The economy was badly hit when the COVID-19 pandemic struck in 2020. Crores of people were pushed into poverty, many lost jobs, income disparity widened, and the supply chain was affected giving rise to inflation. Amidst all this, the government managed to collect a record-high Goods and Services Tax (GST) revenue.

A Record-High GST Collection

In January 2022, the government collected INR 1.4 lac crore, the highest ever in a month to date. In January 2021, it earned 1.2 lac crore, which was 8% higher when compared to the same month in 2020 (before the pandemic hit India).

In December also, over 1.29 lac crore was collected. January is the seventh month in a row when GST collections have crossed the 1 lac crore mark. This was observed from October 2020 to May 2021 as well.

M S Mani, Senior Director, Deloitte India said, “The surge in GST collections observed during the past four months is expected to be sustained in the coming months of the current fiscal with more of service sector activities like aviation, hospitality, entertainment, etc opening up across states since January“.

So, as far as the government earnings remain, the outlook remains positive. It could be a good chance for the government to narrow its fiscal deficit gap.

Such high GST collections indicate the economic recovery and growth of businesses. But, how did the government’s tax revenue increase when so many people have plunged into poverty or their disposable incomes have deteriorated?

Read More: DemystifiED: Why Very Few Indians Pay Income Tax

“Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue over last few months,” said the Finance Ministry.

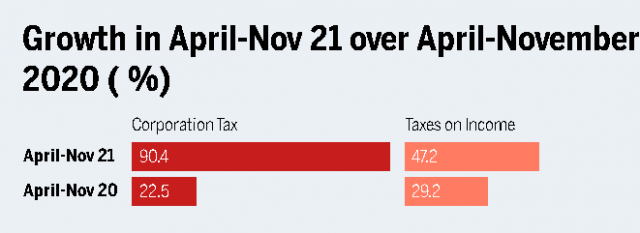

The annual survey report before the Union Budget noted that an increase in corporate tax collection, improved profitability of corporates, formalization of the economy, and improved compliance due to tax reforms are the noteworthy reasons for this remarkable increase in tax collection.

Direct tax revenues increased by more than 24% from their pre-pandemic level, owing to robust growth in both corporate and income tax collections. Direct tax is the one that an individual pays directly to the government.

Indirect tax is the tax levied on the purchase of goods or services. That can be passed from one individual to other and is levied on the taxpayer directly. Examples: GST, excise duty, etc. GST has given good revenue to both central and state governments.

There were several relief measures announced by the government for tax filing that led to greater compliance by the people. Waiver of late fee, reduction in interest in case of late payment, and extending the due date for filing return are a few of them.

Moreover, it is true that many people were forced into acute poverty owing to the pandemic, but several others recorded the highest-ever profits. So, this is a good time for the government in terms of tax collection. Through this money, focus should be made on capital growth, as already sanctioned in this year’s budget.

Disclaimer: This article is fact-checked

Sources: Economic Times, The Hindu, Financial Express

Image Sources: Google Images

Find The Blogger: @TinaGarg18

This post is tagged under: goods and services tax, gst, tax, income tax, tax revenue, record-high gst, robust economy, budget 2022, tax rules, digitization, formalization, excise duty, direct tax, tax on income, corporate tax, tax evaders, strict tax regime, finance ministry, health of government’s financial statement, indirect tax

We do not hold any right/copyright over any of the images used. These have been taken from Google. In case of credits or removal, the owner may kindly mail us.