow the negative aspects,it is almost a sure shot that sooner or later FDI is going to enter the Indian market,most likely in 2012 and if not then by 2013.