By Preeti Kumari

Yes, it is really happening…

China, an important engine of global economic growth, is slowing down.

After growing at 10% per year averagely for past two decades (yes, really), Chinese economy is now in doldrums. But it was also believed that this was going to be inevitable for China to sustain such high level of growth.

The law of large numbers applies to nations as well as companies i.e. bigger an economy gets, harder it becomes to sustain high growth rate. So, what happens to India (at the end that is what matters the most)? Let’s find out…

Behind the scenes–

Last year (and continued this year too) in the light of increased turbulence in stock market worldwide, we saw emergence of concerns among Indian policy makers and people that what will be its effect on India?

However, my inspiration for this article came from slightly conflicting views presented by RBI chief Raghuram Rajan and finance minister of India Mr. Arun Jaitley on this topic.

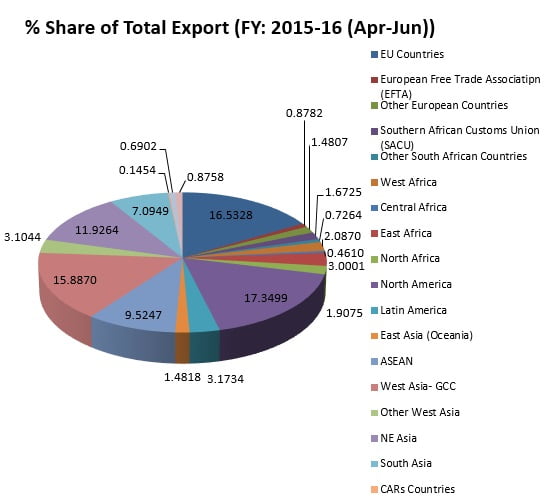

There have been a lot of debates and discussions about it in the past few months. The mayhem in china will mainly effect the trade patterns of India i.e. exports (shipping the goods and services out of a country) and imports (a good brought into a jurisdiction, especially across a national border, from an external source or country) as China is India’s largest trading partner.

From smart cities to gold, the fallout in the Chinese market will have far reaching consequences (good or bad)-

- Exports:

Compared to what we import from China, exports are less diverse. Iron ore constitutes the largest share of exports to China.

If Chinese demand slows down, its raw material requirement will be less, and India’s exports to that country will also decrease. Due to this we may not be able to take advantage of the Yuan devaluation ( it means lowering of the value of a country’s currency within a fixed exchange rate system, by which the monetary authority or central bank sets a new fixed rate with respect to a foreign reference currency) to earn more dollars. Also due to devaluation of Yuan the world market will be flooded with low price Chinese goods which in turn can hurt India’s exports as there are many identical portfolios both the countries compete for.

- Infrastructure/investment:

The prices of the hard commodities (materials which are mined) have been hit due to the slowdown. For India as a consumer this is good news as cost of construction will go down and it will become a little bit less daunting for Mr. Modi to fulfil his dreams (building 100 smart cities). However, its credibility depends upon the running of parliaments…that’s the irony of our lives.

- Gold (glitter, glitter, glittery):

There has been speculation regarding continued low price of gold for some period of time due to spill-over effect of slowdown in global economy (courtesy China). But it might be temporary as there has not been much change in its demand and it doesn’t really matters for India. As it is our obsession for gold has us blinded against any fluctuation in it (courtesy gold love).

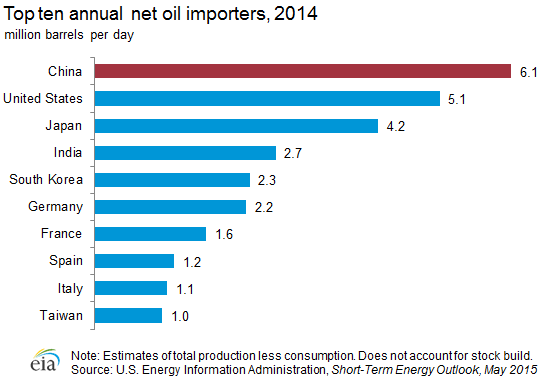

- Crude Oil:

Last, but certainly not the least. Oil prices are one of the major factors that determine inflation in our country (other is agriculture which is an internal factor). Low inflation in simple terms means more money to spend both for government and public and investment is the key for the development in India.

China is a large importer of crude oil from international market. However, due to slowdown, the demand in China has fallen leading to overall fall in demand. Now this is something good for countries like us who has a huge demand for oil as it will further lead to decrease in crude oil prices. This is like killing two birds with one shot- we can manage our fiscal deficits around the target level as well as increase public investment. Though “we” here constitutes government and that’s where problem lies.

So all in all what we can understand from this dissection is that although the global slowdown will have adverse effect on India, it depends on our policy decisions and implementation for sure to mitigate these effects. As slowdown in China strategically pushes India to the forefront as a market to invest, if we push through the reforms, we can actually change the conditions from being painful to gaining.