Carl Richards brings to us some of his most innovative and easy depictions of how finance can be handled. We bring to you 10 of his napkins drawing taken from his blog `The Behavior Gap` which will make you utter ‘wow!’ and ‘Really!’ words together.

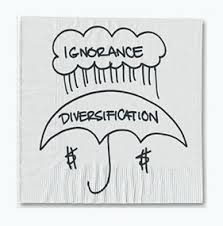

Diversifying our investments is really about protecting ourselves from our own ignorance because we do not (& cannot) know how any single investment will perform over time.

Focus on financial matters within your control, dream realistically and don’t put off an honest assessment of your resources.

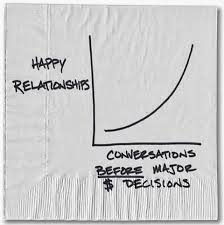

Their is often a radical mismatch between two spouse’s financial expectations that doesn’t emerge until years into a marriage or partnership. Don’t be that couple.

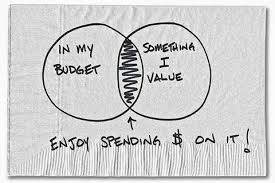

Emotions don’t fit on a spreadsheet and sometimes the best financial decisions are the ones that allow us to sleep better at night

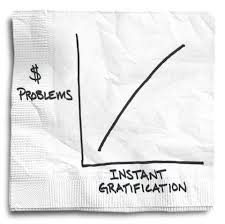

How Amazon Prime and other forms of instant gratification makes it harder to control our spending.

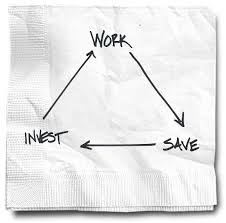

You may not be able to predict the impact of quantitative easing,but you can work more, spend less and not chase silly investments.

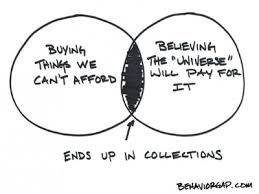

Maybe you’ve already learnt the truth the hard way,but the universe is not going to pay for that BMW you want

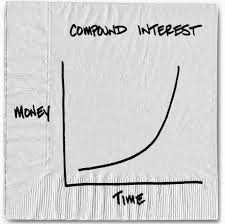

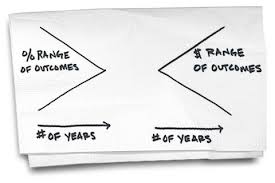

Spend time with financial service sales people and you’ll hear the claim that risk declines over time.