In this age, everyone in every household has a bank account to their name. Might I say, it’s even unimaginable to think that someone who is 18+ doesn’t have a bank account yet.

Opening a bank account is still an easy work, because you have nagging relatives and persistent telemarketers reminding you each second about how if you don’t have a bank account yet, your world might end.

However, there might be a need for you to close your account in a particular bank instead.

Why You Should Close Your Bank Account

You have just quit your job. Your old zero-balance salary account that your previous organization had opened for you will automatically convert into a regular savings account in 3-6 months of your quitting and if you don’t bother to maintain a minimum average balance, the bank will start deducting charges for non-maintenance.

If you rarely use an account, it’s better to close it down because chances of fraud and misuse are high in the case of dormant accounts.

Also, if you are getting a very low-interest rate on your savings, your bank is charging excessive fees or the customer service is not up to the mark, it’s better to close down your account in that particular bank, and take your business elsewhere.

Leaving your bank can be a daunting task, but fret not because here’s a comprehensive guide that will teach you how to close your bank account quickly and easily!

1. Find Your New Bank

Before closing your old account, you should make sure you have found a new bank ready to receive your money or you may find yourself terribly inconvenienced when you need to pay a bill, deposit or transfer money or write a cheque.

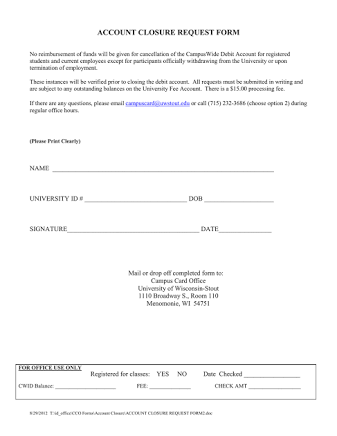

2. Fill The Account Closure Form

Visit your branch and ask for an account closure form which is available to you from any of the branches.

You will be asked to fill in various details like Account Number, your name, registered mobile number and mainly your signature.

You also have to submit some document to the officials such as your Address proof and Identity proof.

Also Read: Your Step-By-Step Guide On How To Get A Voter ID Card In India

3. Reroute Your Automatic Payments

Review your bank statements for the past six to 12 months so you can identify the automated transactions that need to be rerouted to your new bank account if there are any.

A lot of people today, especially the youth and working-class individuals choose the option of automatic payments because it simplifies your task of paying monthly bills.

An automatic bill payment is a money payment scheduled on a predetermined date to pay a recurring bill.

For example, you have linked the payment of your tuition fees to your Axis Bank account, so whenever the fees become due, you will get notified that your bank has paid the fees automatically by debiting your account.

Whenever the payment is due, it is paid off automatically as long as your account has balance.

Today almost all of the major banks like ICICI, HDFC, Axis Bank offer this facility because it is convenient, hassle-free and makes our lives much easier!

These transactions could include bill payments, school/college fees payment, rent payments, direct deposit etc.

To stop this automatic flow of money, change your bank account number and routing number.

4. Transfer The Money From Your Old Bank Account

After the above steps have been completed, you can begin with withdrawing your money or just simply transferring your balance to the new account.

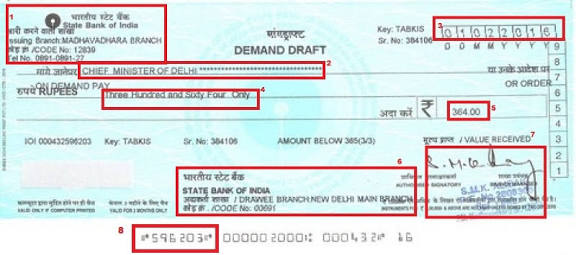

The methods which are basically available are Cash, Cheque, Demand Draft and Balance transfer to other accounts.

However, stay aware of withdrawal or transfer limits that may apply for large amounts of cash.

5. Request A Written Letter

Your account once closed might get reactivated because of billing errors or when some company attempts to draw money from your account because you forgot to reroute the automatic payment.

These are called as, “zombie accounts”.

So, it is important to always request a written letter stating that your accounts are closed to avoid any discrepancies in the future.

Submit an account closure form along with your documents duly self-attested to the branch manager and you are done!

Congratulations, you have successfully closed your account!

Image Credits: Google Images

Sources: Outlook Money, Wikipedia, SBI