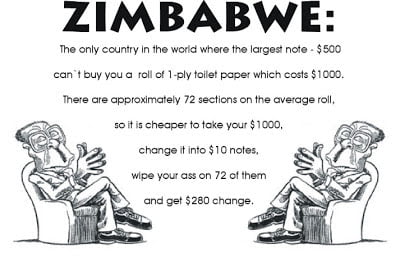

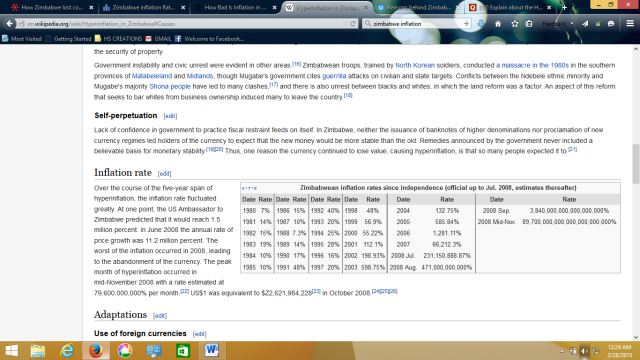

Zimbabwean economy, plagued with Hyperinflation that is so bad that price level rises from sunrise to sunset each day. So, how bad could be the inflation in Zimbabwe? Well, consider this: If you were in a supermarket in 2006, a toilet paper costs $417 (Not the entire roll, you get single sheets in this much). An entire roll costs $145,750 — in American currency, about 69 cents. As shocking these stats are, the condition in the country worsens day by day with failed measures taken by the governmentand the central bank of the country. Zimbabwe’s peak month of inflation is estimated at 79.6 billion percent in mid-November 2008.

So what got Zimbabwe into such a mess?

Confiscation of Land from White Land Owners: During the reform program initiated under President Robert Mugabe’s leadership, most of the farm lands were taken over by local people and other government officials who had only little knowledge about the agriculture and related activities. As a result the production declined to unprecedented worse levels.

- The annual wheat production plummeted from 300,000 tonnes in 1990 to 50,000 in 2007.

- The tobacco industry, which was Zimbabwe’s single largest generator of foreign exchange almost collapsed.

- From a leading exporter of food grains, Zimbabwe now became highly dependent on other countries to obtain the very basic commodities.

- War funding: In September 1998, even as economic conditions continued to worsen, the President sent 11,000 troops to the Democratic Republic of the Congo (DRC) to fight for the discredited leader, Laurent Kabila.

- This lead to the depletion of much of its monetary reserves on the wake of 21st century.

- Government resorted to quantitative easing by printing more money to finance the war.

- Zimbabwe was now under-reporting its war expenditure to the IMF by perhaps $22 million a month.

- Economic Mismanagement:

- According to IMF reports, the budget deficit, including grants, stood at 10.0 percent of estimated GDP in 2006.

- In the 2008 budget announced on 29 November 2007, the forecast budget deficit was approximately 11 per cent of expected GDP of Z$16 quadrillion.

- Government expenditure had reached 53.5 per cent of GDP in 2006.

- Zimbabwe’s Reserve Bank resorted to print more of currency that ultimately led to expansion of the money supply at a rate well over Zimbabwe’s inflation rate.

The deadly aftermath of all this severely mismanaged causes was a food crisis, and a battering for the economy as foreign exchange earnings slumped and widespread agitation against the land reform program.

Source: Wikipedia

Currency of Zimbabwe was at its most vulnerable stage in 2008 leading to abandonment of the domestic currency. In October 2008, US$1 was equivalent to $Z2,621,984,228.

Government with the Central Bank of the country obviously implemented a range of statutes and mandates to control the soaring inflationary rates. The government declared inflation illegal, thereby leading to price freezing wherein shopkeepers were subjected to be arrested if they increased the prices of the commodities.

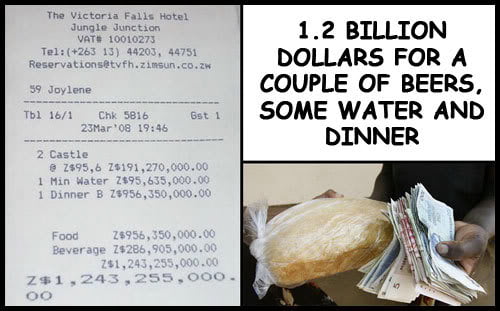

With hourly fluctuations in the inflation rates, Living with hyperinflation became a challenge for the citizens. Prices in shops and restaurants had to adjusted several times a day. Any Zimbabwean dollars acquired needed to be exchanged for foreign currency on the parallel market immediately, or the holder would suffer a significant loss of value. For example, a mini-bus driver charged different rates throughout the day: He sometimes exchanged money three times a day, not in banks but in back office rooms and parking lots. Such business venues constituted a black market where people could evade the price freezes and the mandate to use Zimbabwean dollars.

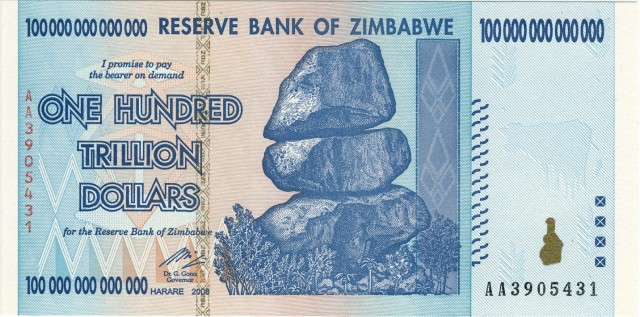

The government did not attempt to fight inflation with fiscal and monetary policy. In 2006, before hyperinflation reached its peak, the bank announced it would print larger bills to buy foreign currencies. The Reserve Bank printed a Z$21 trillion bill to pay off debts owed to the International Monetary Fund. The redonomination of currency by the central bank was a move to slow inflation and make computations more manageable.

Even after repeated measures taken by the government, the economy of Zimbabwe is undoubtedly in turmoil and well devised actions need to be taken so as to revive the economy. With numerous official currencies being used to keep a check on inflation such as the South African rand, Botswana pula, pound sterling, Indian Rupee, euro, Yuan and the United States dollar for all transactions in Zimbabwe; reviving the dying Zimbabwean currency is possible only when the industry and agriculture prospers giving an impetus to the exports of the nation and thereby making it self-sufficient.

Image Courtesy: Google Images

By Vaibhav Agarwal