So, when society was in its early stages, there was no such thing as money. Hence, if someone were to buy something, it’d be based on trade. Cryptocurrency works exactly like that. It’s a trade and is 100% virtual.

It is the transfer of digital assets. And in a world of technological advancements, cryptocurrency has been by far the most effective technological development.

Recently, cryptocurrency has been very popular owing to its availability in all areas thereby minimizing the use of banks. Many areas have access to the internet but not to banks owing to a lot of factors – unfavorable geographical terrain being one of them. You can make international payments almost instantly instead of it taking half a day with no spending limits.

However, if cryptocurrency is so useful then why has the Securities and Exchange Board of India (SEBI) put a ban on celebrity promotion of crypto products?

What Is The Securities And Exchange Board Of India (SEBI)?

The Securities and Exchange Board of India (SEBI) is the regulator of the Securities market in India owned by the Government Of India. It was established in 1988 and given Statutory Power on 30th January 1992 through the SEBI Act, 1992.

In layman’s terms, it is an autonomous regulatory body that controls financial instruments involving mutual funds, bonds, debentures, shares, etc for new-launching in the market. However, the main duty of SEBI is to monitor the Capital markets of India. It enforces certain rules and regulations in order to protect the interests of the investors as well as regulate the stock market.

Now, even though cryptocurrency is a virtual asset, it falls under SEBI’s regulatory ambit.

According to a report by NDTV on 3rd December 2021,

“Cryptocurrency will be described as crypto-asset and will not be recognized as legal currency. These crypto-assets will be regulated by the Securities and Exchange Board of India (SEBI).”

So why did SEBI red flag celebrity promotions of it?

Read More: FlippED: Is It Okay To Capitalize On The LGBT Community For Crypto Culture?

SEBI Red Flagged The Promotion Of Crypto Products

Owing to the unregulated nature of cryptos, SEBI has put a ban on the celebrity endorsement or promotion of crypto products in any advertisement. SEBI notified the parliamentary panel that in case of any crypto endorsement by a prominent public figure will fall under the violation of the Consumer Protection Act or any other law.

On being asked for a detailed cause by the panel, SEBI stated,

“Since crypto products are unregulated, endorsement or any advertised message, verbal statement, demonstration or depiction of the name, signature, likeness, or other identifiable personal characteristics of an individual or depiction of the name or seal of any institution or organization which makes the consumer believe that it reflects the opinion, finding or experience of the person making such endorsement.”

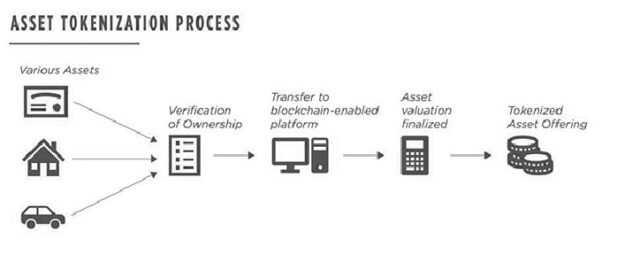

According to SEBI, all assets cannot be rendered into securities, and crypto assets are a tokenized version of assets thereby the tokens issued onto those assets cannot be rendered as securities.

Furthermore, SEBI also added that crypto-assets do not uphold the features of securities under Securities Contracts (Regulation), Act, 1956 or SCRA and neither does the Central Government conform to it.

SEBI clarified,

“Tokenization of assets and running it on a decentralized platform is still linked to the underlying asset it represents. The extant laws applicable on the underlying asset may be applicable on the tokenized asset too. Under these circumstances, it is not clear whether/which crypto assets/ cryptocurrencies can be legally defined as securities.”

According to a report by India Today, SEBI told the parliamentary panel that in case crypto assets are permitted, then the tokenized version of assets need to have feature-based characterizations and this particular act might require the supervision of different sectoral regulators.

According to a panel member,

“People are advertising living a luxurious life after investing in Crypto. But in real life there are cases of suicides due to losses in trading. An Axis Bank employee in Chennai branch killed his wife and kids and committed suicide due to this. There are false claims being advertised to lure people to invest. We had asked What SEBI was doing about it.”

Thereby, SEBI cautioned the ones investing in crypto that the assets are intangible, volatile, prone to market and operational risk and may not have any identifiable issuer.

Hence, dealing in crypto products may lead to the violation of Indian laws such as the Foreign Exchange Management Act (FEMA), Banning of Unregulated Deposit Schemes Act (BUDS Act), and Prevention of Money Laundering Act, 2002 (PMLA), etc.

Disclaimer: This article is fact-checked,

Image Sources: Google Images

Sources: The Economic Times, India Today, The Hindu

Find the Blogger: @Rishita51265603

This post is tagged under crypto, cryptocurrency, tokenization, Securities And Exchange Board Of India, autonomous regulatory body, monitor Capital markets of India, virtual asset, celebrity banned from promoting crypto products, not a legal currency, parliamentary panel, violation of Indian laws, Foreign Exchange Management Act (FEMA), Banning of Unregulated Deposit Schemes Act (BUDS Act), Prevention of Money Laundering Act, 2002 (PMLA)

We do not hold any right, copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.

More Recommendations:

In Pics: Top Ten Cryptocurrencies Of 2022