Today’s topic of conversation is the Chinese economy. To be more specific, we shall talk about the slowdown that has caught the dragon in its web.

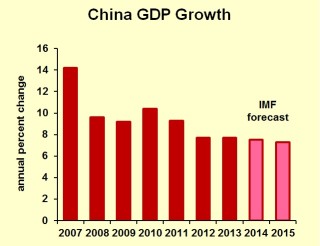

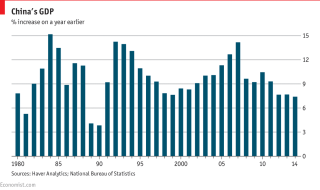

The Chinese growth story is something that is considered to be the stuff of legend. Having double-digit economic growth for close to a decade has clearly taken China to a league of its own, and currently, it stands second only to the USA in terms of value of the GDP (and is #1 in the world in terms of GDP as per Purchasing Power Parity). The country has emerged as India’s largest trading partner and is the largest holder of U.S. treasury debt. Then there’s also all the political power play that it engages in in the Asia region (North Korea and Pakistan, looking at you).

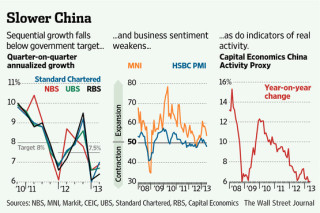

But the Chinese engine has now encountered its first major mechanical glitch. The economy expanded 7.4% in 2014 versus 7.7% in 2013. What’s worrying everybody, however that this growth of 7.4% has come against the Communist Party’s prediction of 7.5%. And when an all-powerful, data-manipulative, Big-Brotherish government is unable to meet growth expectations, one can expect serious trouble to be afoot.

TO THE BEGINNING

So, to understand the future, one must look into the past. And China has had a very colourful past indeed.

Mao Zedong, the founder of the People’s Republic of China, had initiated a ‘Great Leap Forward’ to transform China into a social industrial powerhouse through a series of extremely draconian economic policies implemented in an even more horrific manner. The result was a dystopian, ‘Hunger Games-esque’ situation where close to 30 million people died.

In the late 1970s, Deng Xiaoping enacted sweeping economic reforms to clean up his predecessor’s raita. He let people cultivate their own farms, didn’t crack down on entrepreneurs and finally opened China’s doors to foreign trade and investment. All this helped improve people’s productivity and their incomes and finally kickstarted the country’s growth process. However, the one child policy he introduced in 1979 has finally come around to showing its negative repercussions.

Perhaps one of the biggest successes of Xiaoping’s economic reign was the conceptualization of Special Economic Zones (SEZs), an experiment that India tried and failed (miserably) to replicate. The SEZs were a lucrative package for foreign investors who wanted to try their luck in the country.

The most significant contribution to the Chinese growth story has been made by its authoritarian government. Being able to operate in a pseudo-dictatorial style of governance, without having to worry about some odd party doing a dharna definitely gave the Communist Party a leeway when it came to formulating and implementing non-populist (yet essential growth policies.)

The feather in the cap of this entire exercise is, however, extremely fudged up data. Though they deny it vehemently, the Chinese government has not only been accused of overstating growth figures, seemingly meeting impossible industrial targets, but also for (and this one is the most popular), depreciating (i.e. keeping its currency cheaper versus the rest of the world) its currency to increase export growth.

BREAKING DOWN THE BRAKE-DOWN

And yet, the Chinese economy has hit the bump on the road that has been plaguing the rest of the world for half a decade now. The slowdown can be attributed to the following factors :

- Industrial output (which is the backbone of the Chinese economy) has gone up by only 6.8% in January-February, which is the slowest it has ever been since the 2009 slowdown took place. Being hit in the spine never did anyone any good.

- A housing market bubble burst has led to a downturn in the property market. To people who have no idea what I’m talking about, a housing market bubble usually occurs when real estate becomes overvalued (which occurred in the Chinese case due to overinvestment by the government). When people realize this fallacy and sell in a panic, price falls. (though the consequences are not so dire here)

- That one child policy we were talking about ? That’s led to a contraction in their workforce since there are not enough young people to cover up for the people retiring. In economics, this is often referred to as ‘demographic transition’.

- The pollution conundrum. Beijing needs to pull up their socks and clean up their factories. The rush to expand their industries has led to a serious negligence of the environmental consequences of the same.

- Until now, China used to rely on primarily the international market to push through its industries. However, with government investment in China declining and with rising incomes, household consumption needs to come through and provide some fuel to the fire.

- China is always associated with ‘cheap labour’. But, by simple economics, a rise in demand for this cheap labour has pushed up their costs. Rising wages, though not a serious problem, will have serious consequences for the cost advantage that the country enjoys.

NO REASON TO PARTY IN THE USA

The US officials are worried, no doubt about that. The Chinese are the second largest consumers of US exports. So any hiccups in Beijing will definitely impact the fragile equilibrium that Washington DC has attained.

News channels on the other end of the Pacific, however, are having the time of their life. Headlines proclaim the gloom and doom of China and USA’s victory over another set of commies. Self-proclaimed economic experts shake their heads over the inevitability of China’s downfall, while India jumps with joy about surpassing China as the fastest growing economy in the world (by using questionable data, keeping with true Chinese spirit).

They need to hold back on the champagne bottles though. The slowdown is not necessarily a sign of stagnation, it’s a reflection of the Chinese government’s efforts to bring about a sustainable growth path in China, with more focus on domestic consumption and services than on turbo-charged (and more than often,wasteful) investment in factories and real estate.

The focus on the slowdown alone would mean ignoring the larger picture presented by other data. Last year, China became the second country in the world (after the USA) to have total economic output exceed $10 trillion. A decade ago, its output was $1.9 trillion.

Matlab kya ? It means that if you use simple mathematics, you’ll see that a smaller growth rate when considering a bigger base can translate into more output than an extremely high growth rate with a small base. For example, a 10% growth rate on a base of $10 billion would mean $1 billion every year. But, say that output were to expand to $25 billion, then even a growth rate of 6% would result in additional output of $1.5 billion

WHAT ABOUT US ?

Though India has been mum on the subject, we should be a little bit worried. A shock to a trading behemoth will translate into a dhakka for akka India. But there’s a silver lining to every cloud. This humble blogger is not one for economic predictions, since they seem to be more wayward than bullets fired into the air.

However, the re-sputtered Indian economic engine might just get ready to pick up the slack that China is leaving behind. Since the Chinese currency is more or less pegged to the dollar, any increase in the value of the dollar is leading to the currency becoming more expensive. What that basically means is that their exports are becoming more expensive.

One avenue where we can be happy to be behind China is in our low labour costs. This cost competitiveness can lead to a serious reorientation of the Chinese cheap labour modus operandi and an improvement in the red-tape bureaucratic behaviour of New Delhi.

Or just maybe, China may be re adjusting a snag in its own workings. Like I said before, lower doesn’t mean slower, it might just mean more stable. China still has a long way to go though: their GDP per capita is lower than the world average (32% lower) , and their human rights record is abysmal. This dragon needs to get itself in order before it conquers the world with (metaphorical) fire and blood.