ED VoxPop is where we ask people different survey questions and get responses to conduct sort of a poll of our own.

India’s retail exchange boom has been filled by pandemic-driven limitations and occupation of misfortunes that left a large number of individuals at home with little to do.

Reflecting patterns found in the U.S. and other significant economies, twenty to thirty-year-olds in India have been purchasing stocks at a consistent clasp as pay misfortunes, monetary burdens, and expanded time at home have prodded the chase for new revenue sources.

What Happened During The Pandemic?

In half a year since India forced its first influx of Covid lockdowns, CDSL (Central Depositories Services India Ltd) — one of the nation’s driving protection safes — saw a close to 20% ascent in new records (referred locally as demats), hitting in excess of 25 million almost a month ago.

Of the nation’s new records, by far, most were opened by twenty-four to thirty-nine-year-olds, as indicated by discrete information from the business sector controller, the Securities and Exchange Board of India.

The uptick focuses on youngsters’ endeavours to support their funds as the pandemic burdens, financial development, and loan fees in the nation of 1.3 billion.

India’s various and growing online investment platforms have also seen a surge in demand, especially among more youthful, less experienced financial backers, as compared to abroad business sectors.

In Competition with Super-Power

Internet exchanging stage Zerodha — India’s biggest business by customer numbers — presently claims to deal with more day by day exchanges than the US’s. most famous stages.

India’s homegrown securities exchange is as yet the “predominant road” for retail financial brokers, the market having fallen intensely in March’s auction, a few examiners propose the nation’s significant lists could be ready for solid increases in the coming months.

Likewise, web selection is reaching out to spaces of the country past the enormous urban communities of Mumbai and New Delhi.

Indian millennials are bound to take market chances, a takeoff from other financial backers’ conventional interests in bank stores and actual resources like land and gold, the last of which filled in as, “insurance policy and a retirement plan in a country that lacks robust social welfare systems or widespread access to formal credit,” Bloomberg wrote.

Also Read: “Trading Of Stocks Started Under A Banyan Tree” – This And Some Other Cool Facts About The Bombay Stock Exchange

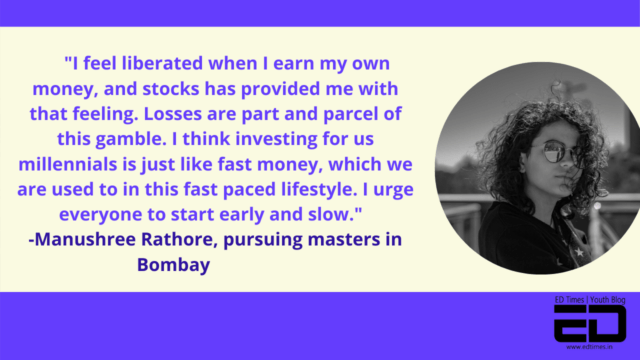

So we asked millennials, how they were making fast money through stock trading and what was their experience like:

Booming Market for the Economy

A flood of five million new Demat accounts in pretty much 9 months mirrors India’s trust in the securities exchanges to assist them with producing abundance.

The Indian economy is generally youthful, with 62.5% of its population in the age gathering of 15-59 years, and this segment profit can assist financial exchanges with extending.

Following some prescribed procedures, for example, getting outer assistance, self-learning, and testing could persuade India’s twenty to thirty-year-olds to make the best of their securities exchange insight and furthermore add to prodding the country’s financial development.

Image Credit: Google Images, Photographs provided by the contributors

Sources: The Federal, Bloomberg, Bussiness Insider

Find The Blogger: @saba_kaila0801

This post is tagged under: Stock Marketing, India, Millenials, Bloomberg, Bussiness Today, Economic Times, Indian Economy, Lockdown, COVID-19, March, Demat, Supply and Demand, Gradual, Happiness, Money, Finance, Liberation, Fiscal Budget, Bombay Stock Exchange, Experiences, Loans, Investments, Banks, Dependence, Boredom, Youth, Monetary Fund, Finances, Homes, Life, Broker, Student, Entrepreneur, Small Scale, Big Bull

Other Recommendations:

How Did CRED Jump From $806 Mn Valuation To $2.2 Bn Within 3 Months With Revenue Of INR 52 Lakhs?