Bid adieu to long queues, ticket-booking hassles, bill payment fraught with anxiety, going to the mall or even frequenting the travel agency as the digitization era has rushed in. Be it planning a vacation or financing education, it is now just a click away.

HDFC Bank has transformed itself from a brick-and-mortar entity into a virtual bank. With digitization providing a quantum leap in the field of banking, it has revolutionized the way today’s generation transacts.

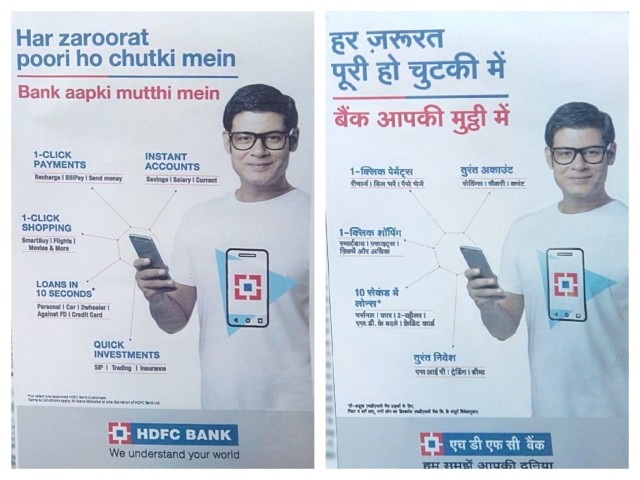

HDFC Bank, one of the leading private sector lenders in India, has launched it’s “integrated, nationwide brand campaign”, ‘Har Zaroorat Poori Ho Chutki Mein, Bank Aapki Mutthi Mein‘ -Bank’s largest brand campaign across print, outdoor, digital and radio.

It has rolled out a fully digitized model for all aspects of transactions. The new HDFC Bank app allows transactions ranging from essential transactions to booking, fixed and recurring deposits, bill, and tax payments, buying insurance, and mutual funds, buying loans etc, covering a total of 75 transactions.

Their digital concept is customer centric in the sense that all services focus on customer satisfaction and convenience as their fundamental objective.

“All our processes have been digitized. This is in keeping with our #GoDigital campaign. Banks that do not use the latest technology to ease the way customers can access its products and services will soon be obsolete,” said Mr. Aditya Puri, managing director, HDFC Bank Limited.

INSPIRATION:

Aditya Puri, MD and CEO of HDFC Bank, had taken a digital pilgrimage to Silicon Valley – habitat to the world’s largest technological giants like Apple, eBay, Facebook and Google to observe innovations and technologies that could benefit India. The launch of ‘Apple Pay’ in the US was a rather awe-inspiring event. “We have the capability to do whatever Apple Pay or PayPal can do,” says Aditya Puri sitting in his boardroom on the sixth floor of HDFC Bank House at central Mumbai. “PayPal is owned by eBay and is one of the world’s largest Internet payment companies. “I will put out my own (mobile) wallet now,“.

Aditya Puri has identified digital banking as the next big opportunity and is focused on creating a world-class Indian bank.

Here is where he draws inspiration from. “Globally, Wells Fargo is a good example for cross-sell as well as virtualized banking. Bank Mandiri in Indonesia is very good for small- ticket loans. There are banks in Hong Kong, such as Hang Seng Bank, which are very good in terms of returns,” says Puri. “So depending upon each segment, we compare ourselves with whoever is the best in class globally.”

Today, HDFC Bank provides more than 175 banking transactions through its Net banking platform and more than 80 transactions through Mobile banking (Mobile and Tablet apps).

The three-month long campaign has multi-pronged benefits with customers at the center stage. It aims to bring the most of power in the hands of the customer. Here is how:

1. You no longer need to plan your day according to bank hours. The bank branch is at an arm’s length to cater to your financial needs.

2. You can access your account from virtually anywhere. If you’re on a business trip or vacationing away from home, you can still close tabs on your transactions, regardless of your location.

3. With the internet, the power has moved on to customers with cheaper telecommunication and computation. HDFC Bank aims to be the fastest bank with facilities like 10 seconds loan coming up.

4. The HDFC Bank has driven to rural areas striving to spread the digital culture to encourage transparent dealings and avoid the danger of borrowing money from unauthorized sources.

5. Micro-ATMs in rural areas across India have been rolled out to bring more and more customers in the domain of clean and convenient banking.

6. The digital banking initiative has introduced apps and features that have revolutionized banking for the customer.

–HDFC Bank Watch Banking– A banking experience on a personalized wearable device taking consumer’s interaction with the bank to a whole new level.

– 30-Minute Auto Loan, 15-minute Two-Wheeler Loan

–10-second personal loan disbursement

– Chillr – App to enable customers to send money to any person on phone contact list

–Digital Wallet -to transact on any website for HDFC Bank and non-HDFC Bank customers

–PayZapp– A complete payment solution for all your needs

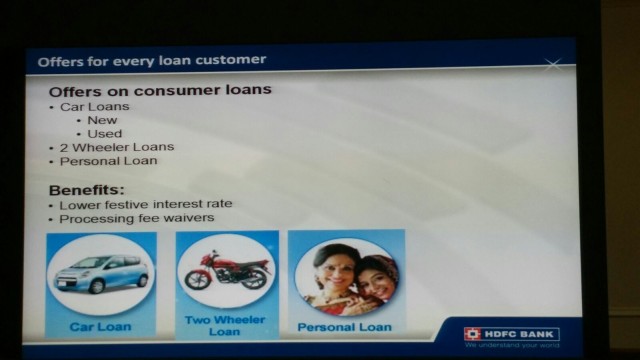

7. These products offer various cash-backs, discounts and offer on loans, be it car loan, two-wheeler loan, personal loans.

8. All types of loans, deposits, withdrawals transactions provide the customer a singular stop for all their financial needs.

9. Conducting business online is now faster than ever. Providing one-click experience to the customers will not only enfranchise them from the online rigamarole but also foster internet values.

10. Customer needs are tracked round the clock by following websites recently visited, covering all categories of consumer spending. This assures better and faster service.

“The concept of digital is now embedded into the DNA of HDFC Bank.” As of FY 2014-15, 63% of all transactions at HDFC Bank are conducted through digital channels.

HDFC Bank has proactively acted to introduce to India a completely new aspect of banking with convenience at its most. The dedication of this bank to the ever-growing customers stands testament to the promising vision of Aditya Puri. With him as a leader, one can eagerly wait for the radical changes banking in India is going to witness.

Image Credits: Google