For the past couple of weeks, Sri Lanka’s economy has plummeted to astounding degrees. Owing to the consistent downward trend, the country has had to make concessions on the most basic amenities accorded to them.

Moreover, this has sparsely been aided by the fact that the economic doom has brought about a dearth of food and edible supplies in the country.

With the entirety of Sri Lanka’s Cabinet resigning, the time for speculations has, conceivably, been lost. No longer can the Sri Lankan government wait for things to change around them as the time has come to sift through the obstacle by minimizing the damage.

The economic crisis should stand as an eye-opener for the Indian government to adjudicate an economic crisis.

What Is Happening In Sri Lanka?

The island nation of Sri Lanka had initially faced the brunt of the pandemic’s upheavals owing to the primordial financial sector of the country, tourism, taking the worst hit. The absolute standstill had led to the Sri Lankan government applying for magnanimous amounts of loans from countries all over, alongside the International Monetary Fund.

Mahinda Rajapakasa, the Prime Minister of Sri Lanka, has refused to step down from office even in the face of the entire cabinet relinquishing theirs.

Rajapakasa had elaborated time and again from the very initial days of the economic crisis during the pandemic that the crisis was not of his making. The bellowing had already been set in stone for the nation as the government had to place a ban on imports in March 2020 to protect any economic deterrent in the foreign market.

To put matters into perspective, they had to pay nearly 7 billion USD this year in a cumulative repayable debt of 51 billion USD.

Unfortunately, the only solution the Lankan Prime Minister could come up with was along the precipice concerning his own safety. On the first of April, the absolute focus of the day’s work was placed upon the declaration of emergency, giving the security forces absolute power after his residence was stormed by about a hundred demonstrators.

The fact still stands that it is through the President’s rule that the country’s consumption of international imports increased.

Distressingly, the cost has to be borne by the common populace. Through fairly consistent power outages of 13 hours every day, the government has been trying to save whatever resources it can without taking help from other countries.

As of now, the situation concerning Sri Lanka’s global exchange scenario has reached such an extent that the value of a single US Dollar has reached approximately 300 Sri Lankan Rupees.

Coupled with this fact, most food materials brought into the country have been imported from far and wide. Thus, inadvertently, they have had to suffer through a massive dearth in food imports.

As of now, the Sri Lankan government has applied for a pardon from the International Monetary Fund (IMF) as the scenario looks grimmer by the day as the prospects of paying their debts dull down by the minute.

The IMF pardon will thus allow them to ask for fresh loans from China and India to help them recuperate their economy alongside acquiring food grains. Sri Lanka has already borrowed 1.5 billion USD from India and quite possibly, it will be a long time until the Lankan government thinks of paying the amount.

Also Read: DemystifiED: What Went Wrong In Sri Lanka And How It Landed In This Messy Economic State

Can This Scenario Happen To India Too?

It is unfortunate to think about but the scenario is as realistic as it gets. Any economy that depends a bit too much on the international exchange will have to suffer the brunt of impending doom.

That is exactly what happened to Sri Lanka wherein they forgot to demarcate the fact that a country’s economy can never function on the pretext of debts and solely forex. Which will always result in a scenario akin to the one facing them in the face presently.

The fact that stands are that it is not entirely fantastical to think of this happening in India. Sri Lanka has been fairly intermittent in using whatever resources were available at their behest in creating a facade of wealth.

The facade, distressingly, led to a cumulative debt of nearly 50 billion USD, with 8 billion USD outstanding as debt to China itself. Furthermore, it is through rampant privatization and building of the usual bling of multiplexes, shopping malls, and shopping centers that forex reserves falter while maintaining the astute show of false wealth.

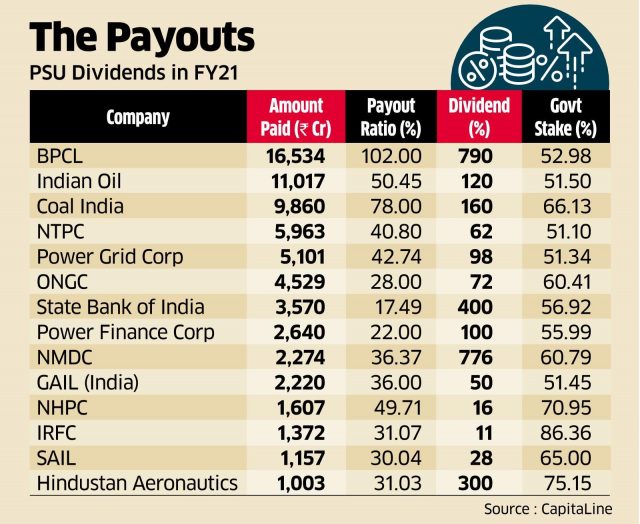

Although Sri Lanka’s crisis was already a decade in the making, only being catalyzed by the pandemic, India’s economy is faltering in a similar way. The Central government’s rampant sale of Public Sector Undertakings in the hopes of slashing “losses” makes the foundations base themselves along with the premises of privatization.

The sale of the said PSUs has been a fair reason for both an increase in inflation owing to a loss of subsidy as well as an increase in people losing their jobs. Owing to the latter, the country’s workforce loses out on a major chunk of revenue in the form of taxes and fair to state, cedes to a lull owing to a lack of new jobs in the market.

Owing to the impending Sri Lankan crisis, the economic load on India has now increased. Refugees have now started entering by the hundreds through Tamil Nadu’s ports. All that remains to be seen is if we have the financial capabilities of handling the influx.

Image Sources: Google Images

Sources: Times of India, Free Press Journal, Hindustan Times

Connect with the blogger: @kushan257

This post is tagged under: Sri Lanka, Sri Lankan economy, economics, economy, India, crisis, economic downturn, Pandemic, inflation, high prices, Sri Lanka Crisis, Economic Crisis, forex, foreign exchange, forex crisis, modi, refugee, refugee crisis

We do not hold any right, or copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.

Other Recommendations:

If COVID Destabilized The Economy, How Did The Govt Collect Record-High GST Revenue?