Passing of insurance bill in upper house of the parliament is being regarded as a major victory for the nine month old BJP government. After almost 11 years when that time finance minister P. Chidambram had proposed to increase FDI limit in insurance sector to 49%, the bill was finally passed in Rajya Sabha on Thursday much to the delight of financial sector. Foreign firms will now be able to increase their stakes in domestic insurance firms up to 49%.

The Rajya Sabha on Thursday passed the insurance sector amendment bill.

Economy Decoded seeks to explain the whys and hows of FDI such as what do you mean by FDI? Why do industry conglomerates cheer on raising of FDI limit, in their respective sector? Why does a pro-reform government ease the FDI limit in a developing economy? Why do rival political parties raise a hue and cry when FDI limit is raised? Why communists and socialists term raising of FDI limit as being anti-poor? Is FDI and economic growth related? If yes, then how so?

Foreign Direct Investment or FDI is an investment in a business by an investor from another country for which the foreign investor has direct control overs the company purchased. The Organization of Economic Cooperation and Development (OECD) define control as owning more than 10% or more of the business.

- Why FDI better than other forms of foreign investment?

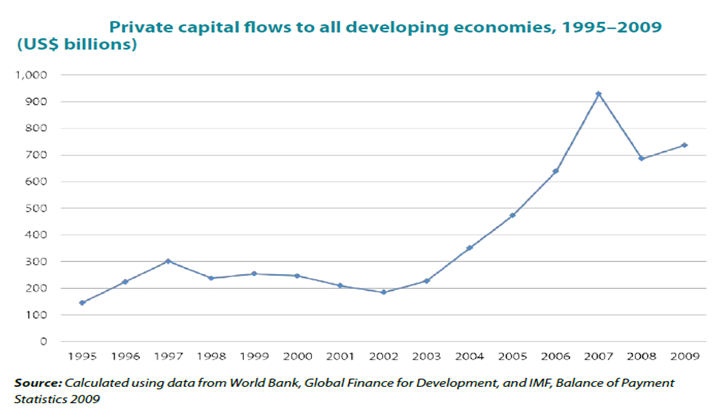

FDI is longer term investment compared to portfolio investments.FDI is recognized as the most stable form of cross country capital flow. Stable in the sense that it is tough for Multi National Enterprises (MNEs) to exit a developing economy at the onset of a financial crisis. Yet, it isn’t as simple as it seems.

FDI reversal can take place through financial transactions. For instance, the foreign subsidiary can borrow against its collateral domestically and then lend the money back to the parent company. Likewise, because a significant portion of FDI is inter-company debt, the parent company can quickly recall it.

Also, foreign investors borrow from domestic credit market and then invest these funds in a domestic firm, this is called leveraging. Thus, capital inflows are not as large as it seems nor the benefit predicted for such inflows.

- FDI and economic development of host country:

FDI contribution to economic development of the host country works in two main ways-

First, augmentation of domestic capital and enhancement of efficiency through the transfer of new technology, marketing and managerial skills, innovation and best practices.

Secondly, FDI has both benefits and costs and its impact is determined by the country specific conditions in general. The policy environment, the ability to diversify growth in all sectors of the economy, the level of ‘absorptive capacity ’, targeting of sectoral-specific FDI and opportunities for backward and forward linkages for foreign owned firms, trade openness etc. determines the extent of positive effects that FDI can have on a developing economy.

The ‘absorptive capacity’ is the capability of the host economy to best utilize technology and knowledge. The main determinant of the “absorptive capacity” is the quality of institutions, particularly, the rule of law and the property rights protection. Research has shown that a minimum threshold level of human capital and technological know-how is essential for the host economy to benefit from foreign fund inflow. And it has been found that more the competitiveness in domestic market, the more is the technological spill from foreign owned firms operating in developing countries. The latest example could be the Rs. 20,ooo crore of foreign fund inflow that is expected from easing of FDI limit in insurance sector. This amount of capital can be put to good use through joint ventures and sharing of management expertise.

By sectoral specific, I meant that FDI has significantly more advantageous effect for manufacturing sector as compared to primary sector or even tertiary sector. This is because linkages such as between suppliers for increased demand for intermediate goods leads to domestic firms competing with foreign owned ones. Such backward and forward linkages are mostly relevant for manufacturing sector only. As the manufacturing sector of any developing economy is recognized as ‘engine of growth’, FDI can truly be said to be significantly contributing to economic growth of a low income country and thus, helping in alleviating poverty and income disparity.

- Repatriation of profits, dividends, royalty from FDI:

A foreign firm invests in an under-developed economy to earn profits in the longer-term. MNCs benefit from investing in host economy and can benefit in two fold manners, either from the factor cost perspective exploiting lower wage cost, cheaper real estate etc. or from market expansion viewpoint for diversifying its market for existing product.

When profits are repatriated to parent company in the form of royalties, dividend to stakeholders or simply as proportion of profits, the host country suffers extensive capital outflows, shrinkage of foreign reserves and Balance of Payments deficit.

This is a major downside of using foreign capital for economic growth. This is minimized by developing economies designing appropriate policy regimes. This can be minimized by the host countries often setting limits on the amount of profits that MNEs can repatriate in order not to have BoP deficits or reduced foreign exchange reserves. Such policy can induce these MNEs to invest profits in different projects within the host country.

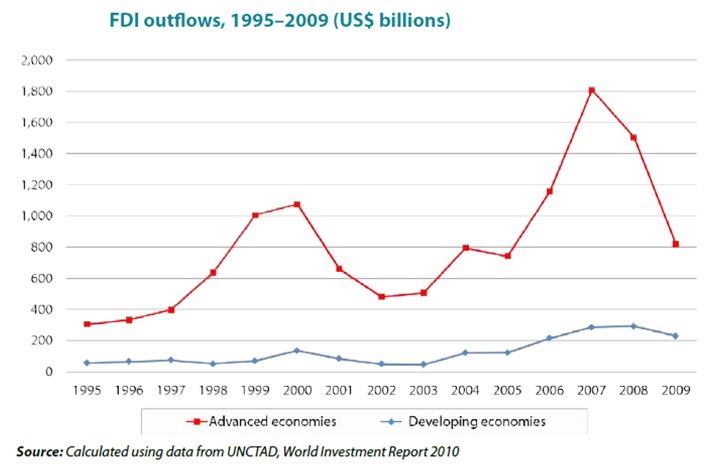

The graph below shows percentage share of FDI outflows for developed and developing economies-

Most of the FDI outflows originate from developed countries because of aforementioned reasons

- Summing Up:

FDI to put simply is neither good nor bad for either the rich or the low-income country at its face value. The policies of the host country, level of dependence on foreign capital, level of indigenous human capital and technology, dependence of GDP on diverse sectors of economy etc. to a large extent are the determining factors behind the successful employment of foreign capital for fast-tracking economic development of a developing country such as India.

By Shriya Dargan

Sources:

http://www.oecd.org/fr/daf/inv/statistiquesetanalysesdelinvestissement/fdibenchmarkdefinition.htm

www.undp.org/content/…/Towards_SustainingMDGProgress_Ch3.pdf

www.ey.com › Home › Services › Tax

www.rbi.org.in › FAQ

http://rbidocs.rbi.org.in/rdocs/Content/PDFs/FDIST_110412.pdf

www.ukessays.com › Essays › Economics