In Hindu mythology, Diwali marks the beginning of a new business calendar. Even though the stakeholders are no longer just Indian, the tradition, on the Diwali day, of opening of new books of accounts and trading for a short while still is customary.

With extraordinary changes in policy and governance happening in the country, and investor sentiment at its peak, nothing better reflects the momentum better than the surge in the capital markets.

“Sensex kaisa raha aaj?” is all I can hear around nowadays. Sensex- the name given to the index of 30 stocks of top Indian companies is regarded as the pulse of the Indian stock markets, and by extension, our economy. The 30 stocks comprising the benchmark index are the largest and most actively traded stocks, and are a representative of various sectors of the economy. The companies in fray account for one-fifth of total market capitalisation of the BSE. Established in 1986, the BSE SENSEX has been steadily progressing to reach its current levels of 28K. With a solid Government at Centre, headed by a decisive and pro-active PM, improving business outlook, accompanied with softening of domestic inflation rates, and positive economic indicators- market participants can hope to continue to witness the bulls exploring the unchartered territory.

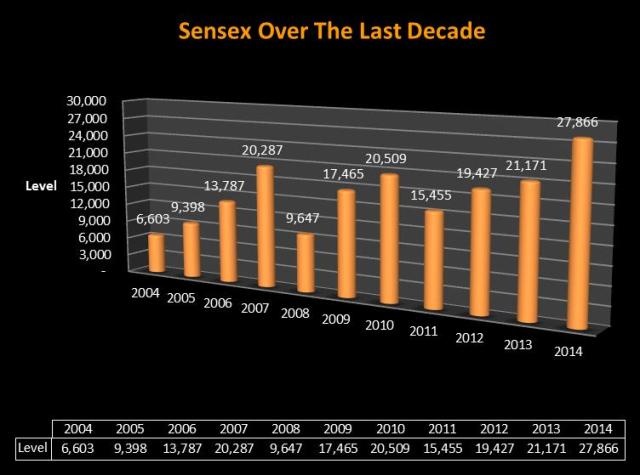

The graph below shows how the benchmark index has moved in the preceding decade. From being at 6600 towards the end of 2004, it is now at its peak hovering just below the 28000 mark.

The Samvat 2070 ended with a bang with Sensex recording a massive gain of 26% this year. The index reached the lifetime high of 27865.83 points intra-day on October 31 on the back of the decision by the Bank of Japan (BoJ) to sharply expand its stimulus programme, along with a lot of positive thoughts about the Indian economy.

Now, you might well be interested in putting your money right away to make a few bucks. But, investing is not as easy as it looks. There is no top and there is no bottom. One needs patience and guts to stay committed to the investments in hand. The quote below by Nobel laureate Paul Samuelson sums up this thought quite beautifully.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

But Paul Samuelson was an old man, why should not we, as investors, seek excitement in the present scenario, when returns of maddening proportions are there to be grabbed? Yes, we can give into this urge, but not without exercising due research.

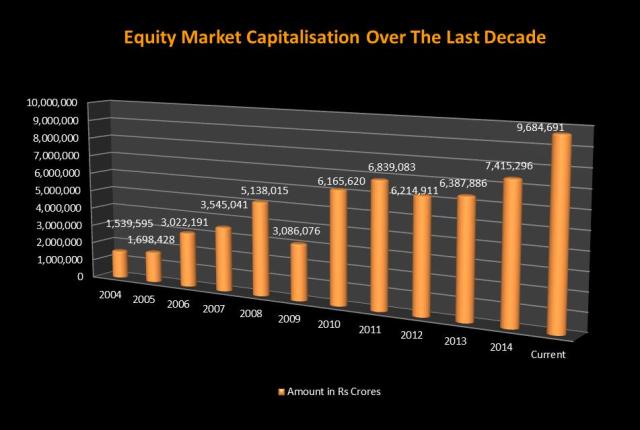

It has been 6 years since our markets last rallied, and it is the underlying potential of equities that has woken it up from its slumber. If the number of new demat accounts is anything to go by, then retail investors are making a comeback. NSDL and CDSL, the two top depositories, have recorded 8 per cent growth in demat accounts for June and July against an average 4 per cent for the full financial year 2014. It is not only the domestic investors going gaga over the valuations. Hot money has been coming in from all around the world. Foreign Institutional Investors (FIIs) – basically the entities outside India, have pumped in more than Rs 1 Lac crore (USD 16.5 Bn) from last Diwali to this one.With the Dalal Street witnessing a dream-run, the market participants have grown rich by over 26 lac crore in this Samvat. The image below shows the value of the domestic markets over the last ten years, with the total valuation of BSE listed companies inching closer to Rs 100 lac crore milestone (USD 1.6 trillion).

With the broader view on equities being constructive, and India holding onto its fundamentals well, India finds itself in a sweet spot. All in all ladies and gentlemen, the Indian markets can no longer be underestimated! The best is yet to come…