Finally! The nod for much awaited deregulation of diesel has been given by the cabinet, and diesel’s price will lastly be in sync with price of Brent crude- the international benchmark for pricing of petroleum products.

But, the question to dwell upon is “Till now, why wasn’t the price of diesel freed to be market determined?”

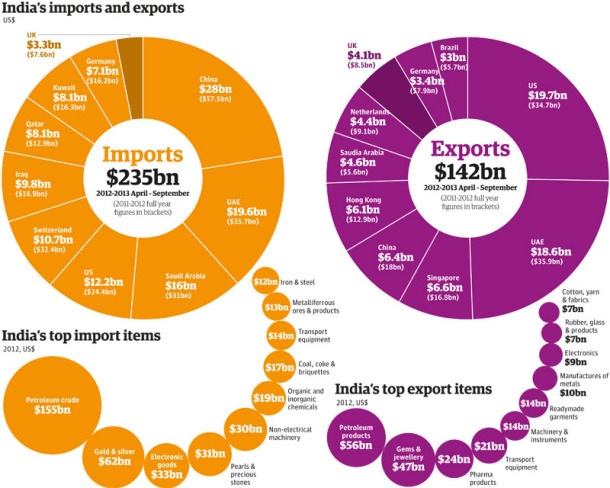

Well, the answer is not just because of the fact that food prices are directly linked with diesel prices (as 67% of diesel used in the country is utilised in the transportation sector), but, because we import oil to foot 80% of our crude oil requirements. Yes! And as a country 65-75% of our import bill constitutes spending towards petroleum products.

Digest this fact- We are in top 5 fuel importing countries in the world, but not in top 25 fuel extracting ones, and this is in spite of the fact that we are the 5th largest refining facility world over (That’s what makes Mr. Reliance the richest Indian, and gives his missus the leisure to own teams in IPL & ISL a piece). As the subsidy on fuel is provided only to the public enterprises, India’s refining establishments (Reliance Industries & Essar) end up exporting crude.

The figure below shows India’s imports and exports product-country wise for FY 2012-13.

Until now, our dear Government was bearing the difference between market rate and retail rate, and paying the differential to Oil Marketing Companies, popularly known as OMCs (such as IOC, BPCL, HPCL). But what we don’t realise is, behind the Parliament, there is no gushing river of coins and notes, and thus the shortfall. This shortage of funds makes the Government of India (GoI), borrow. The borrowing and its servicing requires more coins; and hence emerges another factor to add on to the problem of Fiscal deficit and Current account deficit (CAD).

Simply put, Fiscal deficit means that the Government’s total expenditure exceeds its income. And, CAD represents negative net sales abroad i.e. value of goods imported is higher than those exported. To make the economy ride the highway of double digit growth rate again, it is necessary to curtail the CAD.

Look at it this way; imagine you’ve Rs 100 to buy 10 tablets to cure your cough. On your way to the market, you take your younger sibling with you. On reaching, she demands for an ice cream costing Rs10. If you give into her demand- you end up with one less tablet, which could have well accelerated your cure. But, on buying her an ice cream you lose on a tablet- which is a necessity. In the same way, health and education are medicine for the country to move forward- both socially and economically, with diesel being a lucrative proposition to give away at subsidised rates.

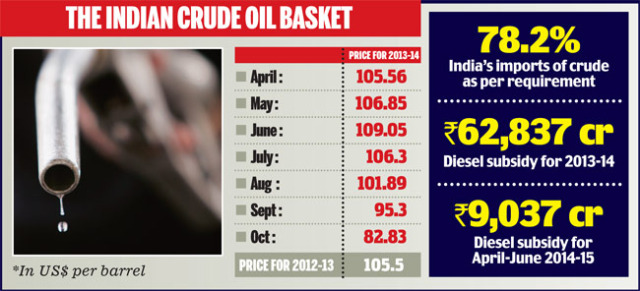

In last financial year, the Government paid heftily—Rs62,000 crores, to compensate sellers of diesel, kerosene and propane cooking gas for selling at a loss. This deficit makes the State borrow more leading to unnecessary spending, giving rise to the possibility of getting stuck in debt traps, pushing the interest rates up and ultimately leading to higher inflation.

Coming back, let’s just go through a few main factors affecting the diesel price in India-

- International Brent Crude price

- Value of Desi Rupaiya vs Firangi Dollar (woh bhi amrican)

- Crude oil exploration and production in the country (Try this noble step and I bet if you don’t end up being like Mr. Ambani getting stuck on onerous grounds- Remember, KG-D6 basin) Also, unlike USA and Brasil we haven’t yet hit Shale-gas lottery. So we are still dependent on imports

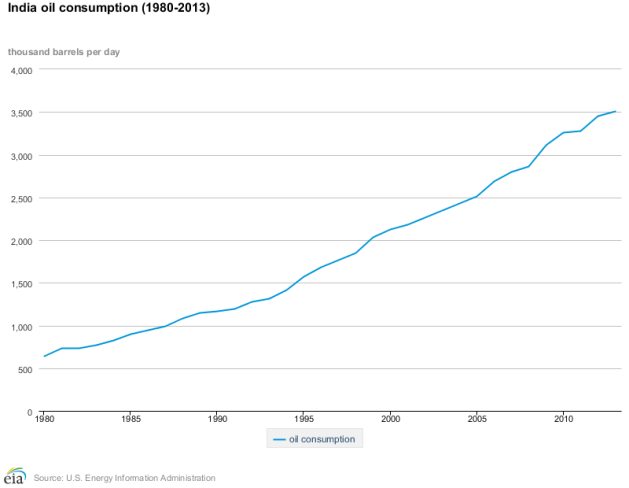

- And demand, which isn’t coming down at least in the near future

Synopsis is in the 2 figures below-

The figure shows how our consumption has increased from 600,000 barrels per day in 1980 to over 3500,000 barrels now.

Then, why deregulate the prices now?

It is better late than never, right! The trigger for the step was softening of global crude prices, hitting a four year low, with a decline of almost 22% from $110 to $85 a barrel. This crash, aided with the already 50 paisa a month slash of diesel/litre in place accelerated the move. The bold decision is expected to tone down inflationary pressures, attract investor attention, and improve prospects for Asia’s third largest economy.

With the diesel prices now in tandem with the market, we can stretch to believe that private companies like Ambani’s Reliance and Ruia’s Essar will venture into retail. The subsidies don’t just end up burning a hole in Government’s finances but they also stem artificial demand for the commodity.

Naysayers may stay cynic, but India is finally on the reforms path once again. The Narendra Modi government has boldly bitten the bullet for the sake of the nation’s future.